It’s official, the saxophone is back and it’s here to stay. Ok so maybe it never left, but lets just pretend we thought it was too cheesy to be cool for the last 10 years or so.

Today the sax is like the golden child of musical instruments who is here to return some much needed warmth to our souls. Our souls can go cold for only so long, luckily Klingande are here to rescue us with their saxaphone enriched house music.

|

Thursday, April 10, 2014

Klingande - Only God Can Save Our Soul

Control your risk with simple and winning rules – SuperStocks trading signals for 11 April

| Super Stocks Trading Signals Report | |

| Latest Free Trading Alerts for 11 April | Download Historical Results |

| Open position value at 10 April $ 2,797.14 | 2014 P/L +3.40% |

| Mixed long/short open position | In true signal service, attachments reports are sent to customers also via email, in the evening after the markets close. Those who wish to receive them during the demo, please send me their email address. |

| We are happy to offer free signal service for Super Stocks until the end of March | Please send me your email address so I can invite you on my server to do the demo. Mail me to take the offer and start the free service until the end of March michele.giardina@quantusnews.com |

| Material in this post does not constitute investment advice or a recommendation and do not constitute solicitation to public savings. Operate with any financial instrument is safe, even higher if working on derivatives. Be sure to operate only with capital that you can lose. Past performance of the methods described on this blog do not constitute any guarantee for future earnings. The reader should be held responsible for the risks of their investments and for making use of the information contained in the pages of this blog. Trading Weeks should not be considered in any way responsible for any financial losses suffered by the user of the information contained on this blog. |

WTI oil poised to replace Brent as benchmark?

By Phil Flynn

| Weak data out of China and Fed worries about low inflation and misleading on rate increases is raising hopes for massive global stimulus giving the risk-on trade new life. Oil (NYMEX:CLK14) that was already creeping higher on veiled threats from Vladimir Putin suggesting that the Ukraine should pay for their gas upfront caused a rally. While he also said there should be some discussion before he cuts off the supply it is clear he is reminding the market that he will use his gas as a political weapon. In the meantime pro-Russian separatists still hold buildings in the Ukraine so there are fears that Russia still could be getting ready to act. The Fed on the other hand is worried that they have been sending the wrong signal that they are ready to act on raising rates. The Fed minutes popped gold oil as well as stocks when it seems that some Fed Policy makers exaggerated the likely speed of tightening and that it could be misconstrued as indicating a move by the committee to a less accommodative reaction function. Love that Fed speak! The bond market always has the Fed a bit worried as they are pushing the Fed further than they want to go. Brent crude gained on the broken promises of Libya surrounding the resumptions of their oil exports. Still Oreck is planning for the return not only from Libyan oil but also from Iraq and Iran. OPEC is signaling that they know they will have or deal with more oil and the Saudi's that have been pumping oil like it is going out style will have to cut back. Yet weak data out of China seems to be cementing expectations that not only will the US lean towards being more accommodative but Europe and China will have to be as well. The FT reported that Imports and exports both contracted in March, with trade data falling well short of forecasts and rattling nerves over the state of the world's second-biggest economy. Exports decreased 6.6 per cent in March from a year earlier, missing forecasts for a 4.9 per cent rise. It was the second consecutive weak month following February's 18% year-on-year contraction. The value of imports fell 11.3 per cent year-on-year in March – a weaker than expected performance. But in volume terms, most of China's commodities imports rose in the first quarter even as international prices fell. Natural gas (NYMEX:HPK14) will show its first breath of spring when the EIA reports what should be our first injection of the spring. Yet while the market may celebrates with a modest sell-off the truth is that we still have a very long way to go. It is unlikely that natural gas supply will even get close to the five year average of near 3.8 trillion cubic feet by the end of the refill season. In fact under the best of circumstances we may not even see 3.2 trillion cubic feet. Producers need to see higher prices to get supplies built up and now we don't see that happening. Today we should see an injection of 11 to 15 bcf. Many years ago I predicted that WTI would reestablish itself as a global benchmark. At that time many in the oil industry thought that that was impossible. Brent was everything and WTI had its day. Yet as the US starts to unleash its oil by building new pipelines and reversing old ones the glut in Oklahoma is now going to be a pulse that will give us an idea how oil demand around the globe is going to be. Now it seems others are agreeing with me. Bloomberg News reports that "West Texas Intermediate crude is poised to be a worldwide benchmark once more as an easing supply glut narrows the grade's discount to global oil markets. Inventories at Cushing, Oklahoma, the delivery point for WTI futures, tumbled to a four-year low in March. The discount to Brent, used to price more than half the world's oil, is now about $5 a barrel, from as much as $23 in February 2013. Futures and options outstanding, a measure of investor interest, rose 3.2 percent this year, after slumping 14 percent in the past three years. The changes underscore how WTI is reconnecting to global trading as improved pipeline networks boost the flow of WTI to refineries on the Gulf Coast where the oil can be processed. Its status as a benchmark underpins everything from what airlines pay for fuel, to the cost of a tank of gasoline, to how much Mexico makes selling a barrel of crude to the U.S." Of course readers of the Energy Report knew that this day was coming! Many times I have written that the Glut in Oklahoma would one day come to an end and that because of new oil production that WTI would once again reestablish itself as the global bench mark as far back as 2012. In May of 2013 I said that "U.S. is the top global crude oil consumer and if it becomes a net-exporter, that will eventually make the WTI the global benchmark, said Phil Flynn, senior energy analyst at The PRICE Futures Group, since it will reflect supply and demand fundamentals. The U.S.'s exposure to emerging markets and South America for export markets will also give the WTI more weight. The energy boom comes from horizontal drilling and multi-stage hydraulic fracturing in "tight" rock formations, mostly located in North Dakota and Texas, the U.S. Energy Information Administration says. It estimates that total U.S. oil production will increase to 8.15 million barrels a day by December 2014, up from 6.89 million produced in November 2012 The speed at which this supply came online changed the economics of oil, Flynn said. "Obviously for the last couple of years, trying to decide on what is the best benchmark has been difficult because of the success of the U.S. energy industry by producing too much oil. We've thought that demand would be determined by China and that all the production would come out of the Middle East," Flynn said. "Part of the problem in the U.S. is that the infrastructure we've built for the last 50 years has been for oil importing… But now that's not the case. Now we're a major producer, and we may become an exporter." |

WTI/Brent finding common ground

| The most significant event in the oil complex over the last twenty-four hours has been the further deterioration in the Brent/WTI spread. In the last twenty-four hours the spread narrowed by another 22% or more than $1/bbl. In spite of the first weekly build in Cushing crude oil stocks in months the spread still narrowed on the potential of the return of Libyan crude oil, a slight calming in the Ukraine and disappointing export and crude oil import data out of China. As I have been forecasting for months the spread is on the road toward normalcy or to the trading level that was in play prior to the Cushing surplus build-up. The following two charts continue to highlight what has been happening. The first chart shows current Cushing crude oil inventory data compared to its five-year average as well as the highest and lowest levels hit during the last five years for each individual week. In addition I have included what I call the pre-surplus five-year average for the period 2004 through 2009. This average inventory level was approximately 21.7 million barrels over the aforementioned period. |  |

| As shown on the chart crude oil stocks in Cushing have been declining (except for this week) at an accelerated rate for the vast majority of this year with the level still well below the current five-year average as well as the minimum level over the last five years for the same week. Inventories are heading toward the so called normal pre-surplus level as the industry moves stocks to normal operating levels required by the refining and logistics sectors.

Crude oil stocks are now only about 5.9 million barrels above the pre-surplus inventory average. With the WTI (NYMEX:CLK14) forward curve still in a relatively steep backwardation the rate of destocking in Cushing is likely to continue at the rate of decline it has been running at over the last few months. If so, current inventory levels should hit the pre-surplus level within the next several months. As the Cushing overhang continues to recede it has a direct impact on the pricing relationship between Brent and WTI. The following chart shows the current path of the spot Brent/WTI spread compared to its current five-year average as well as the average trading level during the pre-surplus five-year average for the period 2004 through 2009. Over the 2004 through 2009 period the Brent/WTI spread averaged a $0.79/bbl. discount of Brent below WTI. As of this writing the spot spread is trading around a $4/bbl. premium of Brent over WTI and has been in narrowing trend for most of the year as it works its way back toward the pre-surplus trading level.

Several factors continue to support my view of the spread returning to a more normal historical trading relationship (what I refer to as the 2004-2009 average). The main drivers keeping the spread in a narrowing pattern are: The WTI forward curve still in a relatively steep backwardation while Brent is starting to move into a slight contango in the front end of the curve. The outflow capacity out of Cushing is continuing to increase as the Keystone Gulf Coast pipeline works its way to its design capacity while the Seaway Twin pipeline readies for start-up toward the second half of May or early June. Global oil demand seems to be easing especially in China and Europe which will impact the Brent side of the spread. The potential return of Libyan oil production in the short term as discussed above will also have a more direct impact on the Brent side of the spread. This week’s EIA oil fundamental snapshot was biased to the bearish side with total crude oil and refined products inventories increasing as crude oil stocks increased in the United States and in PADD 3 due to the re-opening of the Houston Ship Channel. With another above normal build in crude oil stocks in this week’s report the main focus continues to be the big shift that is well underway in crude oil supply between PADD 2/Cushing and PADD 3 (Gulf Region). The shift of crude oil from PADD 2 and Cushing showing up in the Gulf region will result in inventories continuing to build further as the refining sector progresses into the maintenance season. The maintenance season has not impacted the Gulf yet as refinery run rates in PADD 3 are once again above the 90% utilization level. The movement of crude oil to the Gulf is certainly beginning to impact all of the pricing interrelationships for both U.S. and international crude oil grades as well as refined product markets. For example the LLS/WTI spread is now trading below the $3/bbl. level making spot movement of light Bakken crude oil by rail uneconomical. PADD 3 crude oil stocks surged by 3 million barrels (or almost three times as much as the decline from the HSC closure during the previous week) as crude oil imports into PADD 3 increased strongly. PADD 3 crude oil stocks are now showing a surplus of 15.2 million barrels vs. last year with an 18.7 million barrel surplus versus the five-year average. PADD 3 crude oil stocks set yet another new record high as shown in the following chart. The big shift continues.

|

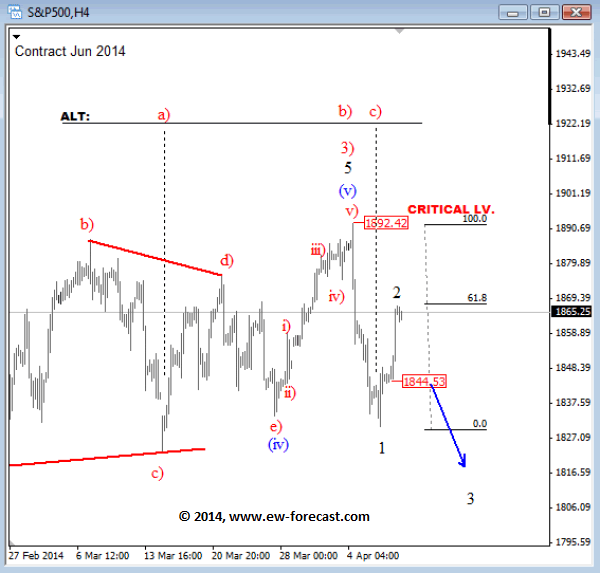

S&P 500: Bearish Reversal

By: Gregor_Horvat

| S&P 500 found a support in the last 48 hours after a completed impulse decline from 1892. As such, current rally can be sharp corrective recovery that should then find a top somewhere around 1865/1870 zone. A reversal from here and back to 1844 would be a strong and important evidence for a downtrend continuation to a new swing low and possibly even to 1800. S&P 500 4h Elliott Wave Analysis |

Let QEdom Ring!... Or The One In Which Jamie Dimon Quotes Martin Luther King

by Tyler Durden

| When one thinks of the bailout-taking, London-Whale-suffering, regulatory-fine-paying, pay-rise-taking CEO of JPMorgan, the first analogy is not the philosophical similarities between Jamie Dimon and Martin Luther King. But, according to Dimon's letter to shareholders below, he feels injustice has been done and quotes MLK on the future ahead. "The arc of the moral universe is long, but it bends toward justice" Progress, sometimes painful and slow, has been happening all around us all the time, and the optimist in me believes that it will continue." What a year... he begins. Dimon "has a dream" of a post-QE, Fed has the tools to exit, inflation not a problem, world is gonna be great future where little rich boys and little poor boys play together. Let QEdom ring! |

Please Don’t Manipulate the Renminbi

by Pivotfarm

| Begging, borrowing or other means. Whatever it takes the US is prepared to get what it wants. Unable to get it any other way because of real clout, the US has resorted to begging these days. The US has asked the Chinese not to go back to manipulating their currency. The Renminbi has been depreciating since the start of the year and the US fears that they might return to old habits. Certainly old habits die hard, don’t they? A senior Treasury official stated “If the recent currency weakness signals a change in China's policy away from allowing adjustment and moving toward a market-determined exchange rate, that would raise serious concerns.” |  |

| In just the space of a few weeks the Renminbi has fallen by 2.5% (since the second half of February 2014) against the Dollar. That’s surprising in itself since the Chinese currency has done very little except steadily grow over the past few years against the Dollar. Emerging economies might have seen their currencies depreciate against the Dollar in past months due to tapering and the withdrawal of investment in their economies, but for China it’s out of character that there should be such a drop. The Renminbi currently stands today at 6.196859 against the Dollar. We are seeing the appreciation of the past year being wiped of the value of the Renminbi today. We know that the Chinese economy is slowing down and seeing greater difficulty for the new administration to meet the target of 7.5% GDP for this coming year. The World Bank has already cut the economic outlook for the country and some are saying that China will do no more than 7.3% in GDP this year. What is irking Washington is that the Chinese might just choose to hold down the currency so that exports are boosted. It would have little choice but to engineer a low Renminbi, given the sorry state of affairs in the EU and the emerging markets suffering from tapering. The People’s Bank of China has the ability to move the currency through a fixing rate every day, directly intervening on it. Thus, with the widening of the official trading band it can trade 2% higher or lower at will. The US administration would clearly like to see the Chinese moving away from reliance on investment and exports and thus secure long-term prospects of growth via consumption. Of course, the US administration would like to see that. It would open up the prospect of increasing exports for the US. The Chinese are hardly going to agree to that. Beg on Treasury for the Chinese not to engineer their currency. But, what has the US been doing all along with Quantitative Easing? Washington has been asking China for years now to allow the Renminbi to trade at stronger values so that competition for exports is better. It is doubtful if firstly the US is actually in a position to warn others to play the game by the rule book and secondly whether or not the Chinese will hear the warning. The G20 meetings taking place on April 10th 2014 will have little room for discussion about the Renminbi or engineering low currencies; not while Ukraine is at the top of the agenda and Russia’s role in Crimea. Then, there will have to be a discussion about the state of affairs of the Eurozone, Greece and the debt situation as well as unemployment…and so the list goes on. What is it they say about needing to flood the public with bad news, so they don’t see exactly what you want to hide from them? |

Anomaly In March NFIB Report

by Lance Roberts

| As regular readers of this site already know, I regularly analyze the data provided by the National Federation Of Independent Business monthly survey. As a small business owner, this data is crucial to digest and understand as it provides a real pulse of what is happening at "my" level as compared to what is provided through government agencies. This report, in particular, is why I have held a long standing position that the recovery on Wall Street is far different from what is actually happening on "Main Street." This month's analysis is coming from a different angle as I think there may be a potential anomaly in the survey data. During my September, 2013 review (for the August data) I noted that:

That inconsistency was corrected by the NFIB in the next month.

The reason that I bring this up is because I see a similar divergence of the data in the latest NFIB survey for March. Overall the optimism index rose by 2 full points from 91.4 in February to 93.4 currently. Unfortunately, that is still below the January level of 94.1. The chart below shows the history of the NFIB survey to put the current reading into perspective. The survey remains at levels that historically been consistent with the troughs of recessions, not entering into the sixth year of recovery. Some of this increase in optimism could certainly be attributed to a "thawing" of attitudes following the repeated blast of freezing temperatures, and inclement weather, during the first quarter of the year. However, if we dig down into the data, we find something very interesting. Out of the 10 small business optimism components most were modestly unchanged moving within a couple of points from last months print. However, the big standout was the nine (9) point leap in the expectation of higher real sales. The reason that I suspect that this jump in sales expectations could be an anomalous reading is the reading was not confirmed by things that should be associated with such an increase. As a small business owner, I am very sensitive to my customer demand as that is the basis from which the majority of operational decisions are made. If current customer demand is strong, and growing, I would consider increases in productivity, employment, facilities, inventories, etc. This is particularly the case if I am expecting substantial increases in sales activity in the next quarter as if I am unable to satisfy demand, I will lose that business to my competitors. However, therein lies the problem with the sharp increase in sales expectations in March as shown below:

You would expect that if businesses were planning for a relatively sharp uptick in real sales in the months ahead, that they would be making changes to accommodate the increased demand. Yet, the data suggests that business owners may just be "hoping" that sales will increase, but not willing to "bet" their capital on it. This is because, despite hopes of increasing sales, business owners simply do not believe that that this is a "good time to expand" their operations. That view has remained unchanged since the depths of the financial crisis. For small businesses, the overall environment remains very challenging. The top 3 concerns of small businesses remain government regulations, taxes and poor sales as shown by the composite indicator below. While improved somewhat from the financial crisis, levels remain well entrenched in recessionary territory. Increased regulations, the onset of the Affordable Care Act (ACA), increased taxes (due to the ACA) and increased costs of compliance keep budgets tight with profitability a primary focus. This is also why the expectations of economic improvement over the next six months remains at extremely low levels. While the expectation of higher real sales certainly gave a significant boost to this month's survey report, it is likely to be a one-month anomaly unless we see a transition into actual sales. However, Bill Dunkleberg, Chief Economist for the NFIB, summed this up well:

With the Federal Reserve now extracting their support from the financial markets, real interest rates higher which impacts borrowing costs, and health care insurance premiums set to rise by as much as 40% over the next two years, the headwinds to small business owners are substantial. As I discussed just recently in "Why Surging Profits Aren't Leading To CapEx:"

|

Gold Bugs index poised to rally 150% again???

by Chris Kimble

| CLICK ON CHART TO ENLARGE Twice in the past 15 years the Gold Bugs/S&P 500 ratio was oversold (2001 & 2009), and the Gold Bugs index ended up with rallies in excess of 150%. The ratio remains deeply oversold at this time and the Gold bugs index could be on support and forming a bullish inverse head & shoulders pattern. The current fish-mouth spread between the two is now the widest in the past 14 years. I have been sharing with Premium members that the Silver/Gold ratio is on a 24-year support line and has created another bullish falling wedge on support. In my humble opinion, this ratio needs to breakout to the upside, for the Gold bugs index to blast off! |

The West’s Financial Arsenal

by Harold James

| PRINCETON – The revolution in Ukraine and Russia’s illegal annexation of Crimea have generated a serious security crisis in Europe. But, with Western leaders testing a new kind of financial warfare, the situation could become even more dangerous. A democratic, stable, and prosperous Ukraine would be a constant irritant – and rebuke – to President Vladimir Putin’s autocratic and economically sclerotic Russian Federation. In order to prevent such an outcome, Putin is trying to destabilize Ukraine, by seizing Crimea and fomenting ethnic conflict in the eastern part of the country. At the same time, Putin is attempting to boost Russia’s appeal by doubling Crimeans’ pensions, boosting the salaries of the region’s 200,000 civil servants, and constructing large, Sochi-style infrastructure, including a $3 billion bridge across the Kerch Strait. This strategy’s long-term sustainability is dubious, owing to the strain that it will put on Russia’s public finances. But it will nonetheless serve Putin’s goal of projecting Russia’s influence. For their part, the European Union and the United States have no desire for military intervention to defend Ukraine’s sovereignty and territorial integrity. But verbal protests alone would make the West look ridiculous and ineffective to the rest of the international community, ultimately giving rise to further – and increasingly far-ranging – security challenges. This leaves Western powers with one option: to launch a financial war against Russia. As the former US Treasury official Juan Zarate revealed in his recent memoir Treasury’s War, the US spent the decade after the September 11, 2001, terrorist attacks developing a new set of financial weapons to use against America’s enemies – first Al Qaeda, then North Korea and Iran, and now Russia. These weapons included asset freezes and blocking rogue banks’ access to international finance. When the Ukrainian revolution began, the Russian banking system was already over-extended and vulnerable. But the situation became much worse with the toppling of Ukrainian President Viktor Yanukovych and the annexation of Crimea, which triggered a stock-market panic that weakened the Russian economy considerably and depleted the assets of Russia’s powerful oligarchs. In a crony capitalist system, threatening the governing elite’s wealth rapidly erodes loyalty to the regime. For the corrupt elite, there is a tipping point beyond which the opposition provides better protection for their wealth and power – a point that was reached in Ukraine as the Maidan protests gathered momentum. Putin’s public speeches reveal his conviction that the EU and the US cannot possibly be serious about their financial war, which, in his view, would ultimately hurt their highly complex and interconnected financial markets more than Russia’s relatively isolated financial system. After all, the link between financial integration and vulnerability was the main lesson of the crisis that followed the US investment bank Lehman Brothers’ collapse in 2008. In fact, Lehman was a small institution compared to the Austrian, French, and German banks that have become highly exposed to Russia’s financial system through the practice of using deposits from Russian companies and individuals to lend to Russian borrowers. Given this, a Russian asset freeze could be catastrophic for European – indeed, global – financial markets. Putin’s plan for destabilizing Ukraine is thus two-pronged: capitalize on linguistic or national animosities in Ukraine to foster social fragmentation, while taking advantage of Western – especially European – financial vulnerabilities. Indeed, Putin sometimes likes to frame it as a contest pitting him against the power of financial markets. The arms race that preceded World War I was accompanied by exactly the same mixture of military reluctance and eagerness to experiment with the power of markets. In 1911, the leading textbook on the German financial system, by the veteran banker Jacob Riesser, warned that, “The enemy, however, may endeavor to aggravate a panic…by the sudden collection of outstanding claims, by an unlimited sale of our home securities, and by other attempts to deprive Germany of gold. Attempts may also be made to dislocate our capital, bill, and securities markets, and to menace the basis of our system of credit and payments.” Politicians began to grasp the potential consequences of financial vulnerability only in 1907, when they faced a financial panic that originated in the US but that had serious consequences for continental Europe (and, in some ways, prefigured the Great Depression). That experience taught every country to make its own financial system more resilient to ward off potential attacks, and that attacks could be a devastating response to diplomatic pressure. That is exactly what happened in 1911, when a dispute over control of Morocco spurred France to organize the withdrawal of DM200 million invested in Germany. But Germany was prepared and managed to ward off the attack. Indeed, German bankers proudly noted that the crisis of confidence hit the Paris market much harder than markets in Berlin or Hamburg. Countries’ efforts to protect their financial systems often centered on increased banking supervision and, in many cases, enlarging the central bank’s authority to include the provision of emergency liquidity to domestic institutions. Subsequent debates about financial reform in the US reflected this imperative, with some of the US Federal Reserve’s founders pointing out the military and financial applications of the term “reserve.” At that time, financial-reform efforts were driven by the notion that building up financial buffers would make the world safe. But this belief fueled excessive confidence among those responsible for the reforms, preventing them from anticipating that military measures would soon be needed to protect the economy. Instead of being an alternative to war, the financial arms race made war more likely – as it may well be doing with Russia today. |

China 'has more gold than official figures show'

Precious metals researcher says the quantity of vaulted gold in China is rising steadily

How much gold does China have? China could be holding even more gold than previously realised, according to Alasdair Macleod, a researcher at online precious metals trader, GoldMoney. Official figures from China Gold Association (CGA) show that the Asian superpower consumed 1,176 tonnes of gold in 2013, 41pc higher than in 2012. However, about 500 tonnes of gold from Chinese mines and scrap is unaccounted for by the CGA. Mr Macleod believes the country holds more gold that the stated figures suggest, and in fact consumed 4,843 tonnes in 2013 alone. He raised his estimate after researching Chinese Gold Reports, where he said he found details of the amount of gold vaulted. He said the quantity of vaulted gold has been increasing steadily. Related Articles

“Nobody had really any idea how much was going into the vaulting figures, " Mr Macleod said. “The changes in the level of vaulted gold has been increased on a fairly consistent level almost at exactly the same rate as the increase in deliveries.” Increased levels of gold held by China match with the country’s politics, according to Mr Macleod. “It fits in with what appears to be China’s geo-political strategy when it comes to gold,” he said. “China, by having control of a large amount of gold, has leverage in the financial relationship with the West. Owning gold gives power to China over America”, he said.

Alasdair Macleod's table from GoldMoney Martin Arnold, director-research analyst at ETF Securities, said that estimates of China's store of gold may well be too low. "The evidence suggests that China is a very big consumer of gold with a gap in reporting for the last several years. It does point to some build up of stocks. “China is the world’s biggest producer of gold. Not only do they consume all the gold that is mined in the country but are also a net importer. 2013 was a record level – we’re talking several million ounces, to the extent where we’re looking at about 35m ounces in terms of the net gold import", he said. Mr Arnold said that by owning gold, China diversified its reserves and so is less dependent on US treasuries. "The US dollar over the past decade or so has been in a period of structural decline so when the public sector invests their holdings, they don’t want to hold it all in US treasuries, which are necessarily dollar based", he said. China is one of the biggest holders of US treasuries in the world. "China have got a large foreign exchange reserve with over £3.5trn invested around the world and so necessarily a large part of that goes into US treasuries", said Mr Arnold. Owning a lot of gold to diversify investments means China is not beholden to the political decisions or monetary policy decisions from the United States, he said. |

World's Largest Gold Crystal Found

By Marc Lallanilla

|

Researchers at Los Alamos National Laboratory have determined that this is the world's largest single crystal of gold. It's the size of a golf ball, but a lot more valuable: Scientists at Los Alamos National Laboratory's Lujan Neutron Scattering Center have verified that a heavy piece of gold, found years ago in Venezuela, is, in fact, a single crystal of the valuable element — and it's worth an estimated $1.5 million. The lump of gold, which weighs 217.78 grams (about 7.7 ounces), was brought to Los Alamos to confirm whether it was a single crystal of gold, or a more common multiple-crystal structure. "The structure or atomic arrangement of gold crystals of this size has never been studied before, and we have a unique opportunity to do so," Miami University geologist John Rakovan said in a statement. To determine the nugget's internal structure, Rakovan and his colleagues used two sophisticated machines: a neutron single-crystal diffraction (SCD) instrument, which determines the atomic arrangement of single crystals; and a high-pressure/preferred orientation (or HIPPO) instrument, which measures the crystal structure and the orientation of crystals in a polycrystalline material. These noninvasive techniques determined that the gold piece was, indeed, a very large and very rare single crystal of gold. |

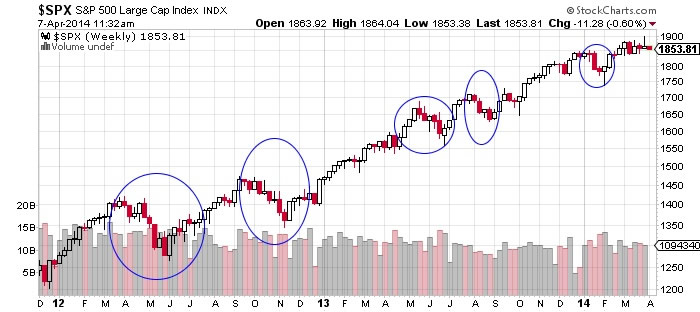

Considering Dumping Stocks? Why You Should Reconsider

By: DailyGainsLetter

| George Leong writes: I’m starting to receive more questions regarding the state of the stock market and whether it’s simply a bout of profit-taking or the set-up of a deeper stock market correction. First of all, panicking is not what you want to do. Yes, we are seeing some selling surfacing, but that doesn’t necessarily mean you should go and dump stocks. After the year we had in 2013 and the fact that the bull stock market is in its fifth year and devoid of a major question despite the advance, it would not be a surprise to see some selling. Also, with bond yields beginning to rise, we will see a reduction in the assumed risk and will likely see a shift of capital into bonds and away from the stock market as yields rise. The reality is that the stock market is already seeing a decline in the assumed risk in 2014. Technology stocks and small-cap stocks are no longer the stars of Wall Street this year. We are seeing a lack of market leadership and extreme selling on the momentum stocks, which clearly is a red flag. The concern is that the drop-off in the momentum stocks is significant and could likely extend lower since the rise was euphoric. Instead of seeking added returns, we are seeing a move towards safety as traders are shifting capital to blue chips and large-cap stocks that are better equipped to withstand a stock market sell-off and have largely proven themselves over decades. On the charts, the NADSAQ and Russell 2000 are down more than two percent in April versus a less than one-percent decline in the S&P 500 and Dow Jones Industrial.

A closer look shows the Russell 2000 down over 5.5% from its record and the NASDAQ is down nearly four percent. After outperforming in 2013, the underperformance of these indices compared to the S&P 500 this year is an indication of the current risk in small-caps. Assuming we are setting up for a stock market correction, recall that the higher-beta technology and growth stocks will decline faster and bigger than the more conservative large-cap stocks. A look at the charts shows a stock market correction is warranted. In fact, we could see a correction of at least five to six percent prior to some support, based on my technical analysis.

Any major correction should be viewed as an investment opportunity. For those of you who are active in the stock market, capital preservation is key at this time. Even if you are a buy-and-hold investor, it’s always good to take some profits at what could be a near-term top, so you can have some funds available for buying on weakness. Also, you should make sure you have some put options protection in place in case the decline is bigger than the recent stock market corrections. The key is not to panic and inadvertently dump everything. |

Hilsenrath Analysis: Fed Worried About Misleading on Interest Rates at Policy Meeting

| Federal Reserve officials worried about inflation and the signals they were sending about interest rates at their two day policy meeting March 18-19. Some officials argued they needed to send a stronger signal that they wanted to see inflation move up toward the Fed’s 2% objective. Some also worried that their interest rates projections might be incorrectly viewed as leading toward a more restrictive policy. Here is a look at key passages from the Fed minutes: 1) DOT ANGST: Fed officials worried at the meeting that their individual projections for short-term interest rates could be misleading. Some officials pushed up their projections for rates in 2015 and 2016, which would be made public in the Fed’s release of projections with its official policy statement. They wanted to avoid sending the message that the group as a whole anticipated more restrictive credit policies. Right after the meeting, many analysts and investors did worry that the Fed had become more hawkish, despite Fed chairwoman Janet Yellen’s efforts during her press conference to play down the meaning of the shift in projections. |

| “A number of participants noted the overall upward shift since December in participants’ projections of the federal funds rate included in the March (projections), with some expressing concern that this component of the (projections) could be misconstrued as indicating a move by the Committee to a less accommodative reaction function. However, several participants noted that the increase in the median projection overstated the shift in the projections. In addition, a number of participants observed that an upward shift was arguably warranted by the improvement in participants’ outlooks for the labor market since December and therefore need not be viewed as signifying a less accommodative reaction function. Most participants favored providing an explicit indication in the statement that the new forward guidance, taken as a whole, did not imply a change in the Committee’s policy intentions, on the grounds that such an indication could help forestall misinterpretation of the new forward guidance.” |  |

| 2) LOW INFLATION WORRIES: Fed officials discussed at length the continued run of inflation below the central bank’s 2% objective. Some officials wanted to make it clearer in their policy statement that the Fed wouldn’t tolerate low inflation and they agreed to monitor the data carefully. “A couple of participants expressed concern that inflation might not return to 2 percent in the next few years and suggested that a protracted period of inflation below 2 percent raised questions about whether the Committee was providing an appropriate degree of monetary accommodation … a few participants proposed adding new language in which the Committee would indicate its willingness to keep rates low if projected inflation remained persistently below the Committee’s 2 percent longer-run objective; these participants suggested that the inclusion of this quantitative element in the forward guidance would demonstrate the Committee’s commitment to defend its inflation objective from below as well as from above. Other participants, however, judged that it was already well understood … in light of their concerns about the possible persistence of low inflation, members agreed that inflation developments should be monitored carefully.” 3) LOW RATES FOR THE LONG-RUN: Fed officials agreed that they would likely keep short-term interest rates low well into the future, but they had different reasons for coming to this view: “Participants observed that a number of factors were likely to have contributed to a persistent decline in the level of interest rates consistent with attaining and maintaining the Committee’s objectives. In particular, participants cited higher precautionary savings by U.S. households following the financial crisis, higher global levels of savings, demographic changes, slower growth in potential output, and continued restraint on the availability of credit.” 4) STAFF A LITTLE MORE PESSIMISTIC: Fed staff members shaved down some of their growth projections and said the recent weakness wasn’t all because of bad weather. “Largely because of the combination of recent downward surprises in the unemployment rate and weaker-than-expected real GDP growth, the staff lowered slightly the assumed pace of potential output growth in recent years and over the projection period. As a result, the staff’s medium-term forecast for real GDP growth also was revised down slightly… “The staff viewed the extent of uncertainty around its March projections for real GDP growth and the unemployment rate as roughly in line with the average of the past 20 years. Nonetheless, the risks to the forecast for real GDP growth were viewed as tilted a little to the downside, especially because the economy was not well positioned to withstand adverse shocks while the target for the federal funds rate was at its effective lower bound.” 5) CHINA FOCUS: Officials appear to have become a bit more concerned about the economic outlook in China. “It was suggested that slower growth in China had likely already put some downward pressure on world commodity prices, and a couple of participants observed that a larger-than-expected slowdown in economic growth in China could have adverse implications for global economic growth.” 6) A THREE DAY MEETING: Janet Yellen is known inside the Fed as a glutton for preparation. That proved true at her first meeting as chairwoman. She gathered Fed officials on a March 4 conference call, two weeks before the planned meeting, to discuss some of the issues that would come up when they met in person March 18-19. This is an early clue on Ms. Yellen’s leadership style – preparation and lots of consultation with colleagues. “The Committee met by videoconference on March 4, 2014, to discuss issues associated with its forward guidance for the federal funds rate. The Committee discussed possible changes to its forward guidance that could provide additional information about the factors likely to enter its decisions regarding the federal funds rate target as the unemployment rate approached its 6½ percent threshold and once that threshold was crossed. The agenda did not contemplate any policy decisions, and none were taken. |

"Fixed Income Only Positive Return Asset Class in 2014, 30-Year Treasury Yield Headed to 2.50%" Says Steen Jakobsen

by Mike "Mish" Shedlock

| I don't believe the growth estimates of the IMF and neither does Steen Jakobsen, Chief Economist of Saxo Bank. 2014 started with high expectations on growth. The IMF, World Bank and ECB were falling over themselves to upgrade growth forecast for 2014 in early January but by now Q1 growth in the US is expected to come in at +1.9% after the initial +2.6% advertised by the pundits in late 2014 (Bloomberg December 12th, Survey). |

USDA pork data may deceive, while report boosts cattle bulls

By Rich Nelson

| Hogs: USDA’s changes made to the pork balance may have appeared supportive. They dropped their 2014 pork production forecast by a sharp 600 million lbs to now 22.777 billion. Net exports were lowered by 210 million lbs as they expect higher U.S. pork prices to turn off some foreign demand. Pork offered to the U.S. consumer was lowered from 46.7 lbs to 45.9. At first glance, these numbers appear bullish. However, this scenario is nowhere near where the private market suggests supplies will be. Their 2014 pork forecast is only 1.9% lower than last year. Remember that the March Hogs & Pigs report suggested producers are in expansion (more farrowings). Also, we have higher weights. We disagree slightly with the expansion discussion, but everyone can agree on the weights. Where we disagree, and sharply so, is with their estimate of PED losses (pigs/litter). As discussed previously, the March H&P report suggests only a 3% to 4% yr/yr loss in slaughter this summer. |  |

| Cattle: USDA gave the beef trade some positive news Wednesday morning. As you know, the supply/demand report covers several agricultural commodities. USDA added a minor 25 million lbs to its 2014 beef production forecast to bring it to 24.648 billion. This change was made due to the recent pace of higher placements that we have discussed previously. These numbers will build up summer slaughter levels. Still, they see 2014 beef production down 4.5% from last year. As imports of cow meat for the supply-starved grinding market has been strong, they added 40 million to their import forecast. We can’t argue too much with their recognition that our beef exports have been better than you could expect given this year’s beef production deficit. The 80 million increase for exports more than offset the increase in supply. These changes brought beef offered to the US consumer number, called per capita consumption, down from 53.9 to 53.8 lbs. |

Goldman Warns 67% Odds Of A 10% Market Decline In Next Year

by Tyler Durden

| While quick to explain how next year will be better (even though he keeps his year-end 1900 target for the S&P 500), Goldman's chief US equity strategist David Kostin warns there is a good chance of a 10% drop sometime in the next 12 months. The recent 6% pullback (sparked by EM concerns) is only one-third of typical historical corrections and as Kostin notes, the market has gone way too long without a so-called correction (10% from peak to trough). It's been 22 months (and 50% gains) since the last 10% drop and, based on Kostin's quant work, there is a 67% probability that we'll see that correction - which would take the S&P to around 1700. |

Rains arrive in time for Brazil corn, but not soy

by Agrimoney.com

| Brazil's weather improved last month in time to boost hopes for safrinha corn, but not to prevent further losses to soybean crops, US farm officials said, explaining revisions to their harvest estimates. The US Department of Agriculture, explaining a downgrade of 1.0m tonnes to 87.5m tonnes in its forecast for Brazilian soybean production in 2013-14, said that rains had not arrived in time to reverse drought damage to all crops in the drought-hit south. "Rains arrived by mid-February and rain have continued in March providing much needed relief, especially in Rio Grande do Sul," the USDA said, in a report which comes a day before Brazil's official Conab bureau is set to reveal its own revised forecasts. "In the other states, however, soybean yield potential did not recover." Conversely, in the western state of Mato Grosso, Brazil's top soybean producer, heavy rains had extended into March, "causing yield losses [and] some quality damage". 'Off to a good start' However, the recent rains had supported prospects for yields of safrinha corn – planted on land vacated by the soybean harvest - in all states, if delaying sowings in Mato Grosso, the USDA said, explaining a 2.0m-tonne increase to 72.0m tonne in its forecast for Brazil's overall corn output. "All areas have been receiving beneficial, above-average precipitation," the USDA said, adding that the safrinha crop had got "off to a good start". "Production is raised due to better yield potential for safrinha (second-crop) corn." The safrinha corn harvest - which is particularly sensitive to rival exporters as it is the main source of Brazilian export supplies – will nonetheless prove smaller than last year thanks to weaker sowings, with price differences driving farmers to soybeans instead, in many cases for the first time as a second crop. South Africa record The USDA also raised its estimate for the South African corn harvest, which it said would show a record yield of 4.38 tonnes per hectare "due to timely and well-above-average rainfall during February and March in the western and central Corn Belt when the crop was in the critical pollination and grain-filling stages". A field trip last month "observed good-to-excellent crop conditions, with interviewed farmers and traders reporting a bumper harvest expected for most regions", after drought had threatened crops early in 2014. Satellite imagery showed that yields should come in "well above-average in the central and western part of the country". The estimate for South African corn production was upgraded by 1.0m tonnes to a 23-year high of 14.0m tonnes, a rise of 1.6m tonnes year on year. |

Performance of 40 Futures Markets after Q1

| Commodities continue to grab headlines this year, as stocks have took a tumble in April, forcing many to question whether 2014 is the year of “Commodity Sex Appeal?” We’re a little bit past the first quarter of the year, and there’s reason to believe in the appeal by the amount of green shimmering below. (Disclaimer: Past performance is not necessarily indicative of future results) Here’s some of our thoughts:

What’s in store for the rest of the year? Is Coffee and Lean Hogs done with their uptrend? Will the Ag Markets be one of the top performers list for the full year? Are stocks going through a “correction” phase, or is the bull cycle over? From a managed futures perspective, CTAs don’t care about the headlines, the hype; they don’t even care if Commodities themselves are up or down. All they care about is a consistent prolonged trend in either direction. Although we will say the nice thing about up trends is there is no cap on how high they can go (in theory). In comparison short trades have a natural floor (cost of production) and can never go below zero. From a more broad perspective, after last weeks fall in stocks, we can only guess that there were more than a couple investors searching “Alternate Investment Opportunities.” So is it time to Google Alternative Investments, or is this just a blip before the stock market run continues? For those of you who think stocks will have another repeat year, ignore the last part. For those of you who might consider protecting your portfolio, do your due diligence about what alternative investments are out there, and what their return drivers are before taking your next step. |

5 rules for using the Internet after ‘Heartbleed’

By Priya Anand

| You know the lock icon that pops up next to URLs to tell you a website will keep your information safe? It turns out it has actually left your private data unsecured for more than two years. Websites encrypt your information, like emails, passwords and credit card numbers, so if anyone tries to snoop, they get a gibberish code and your data stays between you and the people you want to send it to. At least that’s the way it’s supposed to work. This week, researchers found a hole in OpenSSL, the lock that an estimated two-thirds of websites use. They’re calling the bug “Heartbleed.” What’s more, any attacks let in due to the bug can’t be traced, experts say. This is a gaping security hole with “epic repercussions,” director of security firm AlienVault Labs Jaime Blasco says, even if you’re starting to become numb to all the data breaches of late. Here are 5 rules for using the Internet after Heartbleed. 1. Trust no one Run the websites you have accounts with through tools like the Heartbleed test to see if they’re vulnerable or if the security gap has been patched before logging on. The page is fielding about 4,000 searches a minute, Milan-based freelance developer Filippo Valsorda said. Download the Chrome browser extension, Chromebleed, to receive notifications when you land at a website that hasn’t fixed the problem yet. “In computer security, you never know when there’s going to be a vulnerability,” says Joost Bijl, marketing manager at the security firm Fox-IT. 2. Change your passwords and use two-step verification “Change your password” is a mantra consumers have heard for years. It sounds simple and experts say it’s still the first step users should take to protect themselves in case their communications were intercepted due to Heartbleed over the last two years. The safest move would be to change all your passwords, given the dominance of OpenSSL, the technology associated with the bug. Many companies, including Google /quotes/zigman/30194416/delayed/quotes/nls/goog GOOG +0.07% , Facebook /quotes/zigman/9962609/delayed/quotes/nls/fb FB +0.27% , Twitter and PayPal offer two-step authentication, asking users a security question or sending a code via text message when someone tries to log in from a new machine. “If someone lifts your password, then they still can’t log in,” Bijl says. 3. Be wary of public Wi-Fi networks Turn off the setting that autoconnects your smartphone to public Wi-Fi networks, which can be exploited by malicious hackers. Airport and hotel Wi-Fi connections are convenient, but experts say these unsecured connections leave you open to attacks. When you do use them, set up a virtual private network to secure your Internet traffic. There are some free VPN services, though many charge monthly rates. 4. Monitor recent account activity Some companies, like Google, offer email activity reports that show where and when an account was accessed. On Gmail, click on the small “details” button at the bottom of your inbox for a report complete with timestamps, maps and IP addresses. If a timestamp doesn’t match up with your usage, change your password (and remember rule No. 2, two-step verification). 5. Install all the annoying security updates and read the alerts Everyone’s guilty of snoozing the prompts to install a security update and reboot, or ignoring an alert message to get to a Web page. These updates guard your computer from malware and other threats, and also fix any security gaps that might have gone undetected when you first downloaded software. If a security alert pops up on a familiar website, users sometimes ignore the notice and hit accept to move on, but can get caught in what are known as “man in the middle” attacks where a hacker eavesdrops on communications. “Users really don’t care and usually they don’t read those messages,” Blasco says. “Please read the messages and try to understand what you’re doing before you really make a mistake and your data can be compromised.” Also see: ‘Heartbleed’ bug warning: ‘Time to change passwords everywhere’ |

The Federal Reserve Under Fire

by sprout money

| Ultimately it is not a coincidence that the markets are correcting at a time when the Fed is halfway in its tapering program. The central bank gave the high flyers of the stock market wings in recent years, but are knocking it out of them as we speak. A lot of investors are reaching for stable large cap stocks and gold once again as a consequence. |

Forget HFT: The 4 Greatest Risks To Investors Now

by Lance Roberts/Richard Rosso

| The financial media discussions regarding high-frequency trading have reached a fevered pitch. No pun intended as the igniter of this public relations flame is famous author of “Money Ball” Michael Lewis who has been making the television circuit promoting his new book “Flash Boys.” Heated public discourse about how the stock market is “rigged” by the high-frequency traders has caught the attention of the Justice Department. So, you’re telling me this is a new condition? Please. Let’s provide some perspective to the argument. First, the market is not your friend. It’s not the focal point for the pervasive inequality rhetoric circulating through politics and the media today. It’s regulated to the point of sublime, so that’s not it, either. “Greed” and “fear” are the oils that run the machine. Some possess more oil than others. That’s how it works. Get over it. Since you’re going about your daily business working a job, trying to provide for your family, making it to the kids’ soccer games, let us expand on the impact of HFT on you. High-frequency traders utilize powerful technological tools to rapid-fire trade securities. Sophisticated computer models seek to exploit penny differences in prices of stock long before you as a retail investor even hit the enter key to electronically purchase 100 shares of Coca Cola. While many “experts” claim that HFT provides greater liquidity and transparency, the markets seemed to operate efficiently enough for the last 100+ years. However, while technological advancements can be beneficial, they open the door to the many nefarious individuals which will choose to exploit it to their advantage by employing the following:

This is clear manipulation of the prices to anyone who has a vague understanding of how financial markets operate. However, here some of the more insightful writings to help you gain clearer perspective on what HFT is, and isn’t. How to Unrig the Stock Market. HFT is no BFD for Buy/Holders. With this in mind here are some thoughts to consider. 1). Markets have and always will be “rigged” to some degree. C’mon we’re not that stupid – this shouldn’t be big news. We have the finest stock markets in the world, but guess what – there will always be someone faster than you, smarter than you and willing to spend the money and time to create algorithms to try to gain an edge. In the 1930's, it was a consortium of banks and wealthy families. Today it’s programmed traders who move like serpents in the underbelly of markets and nip at your wallet. Even Ray Dalio has stated that if you want to play in the markets you had better come to the table ready to beat him, his hundreds of financial professionals and billions of dollars in technology. If you don’t that – you should. However, this doesn’t mean you can’t be a long-term participant and take advantage of momentum. How can you attach to the stars of these HFT players and take advantage of what they do? Investors in the market since the bottom of March 2009, have benefitted by returns close to 200% (talk about a home run). Change your perspective. Turn around your mindset. As Michael Corleone lamented in “The Godfather “keep your friends close but your enemies closer.” You can make money in “rigged markets” but you can’t lose sight of reality. It’s a double-edged sword, obviously. While you can make money by riding the wave up, you can lose more when the trend changes. Despite what the daily blathering of Wall Street analysts and financial professionals needing your money to create their profits, rising markets will end, and end badly. They always have, they always will. It is the cycle of life. To profit alongside HFTraders, you can no longer be a "buy and hold" investor. If you work with a financial professional who believes your investments are set and forget, you need to move your legs, and accounts, out of there. Ask your advisor today: What’s your sell discipline? You will like see them almost pass out in front of you. 2). Let’s reveal the TRUE market manipulator: The Federal Reserve –The biggest driver of asset prices over the last 5 years has been the direct monetary interventions of the Federal Reserve. Over the last couple of years, we have updated our analysis of the correlation between the Federal Reserve’s monetary interventions and the S&P 500 (latest update here). I have also projected the theoretical conclusion of the Fed's program by assuming a continued reduction in purchases of $10 billion at each of the future FOMC meetings. If the current pace of reductions continues it is reasonable to assume that the Fed will terminate the current QE program by the October meeting. If we assume the current correlation remains intact, it projects an advance of the S&P 500 to roughly 2000 by the end of the year. This would imply an 8% advance for the market for the entirety of 2014. Such an advance would correspond with an economy that is modestly expanding at a time where the Federal Reserve has begun tightening monetary policy. (Yes, Virginia, "tapering" is "tightening.) Historically speaking, such retractions of support from the financial markets have not fared well for investors as the ongoing “carry trade” is unwound. The problem for most individuals will be understanding the difference between a “dip” and a full blown reversion, until it’s too late. 3). Investors rig themselves mentally for anemic returns. Investors are saddled with behavioral and cognitive biases.

While the markets have rallied nearly 170% from the 2009 lows, most individuals did not garner those returns. They were buying into the peak of 2008 because Wall Street told them that it was a “Goldilocks Economy”, they held on during the entire crash because Wall Street told them too, and they finally sold at the bottom when the losses were too great to bear. Unfortunately, it took nearly four years from them to come back to the market, most likely very near the next major market peak. Wash, rinse, repeat. 4). Your broker may be rigging you. It’s ironic how financial services CEOs can exploit HFT for their own benefit to gain publicity and rail against it when they advocate their front-line sales forces to engage in HPST (high-pressure sales tactics) which are exponentially more detrimental to the wealth of retail investors. I don’t recall these CEO's suggesting “don’t invest until HFT is fixed,” do you? Of course not. They tell you to “buy and hold”, purchase your full asset allocation to stocks regardless of valuations and they never share what could happen if you miss the 10 WORST market days, only if you miss the 10 BEST.

So let’s get real, here. While HFT is a headline, a media grabber, it really has very little effect to your bottom line. However, what has the most important effect on your long term financial prosperity is managing the risks of investing that can do long-term, irreparable damage to your financial health. As discussed recently, it makes little sense to focus only on what could go right. You can readily find that case being made in the mainstream media daily. However, finding an advisor that can understand the impact to portfolios when something goes "wrong" is inherently more important. However, an independent advisor can help level the playing field between Wall Street and you. Provided they have the right team, tools and data they can spend the time necessary to manage portfolios, monitor trends, adjust allocations and protect capital through risk management. If the market rises, terrific. It is when markets decline that we truly understand the "risk" that we take. A missed opportunity is easily replaced. However, a willful disregard of "risk" will inherently lead to the destruction of the two most precious and finite assets that all investors possess – capital and time. |