by oldprof

This is a landslide week for economic data, and earnings season is in full swing. Last week’s Q4 GDP report and overall market tone has revived deflation concerns. I expect market participants to be watching each economic release closely, asking: Are there signs of incipient economic weakness?

Prior Theme Recap

In last week’s WTWA I predicted that there would be special attention to Europe and the Greek elections, with a mid-week switch to the Fed and continuing interest in earnings. That was pretty accurate for the week as a whole, but there were two surprises. The downbeat GDP report, normally regarded as old news that will be further revised, had a modest pre-market and intra-day effect. The late-day ISIS/Iraq news was important on Friday afternoon. Since the spike in energy prices had a specific cause and left many not wanting to be short over the weekend, the standard energy-stock price correlation did not hold up. This was just bad news.

There is no better way to review the past week than Doug Short’s 15-minute chart. While I highlight this time period for the “week behind” purpose, Doug’s article has plenty of other charts and great analysis. I hope readers are following the links.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

The week ahead includes plenty of economic news, earnings reports, speechifying, and geopolitics. People frequently expect this to mean exceptional volatility, and it might. More often the news cuts both ways. As we saw last week, volatility can result from a few key stories, especially when the news is a surprise.

The disappointing report on Q4 GDP has set the tone for this week. The popular meme has been that declining commodity prices and bond yields carry an important message about the US economy. I expect a major media focus to be the following:

Do the economic data reveal growing weakness in the US economy?

I expect this to be sliced, diced, and compared to the “messages” from commodity prices and corporate earnings, continuing through Friday’s employment report. Here are the contending viewpoints:

-

QE is failing everywhere. Central bankers are out of ammo. Marc Faber in this week’s Barron’s roundtable wants to “short central bankers.” Also writing for Barron’s, Vito J. Racanelli captures what I often call the trader perspective:

Ostensibly, investors were disappointed by data on U.S. economic growth, but the deeper issue is a nascent feeling that the worldwide quantitative easing (QE) cycle has reached the limits of encouraging growth.

This thinking is sustained by tumbling oil prices—which rose 6% last week to $48.24 per barrel but have fallen for seven consecutive months. Where once that plunge was welcome, investors now see it as a barometer of weak global gross-domestic-product (GDP) growth in 2014. The ongoing Greek drama over the country’s huge fiscal imbalances is also fueling uncertainty and keeping pressure on stock prices.

- Economic data show continuing modest growth, a bit slower than Q3. (Chicago Fed indicators reported by Doug Short).

- Global economic signs are showing some bottoming. Dr. Ed considers Asian countries, commodities, monetary policy and the Year of the Sheep.

My sense is that choice #1 is the prevailing theme. What do you think?

As always, I have some additional ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

Despite the market reaction, there was plenty of good news last week.

- Weekly jobless claims fell dramatically, to 265K, lowest since 2000. The survey period included the MLK holiday, but the BLS did not cite that as a problem. Normally I would not mention this, preferring to look at the four-week average of the noisy series, but I have highlighted as “bad news” the two recent reports above 300K. It is only fair to mention the good news. Properly interpreted, this is an important series.

- Earnings reports have been positive. It does not seem like it, but 80% of reporting S&P companies have beaten on earnings and 58% on sales. Overall growth is running at 2.1%, slightly better than predicted at the start of the quarter. Apple was a big positive for the overall numbers and energy stocks remain a drag (FactSet).

- Personal consumption increased 4.3%, beating expectations of 4%.

- Michigan consumer confidence nearly held the preliminary reading, scoring 98.1. Some ascribe the enthusiasm to lower gas prices or the hiring of Jim Harbaugh as the new football coach. In fact, this is an excellent nationwide survey which takes a panel approach. This means that there are some continuing members each month. My own research shows it to be helpful in tracking both spending and employment. Regular readers know that I love the Doug Short chart, which clearly illustrates the economic relationships. As always, his posts have plenty of extra analysis and charts, so please check it out.

The Bad

The bad news included some significant economic reports.

- Greek elections. To emphasize, I am not interested in the politics nor am I advocating particular policies. There is a simple test: Is this market-friendly news. The Syriza success increased uncertainty for the Eurozone. When the new coalition took a hard line about austerity and negotiating with “the troika” it opened the door to speculation about broader effects. (FT).

- China’s PMI fell to 49.8, worse than the expected 50.2. This was the “official” version instead of the “flash” version. It was the “factory” PMI, not the “manufacturing” PMI. There are different data points and series for each. Make of it what you will. Someone needs to sort these out and provide some better guidance on interpretation. (Reuters).

- Ukraine fighting. Violence increased during the week. While popular with the public, Putin is coming under some pressure from wealthy friends. (Bloomberg) This might eventually be a positive if it sparks a move toward compromise, but so far it has just increased reciprocal sanctions. Russia credit downgrade (WSJ). Excellent analysis from Thomas Friedman – both motivations and what might happen. Could Russia use HFT to crash the markets? (MarketWatch).

- The Fed Announcement. For experienced Fed watchers focused on economic data, this seemed like a non-event. Why did stocks decline and bonds rally? You need to read this interesting interpretation from Brian Kelly, one of the Fast Money gang, to get the trader take. It seems to warn us that many are ready to react to a small change in timing of the first 25 bps increase in short-term rates. (Contra – WSJ). Bespoke sees no change, providing this analysis and chart:

- Durable goods declined by 3.4%, significantly worse than expectations. Steven Hansen at GEI has full analysis and this chart:

- Pending home sales fell by 3.7%, month-over month.

- Q4 GDP missed expectations, growing at a 2.6% rate instead of forecasts of 3% or higher. The general media reaction emphasized reduced business investment and international concerns (WSJ). Calculated Risk says to “R-E-L-A-X” and notes the increase in consumer spending and private fixed investment. James Hamilton at Econbrowser calls the report “solid” and updates his recession indicator (1.6%). The market reaction was slightly negative, and the story has markets on edge concerning upcoming data, so I am scoring this miss as “bad news.”

The Ugly

ISIS. We always have compassion for the human effects of conflict. We must also recognize the economic effects. The spread of fighting to Kirkuk shows how sensitive oil markets are to supply disruptions. Futures spiked 8% in a few minutes. Stocks sold off sharply.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week, but nominations are welcome. I am seeing plenty of bad charts, but little refutation.

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators.

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. Doug has the latest interviews as well as discussion. Also see Doug’s Big Four summary of key indicators.

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. Georg continues to develop new tools for market analysis and timing. Some investors will be interested in his recommendations for dynamic asset allocation of Vanguard funds. Georg has a new method for TIAA-CREF asset allocation. He has added a method for Vanguard Dividend Growth Funds. I am following his results and methods with great interest. You should, too. Georg’s update this week was his BCI index, also showing very low recession changes.

Despite the facts, the average fund manager or trader views oil prices as a recession signal. (MarketWatch)

Dana Lyons notes, without really recommending this indicator, notes that the Baltic Dry Index is at a 30-year low. I dumped this indicator years ago when it seemed to reflect supply from Greek shipping magnates more than actual shipping and demand. Perhaps aluminum is better. (WSJ).

This is a subject where many authors begin with a viewpoint….

The Week Ahead

It is a big week for economic data.

The “A List” includes the following:

- Employment report (F). Despite the revisions and large error band, this remains the focus of the economic debate.

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

- ISM Index (M). Good concurrent read on manufacturing with some leading components.

- ADP employment report (W). Deserves credit as an independent measurement.

- Personal income and spending (M). December data, but especially important given last week’s GDP news.

The “B List” includes the following:

- ISM services index (M). Bigger sector than manufacturing, but still not as much significance.

- Trade balance (Th). December numbers will affect Q4 GDP revisions.

- Auto sales (T). Good read on consumers. Will the F150 indicator start to be relevant again?

- Crude oil inventories (W). Maintains recent interest and importance.

- Productivity and unit labor costs (Th). Indicator of the pressure (or lack thereof) on the Fed’s patience in raising rates.

- PCE prices (M). The Fed’s favorite inflation measure will become more important when the core approaches 2.5%

- Construction spending (M). December data makes it a bit less relevant, but still significant.

With the FOMC announcement out of the way, your favorite Fed speaker is back on the speech circuit!

Important corporate earnings continue. There is always the chance of breaking news from various hot spots, but this week seems to have more such potential than usual.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix continues a “neutral” posture for the three-week market forecast, but it continues to be a close call. The data have improved a bit, but are still marginally neutral. There is still plenty of uncertainty reflected by the high (but declining) percentage of sectors in the penalty box. Our current position is still fully invested in three leading sectors, but these still include some defensive themes. This helped us dodge most of last week’s decline. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Another 8-Step guide for traders, this time from Steve Burns. Some advice will be familiar. I like “Hold your opinions loosely and your discipline tightly.”

As I have noted for four weeks, Felix continues to feature selected energy holdings. Felix is not just a momentum trader!

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. We have recently updated our current ideas for investors.

Other Advice

Here is our collection of great investor advice for this week:

Getting the Right Take on QE

Former Dallas Fed President, whom I admire from his writing and appearances, and like from our personal conversations, does not get enough credit. He is a pragmatic conservative and not a knee-jerk defender of the Fed. Anyone who really wants to understand the inner operations at the Fed would do well to read McTeer.

With the focus on worldwide QE, Bob asks, Are All QE’s the Same? Here is a key quote:

The fact is that the Fed’s QE programs didn’t work as expected, and it took huge bond purchases to achieve modest to moderate results. Like the rider of a very low-geared bicycle, the Fed had to peddle furiously to keep the bike upright. But, at least, the expected harm was not done and some good was done.

When short-term interest rates reached effective zero and we found ourselves in a Keynesian liquidity trap where more money would not reduce interest rates farther, there was every reason to believe that significant bond purchases would stimulate the economy by increasing the “quantity” of money and credit. We learned in school, and from past experience, that asset purchases by the central bank would increase bank reserves and the money supply initially by the same amount and that the excess reserves created in the banking system would result in a further multiple expansion in the retail money supply. Banks would use their new reserves to create new money by lending their newly created excess reserves. With about a 10 percent reserve requirement, the money multiplier would be around 10.

That didn’t happen.

You could also check out my article collection on this topic, which has been quite accurate, beating down the nay-sayers since 2010.

Stock Ideas

Barron’s has the last segment of their annual roundtable. You can see plenty of divergent opinion for a small investment. I enjoy reading it with some for entertainment and others for ideas.

Beware of the reach for yield – the crowded trade that worked last year. Well it also worked in January, making me wrong so far in 2015!

Cheap Sectors

Energy and Consumer discretionary, via Alpha Architect. This is consistent with many other value sources, despite the current market love affair with utilities and bonds.

Caution in energy? That seems to be the standard take. Here is the CNBC advice, which is OK both for initiating and adding to positions.

Market Outlook

Financial media follows the theme of the moment. It was the week for the bears, back in vogue according to CNNMoney.

The bears build their case that a crisis is near on four factors: falling oil prices, stagnant wages, the “two-edged sword” of a strong US dollar and big trouble abroad.

David Rosenberg is not bearish, but highlights “8 Things Giving Investors Angst.” My own effort to consolidate material on the ongoing investor fears is a work in progress. Topics and suggestions are welcome.

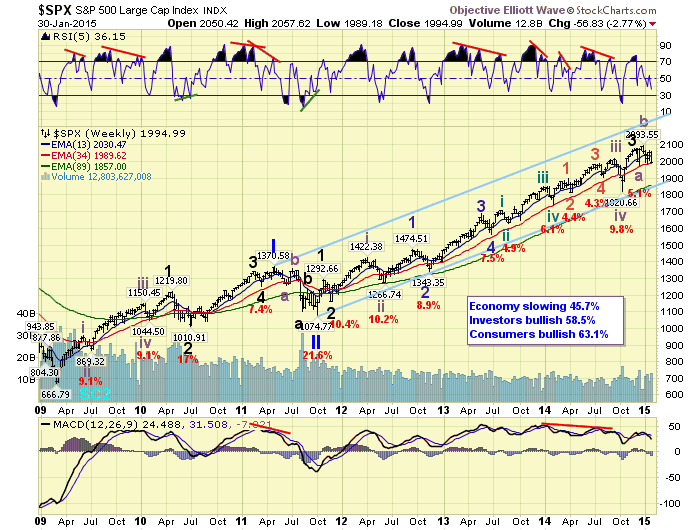

Scott Grannis has the contra viewpoint, seeing the “wall of worry” as typical. (See also my own Dow 20K/Wall of Worry Analysis).

Final Thought

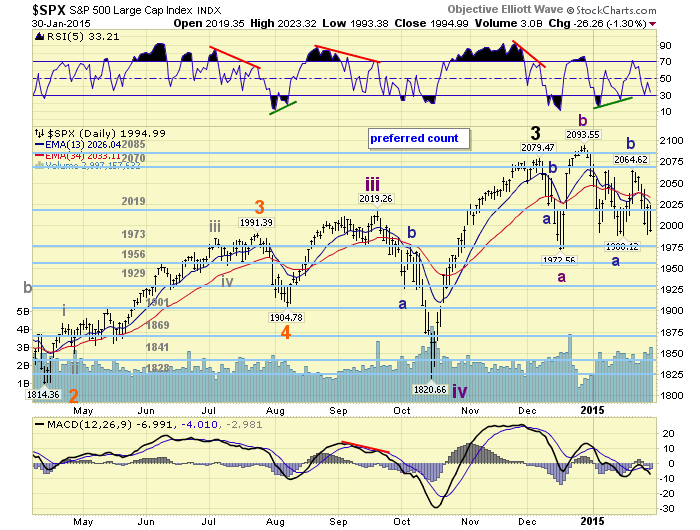

Every time the market makes a slight decline, some investors panic. This comes from two sources:

- Failing to separate the major market themes – recessions, financial crises, big earnings declines – from the routine noise;

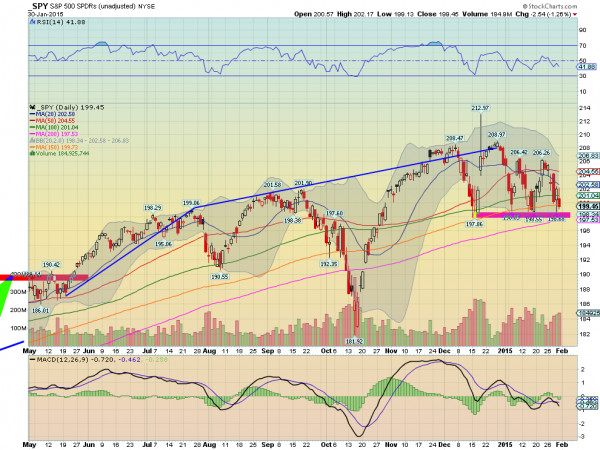

- Failure to understand the normal market drawdowns, which have actually been quite mild over the last few years. Doug Short has a great chart:

The modest downward blips send investors on a quest to become traders. They enter a world of charts, indicators, stop loss rules, and frequent adjustments. There are many successful traders, but the odds are challenging. It requires system, discipline, and constant attention – and that is just for starters. Michael Batnick has a good post for both traders and investors, and the right perspective for each. Should you be selling stocks now?

An investment perspective is much better for most. Sticking with fundamental factors, you accept the trading gyrations as opportunities to buy or to sell businesses based upon your own underlying valuations and price targets. If you have some stocks you are watching, you get exceptional buying opportunities when short-term traders are fearful. My new “Investor Fear” page takes a look at the list of oft-repeated concerns.

There are no shortcuts to successful investing.

Unless you have some magic formula. Which team are investors supposed to be cheering for in the Super Bowl?

See the original article >>