By: GoldSilverWorlds

Ted Butler writes: I’ve had some recent conversations with attorneys who were considering class-action lawsuits regarding a gold price manipulation stemming from reports about the London Gold Fix. I told them that while there is no doubt that gold and, particularly, silver are manipulated in price, I didn’t see how the manipulation stemmed from the London Fix. I wished them well and hoped that they may prevail (the enemy of my enemy is my friend), because you never know – if the lawyers dig deep enough they might find the real source of the gold and silver manipulation, namely, the COMEX (owned by the CME Group) and JPMorgan.

So I thought it might be constructive to lay out what I thought a successful lawsuit might look like, although I’m speaking as a precious metals analyst and not as a lawyer. I’ll try to put the whole thing into proper perspective, including the premise and scope of the manipulation as well as the parties involved.

The first thing I should mention is how unprecedented it is that I’m writing this in the first place. Here I am, directly and consistently accusing two of the world’s most important financial institutions of market manipulation (making sure I send each all my accusations) and I have received no complaint from either. I don’t think that has ever occurred previously. Now I am taking it one step further; presenting a guide for how and why JPMorgan and the CME should be sued for their manipulation of gold and silver (and copper, too).

Let me explain why I am doing this. I am still certain that the coming physical silver shortage will end the price manipulation, but I see nothing wrong with trying to hasten that day. Over the past quarter century, I petitioned the regulators incessantly to end the manipulation, but the CFTC refused to do so. Far from regretting my past efforts, I feel it has greatly advanced and legitimized the allegations of manipulation. After 25 years, however, one must recognize that the horse being beaten is dead and that the CFTC will never act.

So, instead of simply waiting for the silver shortage to end the manipulation, I thought it advisable to try a new approach that was completely compatible with the real silver story to date. Since I (we) couldn’t get the CFTC to do its job and end the manipulation; why not try a different approach? The truth is that I have long believed that the right civil lawsuit stood a good chance at ending the manipulation before a silver shortage hit. I had high hopes initially that the class-action suit that was filed against JPMorgan for manipulating the price of silver a few years ago might succeed; but it seemed to drift off track and I wasn’t particularly surprised that it was ultimately dismissed. My intent should be clear – I want to see the next lawsuit succeed.

The stakes in a COMEX silver/gold/copper manipulation lawsuit are staggering. Not only is market manipulation the most serious market crime possible, the markets that have been manipulated and the number of those injured are enormous. I don’t think it’s an exaggeration to say that any finding that JPMorgan and the COMEX did manipulate prices as I contend could very well result in the highest damage awards in history. That’s no small thing considering the tens of billions of dollars that JPMorgan has coughed up recently for infractions in just about every line of their business.

My point is that no legal case could be potentially more lucrative or attention getting than this one. Certainly, this also includes the pitfall that JPMorgan and the CME are legal powerhouses who are not likely to roll over easily. Because the silver manipulation has lasted so long and damaged so many, the stakes away from any monetary finding are staggering. It is no real stretch to suggest, with or without eventual criminal findings, the reputational and regulatory repercussions (from other countries) could threaten the existence of each institution in current form (or at least management).

What is the theory or premise of the legal case for market manipulation against JPMorgan and the CME? The COMEX has evolved into a trading structure that has allowed speculators to control and dictate the price of world commodities, like gold, silver and copper, with no input from the world’s real producers, consumers and investors in these metals. The CME has allowed and encouraged this development for the sole purpose of increasing trading fee income. Not only do the world’s real metal producers, consumers and investors have no effective input into the price discovery process on the COMEX; because the COMEX is the leading metals price setter in the world, real producers, consumers and investors are forced to accept prices that are dictated to them by speculators on the exchange.

Because so few of the world’s real producers, consumers and investors deal on the COMEX, the exchange has developed into a “bucket shop” or a private betting parlor exclusively comprised of speculators. Again, this is an intentional development as much more trading volume is generated by speculative High Frequency Trading (HFT) than by legitimate hedgers (like miners) transferring risk to speculators. Legitimate hedgers don’t day trade. It is no exaggeration to say that the COMEX has been captured by speculators and abandoned by legitimate hedgers.

In turn, JPMorgan has developed into the “King Rat” in the speculative bucket shop by virtue of its consistent market corners in COMEX gold, silver and copper futures. The COMEX market structure was already rotten when JPMorgan blasted onto the scene in March 2008 when the bank acquired Bear Stearns’ short market corners in gold and silver. Incredibly, the regulators engineered the Bear Stearns rescue, granting to JPMorgan a listed market control in addition to the OTC market share control that JPM held for years. Talk about a powerful manipulative combo – JPMorgan and the COMEX.

Perhaps the most compelling aspect of my premise for a legal case against the CME and JPMorgan for market manipulation is that it is based exclusively on public data available from the CFTC in the form of the agency’s weekly Commitments of Traders (COT) and monthly Bank Participation Reports. There is additional proof of JPM’s controlling market share in the Treasury Department’s OCC OTC Derivatives Report (please see my public comment to the Federal Reserve at the end of this piece). The CFTC data may seem somewhat complex at first, but there can be little question as to its general accuracy and government pedigree. In fact, the data is compiled from exchange information transmitted to the CFTC, so the CME can’t deny its accuracy. There’s no he said/she said or ambiguity in these data series. In short, it is type of data that will hold up in a court of law.

According to the CFTC’s data, there are two primary groups of speculators setting prices on the COMEX. One group are the technical funds, traders that buy and sell strictly on price movement. Also referred to as trend followers and momentum traders, the technical funds buy and continue to buy futures contracts as prices climb; and sell and continue to sell, including short sales, as prices fall until prices subsequently reverse. These traders are included in the Managed Money category of the disaggregated version of the COT report, primarily because they are investment funds trading on behalf of outside investors, also known as registered Commodity Trading Advisors (CTA’s).

One thing that can be said for certain about these technical funds is that they are pure speculators, as there is no mining company or user of metal in this category by CFTC and CME definition. By itself, there is nothing wrong with that as regulated futures exchanges need speculators to take the other side of the transaction when legitimate hedgers wish to lay off price risk in the normal course of their underlying business. This is the economic justification for why congress had authorized futures trading originally. The problem is that there are few, if any, legitimate hedgers involved on the COMEX nowadays; only other speculators that are falsely categorized as legitimate producers and consumers.

The second group of speculators are primarily categorized as commercials, mostly in the Producer/Merchant/Processor/User category, but also in the Swap Dealers category. Since these terms are quite specific and strongly suggest that only legitimate hedgers are included, most people automatically assume the traders in these commercial categories are just that – hedgers. But that is not the case, as most of the traders in these two categories are banks, led by JPMorgan, pretending to be hedging, but which are, in reality, trading on a proprietary basis strictly for profit. Simply put, JPMorgan and other collusive COMEX traders are just pretending to be commercially engaged in COMEX trading in gold, silver and copper when, in reality, they are nothing more than hedge funds in drag.

http://www.cftc.gov/MarketReports/CommitmentsofTraders/DisaggregatedExplanatoryNotes/index.htm

The lynchpin of any legal case against JPMorgan and the CME revolves around whether the traders in the commercial categories of the COT report are, in fact, hedging or simply speculating, as are the technical funds. The CME and JPMorgan will go to the ends of the earth to show that the commercials are hedging, not speculating and will hide behind the twin concepts that the commercials are either trading on behalf of clients or are actively involved in market making and are thereby providing much needed liquidity. It will sound legitimate if you believe in make believe stories instead of facts.

JPMorgan has a history of proclaiming it is hedging when confronted with an unnecessarily large speculative position. The first thing the bank declared when the London Whale debacle surfaced was that it was part of a hedge against the bank’s portfolio. But that was openly scoffed at and quickly discarded as an excuse. JPM is likely to trot out the hedging or market making justification, but any competent attorney will blow that away. No one (openly or legitimately) granted JPMorgan the right to maintain market corners in COMEX gold and silver.

In December 2012, JPMorgan held market shares on the short side of COMEX gold and silver that amounted to 20% and 35% of the net open interest in each market respectively. It is not possible that a reasonable person would not consider those market shares in an active regulated futures market to constitute market corners. After rigging prices lower by historical amounts in 2013, JPMorgan flipped its short market corner in COMEX gold to a long market corner of as much as 25% and reduced its short market corner in COMEX silver to under 15% from 35%, pocketing more than $3 billion in illicit profits. I’d like to see JPMorgan explain some connection to hedging with regards to its position change.

Undoubtedly, JPMorgan will claim it was “making markets” to explain away its huge position shifts in COMEX gold and silver (and copper), proclaiming it was always a buyer on the downside and a seller on the upside of prices. True enough, but far from being the market hero it will pretend to be, a closer examination will reveal something else entirely. The purpose of market making is to provide market liquidity and price stability. Legitimate traders are given some leeway from regulations limiting speculative positions and market shares from growing too large in order to enhance liquidity and price stability which benefits everyone.

But the record clearly indicates that JPMorgan, in cahoots with the CME, has used its dominant market shares in COMEX gold, silver and copper to instead engage in an evil form of market making whose intent is to constrict liquidity and create disorderly pricing. What record indicates that? The price record. Twice in 2011, the price of silver fell more than 30% ($15) in a matter of days and last year gold fell $200 and silver by $5 in two days. These price declines were unprecedented, had no legitimate supply/demand explanation and the regulators, including the CME did or said anything.

For sure, JPMorgan was a buyer on those deliberate price smashes and every other COMEX gold, silver and copper price smash for the past six years, but how does that make them a hero? This crooked bank and the CME and others arranged every COMEX price smash in order to create chaos, drain liquidity and disrupt pricing; the exact opposite of what legitimate market making is supposed to be. JPMorgan and the CME violated public trust in our markets as proven by the price record. For that, they should be made to pay dearly.

The key question is how did (and does) JPMorgan and the CME pull this off repeatedly? It all has to do with market mechanics, of which JPM and the CME are absolute masters. Since there are, essentially, two separate and competing speculative groups setting prices on the COMEX, it comes down one group scamming the other. (I know this is old hat to subscribers, but please remember I’m writing this to convince the right attorney to take on these crooks). So how does JPM get positioned to profit from a price smash (or price rise) and then rig prices to go in their direction? Basically, by scamming the technical funds by getting those funds to do what is profitable for JPMorgan and other collusive commercial traders and including the CME in the form of extraordinarily large trading volume.

How the heck does JPMorgan and the CME pull that off? They can pull it off because they know how the technical funds operate and because JPM and the CME also know how to cause the funds to buy and sell when JPM wants them to buy and sell. Since the technical funds only buy as prices are rising and only sell as prices are falling, particularly when prices penetrate key moving averages, all JPMorgan and the other collusive commercials have to do is occasionally set prices above and below those key moving averages. And thanks to an array of dirty trading tricks developed over the past 30 years, the most recent being HFT, JPMorgan can set short term prices wherever it chooses, whenever it desires.

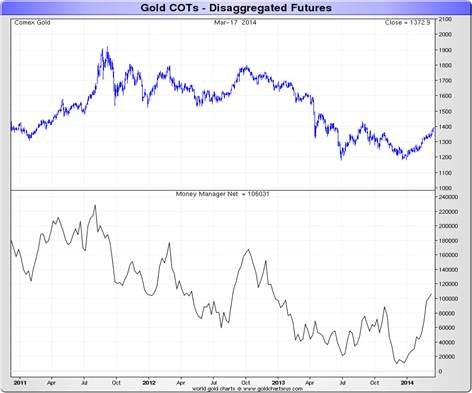

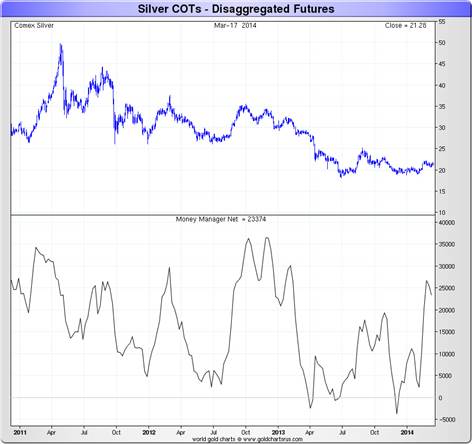

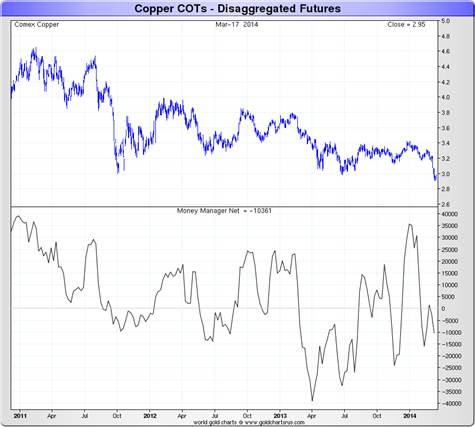

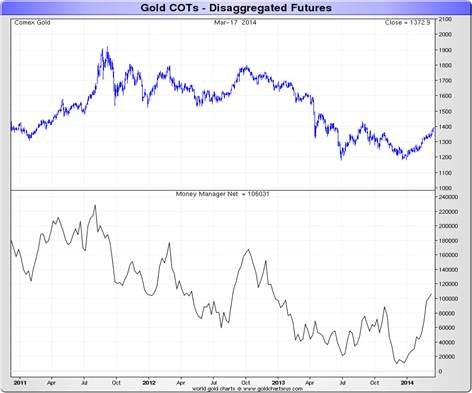

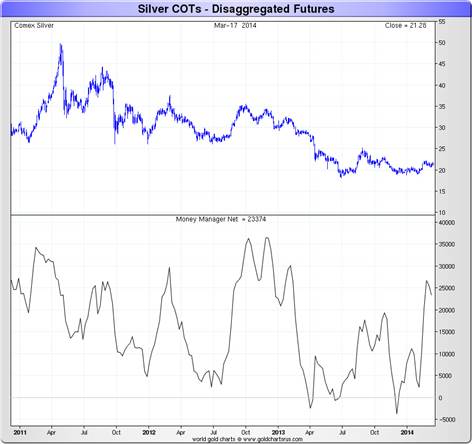

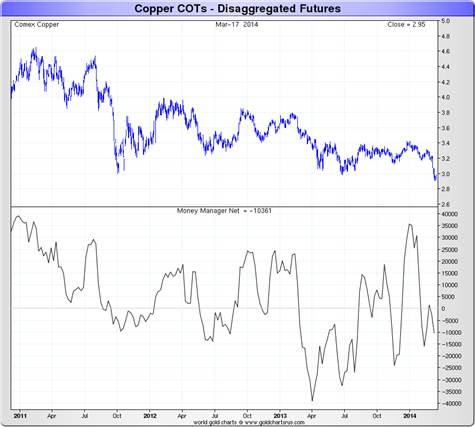

In a very real sense, JPMorgan and other collusive COMEX commercials have become the puppet masters controlling the technical funds’ movements. It is an exquisite racket – JPMorgan gets the technical funds to buy or sell in order to take the other side of the transaction as counterparties. This can be seen in almost every price move in COMEX gold, silver and copper over the years. Let me try to present the data in graphic form, courtesy of some charts by my Aussie friend, Nick Laird of sharelynx.com.

Depicted below are the three main metals of the COMEX, gold, silver and copper and the net positions of the traders in the managed money category – the technical funds over the past couple of years. If you plot when the technical funds buy or sell, there is almost a 100% correlation to price. In other words, when the technical funds buy, prices for gold, silver and copper rise and when the technical funds sell, prices fall. The correlation is almost uncanny, to the point where some pundits have recently claimed that it is the technical funds, not the commercials, which are manipulating prices. But those claims melt away once one considers the nature of this bucket shop fraud.

Sure, the technical funds move prices when they buy and sell, but that’s just what JPMorgan and the CME count on. If the technical funds weren’t mechanical and predictable there would be no scam possible. It is only because the technical funds can be counted on to do the same thing repetitively that allows JPMorgan and other collusive commercials to take counterparty positions. If the technical funds weren’t predictable, JPMorgan would never have made $3 billion+ last year in COMEX gold and silver and been able to flip a short market corner in COMEX gold to a long market corner. Or just ask yourself – why would the technical funds collude to harm themselves?

I also feel it is significant that I can now include copper in the JPMorgan/CME illicit scheme to manipulate. This broadens the manipulation in a systemically important way. If ever there was a case for the Racketeer Influenced and Corrupt Organizations Act (RICO), this must be it.

In one recent attorney conversation, I was asked to provide the name of a technical fund that was duped as I described and would like to seek legal redress. If I could have, I would have, but I don’t think that’s possible. It’s another reason I refer to this COMEX manipulation as almost the perfect crime. In this case, any technical fund would not likely seek redress as a victim (certainly not as the initiator of legal action) because to do so would involve having to admit being the mark at a crooked poker game, something not conducive to attracting additional investor funds. In fact, it would invalidate a technical fund’s core business and be tantamount to simply quitting a business that may have been in existence for decades. It just isn’t going to happen.

But that hardly matters because the nature of market manipulation means there are untold numbers of other victims, particularly considering the scope of the gold, silver and copper markets. Whereas the technical funds were both the enablers and sometimes victims of the scam I described above, there are many thousands of legitimate victims (including me and many of you) who did nothing to enable the scam.

I dare say that there are more potential victims of the JPMorgan/COMEX gold, silver and copper manipulations than in just about any previous financial fraud. Let’s face it, there is hardly a mining company or investor in gold and silver or mining company shares that hasn’t been damaged over the past six years to some extent. That’s when JPMorgan came to dominate COMEX trading. If a legitimate class-action lawsuit was initiated, I believe potential litigants would emerge in massive numbers. Then again, there’s only one way to find out for sure and that’s to have such a case filed.

On a number of occasions in the past, when there was still some slim hope that the CFTC might address the ongoing silver manipulation, I publicly requested that you should submit public comments on issues related to position limits. By my count, upwards of 10,000 comments were submitted collectively, for which I offered my profuse thanks. Unfortunately, because the agency appeared to be compromised on the issue, no real good came from it through no fault of our own. Therefore, I would hardly ask anyone to do that again.

But I was reminded by a subscriber that I should submit a comment in regard to the Federal Reserve’s open public comment period seeking input on whether banks should be allowed to deal in physical commodities and derivatives on such commodities. I had mentioned in a previous article that I was undecided whether to do so or not. The subscriber convinced me that it was the right thing to do in order to go on the record, to which I had to agree. I understand the comment period has been extended to April 14, for anyone wishing to submit comments for the record. There have been less than 80 comments posted thru today and mine are near the bottom http://www.federalreserve.gov/apps/foia/ViewAllComments.aspx?doc_id=R-1479&doc_ver=1

See the original article >>