| | |

|

|

Market participants are ready for the employment report on Friday having seen an unexpectedly weak ADP payroll report on Wednesday.

The ADP report had been showing greater employment strength than had the Bureau of Labor Statistics non-farm payroll series over the last months. Many would assume that this lower ADP report on Wednesday is syncing the two series at a lower level of employment growth.

Changes were made to the ADP survey about a year ago with the expectation that variance between the two surveys would be reduced. Since then, there have been only mild discrepancies in the data series and traders have once again become comfortable in finding predictability for through the ADP releases.

Over the years, there have been repeated, but well separated, instances where an ADP report altered expectations for a nfp report only to have given a false signal. It has been a long time since any large discrepancies in these two data series has occurred and traders are once again comforted by this period of data sync.

The ADP payroll report on Wednesday was 139,000, 10% below the Bloomberg survey estimates. Since then, economists have been lowering their forecast for nfp. Bloomberg survey now shows expectations for 149,000, above the prior month 113,000, but well below the prior 4 month average of 188,000.

Treasury prices had risen as continued weak economic reports found concerns growing that severe winter weather may only be a small part of the reason for recent below trend growth. Too often has the Fed failed by predicting forthcoming economic strength and the recent tapering of security purchases is seen by some as another in a series of accommodation removal episodes prior to sufficient economic traction being achieved.

This was the backdrop for already firm Treasury prices late last week. Over the weekend, news of Russian moves to secure interests in Ukraine prompted bullish ‘haven’ status buying of U.S. Treasuries. On Monday, 10 year Treasuries moved above recent highs to test levels not seen since late October ’13. While prices remained higher on the day on Monday, they were unable to hold the session highs and formed a bearish technical pattern in candlestick analysis--a bearish ‘hanging man’.

The bearish implications of this pattern was confirmed on Tuesday when the June 10-year Treasury future(CBOT:TYM14) had its largest single session open to close decline since early November. This confirmation session followed with a lighter volume pause on Wednesday that failed to recover much of the prior session decline.

As of 9:00am EST on Thursday, Treasury prices are slightly lower (TYM4 -9+ to 124-01). Generally speaking, Treasury prices have a tendency to consolidate on the approach of the payroll data.

However, when there is a ‘significant’ move in the session prior to the employment report, it may indicate that economic agents have found something that has materially changed their collective view and are found not waiting for confirmation in the payroll data. At this stage, no such argument can be made that 9 to 10 tics lower in TYM indicates such a sentiment change. A move to 123-19 might indicate such a changed view.

Because accounts have already adjusted to weaker economic data and have factored in heightened geopolitical risk, the prospect are high for an exaggerated reaction to a slightly better than expected economic data event.

by Marketanthropology

Welcoming Draghi's perpetual patience towards further monetary actions, the euro is meeting our expectations today and breaking out of the consolidating range it has traded in since last fall. On a longer-term horizon, it is also now above overhead resistance that capped the sharp rally last year as well as the exhaustive highs in Q2 2011.

The breakout is coming at the expense of the US dollar, which we have expected would support the gathering bid in the commodity and precious metals markets as well as those currencies buttressed by their strength.

By Debarati Roy

Gold (COMEX:GCJ14) futures rose for the second straight day amid forecasts that U.S. borrowing costs will hold at a record low and European inflation will pick up gradually.

Expectations that interest rates won’t rise until mid-2015 are appropriate, William Dudley, the president of the Federal Reserve Bank of New York, said today. European Central Bank President Mario Draghi said that the inflation rate will gain in the next 30 months, damping deflation risks. Yesterday, gold climbed after U.S. service industries expanded in February at the slowest pace in four years.

Through yesterday, gold climbed 11% this year on demand for a haven amid turmoil in Ukraine and concern that the U.S. is faltering. The Labor Department will release jobs data tomorrow. In 2013, the metal tumbled 28%, the most since 1981, as global equities rallied and U.S. inflation was muted.

“Comments from Dudley and Draghi have helped gold find support,” David Lee, a vice president at Heraeus Precious Metals Management in New York, said in a telephone interview. “People will be closely watching tomorrow’s employment numbers to assess the health of the economy.”

Gold futures for April delivery gained 0.7% to $1,350.20 an ounce at 12:02 p.m. on the Comex in New York. On March 3, the price reached $1,355, the highest for a most-active contract since Oct. 30.

Stimulus Cutbacks

Fed Chair Janet Yellen said last week the central bank is “open to reconsidering” the pace of cuts in monetary stimulus should the economy waver. The Fed, which next meets March 18-19, announced a $10 billion reduction in bond buying at each of its past two meetings, leaving purchases at $65 billion.

“While the situation between Russia and Ukraine has improved, the uncertainty of it is still expected to lift demand for a safe haven,” said Wang Xiaoli, chief investment strategist at CITICS Futures Co. in Shenzhen, a unit of China’s biggest listed brokerage. “On the downside, the pace of tapering isn’t expected to change unless U.S. economic data turns really bad.”

Gold surged 70% from December 2008 to June 2011 as the central bank pumped more than $2 trillion into the financial system and lowered interest rates to a record low to boost growth.

Silver (COMEX:SIJ14) futures for May delivery climbed 1.5% to $21.58 an ounce on the Comex.

by Lance Roberts

Earlier this week I discussed the expectations for an increase in reported earnings of 50% over the next two years:

"Currently, according to the S&P website, reported corporate earnings are expected to grow by 20.26% in 2014, and by an additional 20.28% in 2015. In total, reported earnings are expected to grow by almost 50% ($100.28/share as of 2013 to $147.50/share in 2015) over the next two years."

However, as I also noted, the rise in corporate profitability has come from accounting magic and cost cutting along with a healthy dose of share buybacks. Since there is "no free lunch," the drive for greater corporate profitability has come at an economic expense. Since 1999, the annual real economic growth rate has run at 1.94%, which is the lowest growth rate in history including the "Great Depression." I have broken down economic growth into major cycles for clarity.

As I discussed previously:

"Since 2000, each dollar of gross sales has been increased into more than $1 in operating and reported profits through financial engineering and cost suppression. The next chart shows that the surge in corporate profitability in recent years is a result of a consistent reduction of both employment and wage growth. This has been achieved by increases in productivity, technology and offshoring of labor. However, it is important to note that benefits from such actions are finite."

The latest report on unit labor costs and productivity produced the following two charts which underscore this point and suggests that the current rate of economic growth is unlikely to change anytime soon.

I stated previously, that in in 2013 reported earnings per share for the S&P 500 rose by 15.9% to a record of $100.28 per share. Importantly, roughly 40% of that increase occurring in the 4th quarter alone. The chart of real, inflation adjusted, compensation per hour as compared to output per hour shows a likely reason why this occurred. The sharp increase in output per hour combined with the sharp decline in compensation costs is a direct push to bottom line profitability.

However, it was not just a decrease in compensation costs but in total labor costs as well which includes benefits and other labor related costs. This suggests that the drop off in hiring in the 4th quarter was more than just "weather" related.

Labor costs are one of the largest detractors from net profitability on any income statement. The problem with cost cutting, wage suppression, labor hoarding and stock buybacks, along with a myriad of accounting gimmicks, is that there is a finite limit to their effectiveness.

I say this because of something my friend Cullen Roche recently pointed out:

"We’re in the backstretch of the recovery. We’re now into month 47 of the current economic recovery. The average expansion in the post-war period has lasted 63 months. That means we’re probably in the 6th inning of the current expansion so we’re about to pull our starter and make a call to the bullpen. The odds say we’re closer to the beginning of a recession than the beginning of the expansion. That puts the Fed in a really odd position and not likely one where they’re on the verge of tightening any time soon."

This is a very important point. While the Fed's ongoing interventions since 2009 have provided support to the current economic cycle, they have not "repealed" the business cycle completely. The Fed's actions work to pull forward future consumption to support the current economy. This has boosted corporate profitability at a time when the effectiveness of corporate profitability tools were most effective.

However, such actions leave a void in the future that must be filled by organic economic growth. The problem comes when such growth does not appear. With the economy continuing to "struggle" at an anaemic pace, the effects of cost cutting are becoming less effective.

This is not a "bearish" prediction of an impending economic crash, but rather just a realization that all economic, and earnings, forecasts, are subject to the overall business cycle. What the unit labor costs and productivity report suggest is that economic growth remains very weak. This puts current forward expectations of accelerated economic and earnings growth at risk. With asset prices extended, valuations rich and optimism at extremes, such a combination has historically become a rather toxic brew when exuberant expectations fail to align with reality.

By Sholom Sanik

Sugar(NYBOT:SBK14) prices have rallied by close to 20% off their late-January lows. Yet a glance at the weekly chart shows a mere blip in a long bear market. The anticipated pre-March-expiry short-covering rally has been true to form, with open interest shedding 50,000 contracts in the last two weeks of February.

Will that be all? Or is this the beginning of a much broader bull run?

The rally was underpinned by some potentially very bullish news. Extremely dry weather conditions for the first six weeks of 2014 in Brazil could wipe out a significant chunk of the 2014-15 crop. The crushing season begins in April. Early forecasts called for a cane crop that would be 10 to 20 million tonnes above 2013-14. With the inclement weather, however, analysts estimate that about 40 million tonnes of cane may have been compromised. Both ethanol and sugar output will suffer. A rough estimate would put sugar production about 2 million tonnes below 2013-14--enough to compromise the comfortable availability of exportable global supplies the market has become ccustomed to over the past few years. If the weather does not improve, the shortfall could be closer to 4 million tonnes.

The 2013-14 marketing year will end in surplus, but the International Sugar Organization (ISO)—as well as analysts at all the major trade houses—have been trimming their estimates during the past couple of months. On Feb. 26, the ISO revised its estimate for the surplus to 3.6 million tonnes, down from its previous estimate of 4.4 million tonnes. According to the ISO, it will be the first time since 2008-09 that sugar production will fall from previous-season levels. Some analysts see the surplus falling to closer to 2 million tonnes.

Cane crops were robust in 2013-14. Now that we are in the crushing stage, the dwindling surplus may be the first indication that low prices are discouraging sugar production.

On Wednesday, crude oil lost 2.27% as tensions cooled in Ukraine and U.S. supply data missed investors’ expectations. Because of these circumstances, light crude erased all its gains from Monday's jump and dropped below $101 per barrel.

Yesterday, soft U.S. service-sector data weakened the price of light crude and pushed it below $103 per barrel. The ADP nonfarm payrolls data showed that the U.S. private sector added 139,000 jobs in February, well below expectations for an increase of 160,000. Additionally, the ISM's purchasing managers' index fell to 51.6 in February from 54.0 in January (while analysts had expected a drop to 53.5 in February). At this point, it’s worth noting that February's PMI is the lowest since February 2010.

Later in the day, the U.S. Energy Information Administration showed in its weekly report that U.S. crude oil inventories rose by 1.4 million barrels in the week ended Feb. 28, missing expectations for an increase of 1.3 million barrels. Although this increase was largely in line with market expectations (and the price of light crude declined only slightly from its prior level after the report's release), distillate stockpiles (which were expected to fall by 1.1 million barrels but instead rose by 1.4 million barrels) disappointed investors and sent crude oil to its lowest level in more than two weeks.

Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

Quoting our last Oil Trading Alert:

"Light crude closed the day below February high, which is not a positive signal ... when we factor in the current position of the indicators, it seems that further deterioration is just around the corner ... the RSI and Stochastic Oscillator generated sell signals, while the CCI is very close to doing it. If oil bulls do not trigger a corrective upswing today, crude oil may extend losses and drop to the upper line of the rising trend channel."

Looking at the above chart, we see that although the buyers tried to push the price higher, they failed, which triggered a sharp decline in the following hours. With this downswing, crude oil not only dropped to the upper line of the rising trend channel, but also reached the December high. If this support line is broken, we will see further deterioration and the first downside target will be the lower border of the rising trend channel, which is slightly above the 38.2% Fibonacci retracement level based on the recent rally (which corresponds to the 200-day moving average at the moment). Looking at the position of the indicators, we see that the CCI generated a sell signal (while the Stochastic Oscillator declined below the level of 80), which supports sellers and suggests that the bearish scenario is likely to be seen in the coming day.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

In our previous Oil Trading Alert, we wrote the following:

"WTI Crude Oil declined to the very short-term rising support line (marked with dark green). If it is broken, we will see a drop to the upper line of the rising wedge (marked with thin blue lines) ... the CCI and Stochastic Oscillator generated sell signals, which supports the bearish scenario and suggests further deterioration.

As you see on the daily chart, after a breakdown below the very short-term rising support line, oil bears not only pushed the CFD under the upper line of the rising wedge, but also approached the lower border of this formation. If this support line encourages buyers to act, we may see a corrective upswing to one of the previously broken support lines, which serve as resistance at the moment. However, looking at the position of the indicators (sell signals remain in place, supporting sellers), it seems that further deterioration is more likely. If this is the case, the first downside target will be the 38.2% Fibonacci retracement based on the entire rally.

Summing up, the very short-term (and also the short-term) outlook for crude oil has deteriorated as crude oil extended declines and dropped to the rising trend channel range, reaching a support level created by the December high at the same time. As mentioned earlier, if oil bears push the price below it, we will see further deterioration and a drop to the lower border of the rising trend channel or even to the 38.2% Fibonacci retracement level and the 200-day moving average. Please note that this bearish scenario is also reinforced by the current position of the indicators (sell signal in crude oil and also in the CFD remain in place, supporting sellers).

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, if crude oil drops below the 38.2% Fibonacci retracement level and the 200-day moving average, we will consider opening short positions.

Page 2 of 2 « Previous

Nadia Simmons

Nadia is a private investor and trader, dealing in stocks, currencies, and commodities. Using her background in technical analysis, she spends countless hours identifying market trends, major support and resistance zones, breakouts and failures. In her writing, she presents complex ideas with clarity that enables you to easily understand market changes, and profit on them.

By Phil Flynn

While markets are trying to down play the Russian invasion of Crimea now it is being reported that Crimea is going to hold a vote on joining the Russian Federation. In the latest development in Russia’s desperate attempt to keep its monopoly on European energy supply. Once again it is all about energy and energy is power.

Russia is pushing a vote to try to justify the unjustifiable. Russia is desperate and fears the potential of the Crimea regions potential natural gas supply as well as it’s off shore oil production capability. Chevron and Royal Dutch Shell that were interested in developing Ukrainian shale and the Ukraine thought that that could make them independent of Russia. The government said there may be enough natural gas in shale reserve areas to meet the country's needs without imports. In fact it is possible that could make the Ukraine a net natural gas exporter.

Russia wants Russian gas running through Ukrainian pipelines not Ukrainian gas running through Ukrainian pipelines. The Russian Natural Resources Ministry said just last January that it was not concerned about the potential boom in natural gas supply but it was concerned hydraulic fracturing in neighboring Ukraine could pollute regional water supplies. I wonder if they will have the same concerns when they are in charge of Crimea. At the same time Russia want to get its hands on the offshore production potential.

As the Russian economy suffers due to the lack of imagination of its system in the Russian Federation looks to its dark past to try to secure its future. While the US is fast track economic sanctions the rest of the world seems to send signals to Putin that he can do whatever he wants. In the meantime Russia’s future is being squandered by an egomaniacal leader that has no vision other than power. The U.S. Republicans are calling for fast tracking U.S. natural gas exports to help Europe. The Obama Administration has approved six of 21 applications to build port facilities to export liquefied natural gas. President Obama, who has been slow to grasp the economic and political advantages to U.S. oil and gas production, should hopefully start to get the message. Instead of fighting the Keystone Pipeline you should take a cue from President Carter that energy security is the moral equivalent of war. We are seeing that Russia is willing to risk war to try to control energy in Europe.

Seems to be more worried about demand. Weak data and weak demand numbers are making U.S. supply look more ample. Traders look to Europe not only for word of sanctions on Russia as well as their interest decisions. Both the UK and the EU will release their decisions. It will be all about the statements and not the policy.

In the meantime platinum(NYMEX:PLJ14) and palladium(NYMEX:PAM14) are also worried that Russia could impact supply as well as strikes in South Africa. Bloomberg News report striking platinum miners are marching on South African government offices in Pretoria after talks to end a dispute over pay collapsed without any prospect that a deadlock at the biggest producers will be resolved soon.

The Association of Mine workers and Construction Union, which has been on strike for six weeks, has said it will gather 40,000 workers and supporters for the protest ending at the Union Buildings. It was due to start at 9:30 a.m. local time.

The union and Anglo Platinum Ltd. (AMS), Impala Platinum Holdings Ltd. (IMP) and Lonmin Plc (LMI), which together account for more than two-thirds of all the platinum mined globally, remain far apart in negotiations over pay demands, the state mediator said yesterday. More than 70,000 members of the union walked off the job in support of wage increases that include more than doubling pay for entry-level miners. The producers say they have lost a combined $660 million in revenue and that employees have forfeited $290 million since the strike started on Jan. 23.

After more than quadrupling in 2009-2010, palladium prices have been more-or-less stuck in a range for the past three years until a major break of the established trend-line on Tuesday.

Much of the demand for palladium comes from the auto industry, which uses it in catalytic converters to reduce emissions, but this is more of a supply-driven story. Johnson Matthey estimates that 78% of global palladium supply comes from South Africa (36%) and Russia (42%).

We all know that Russia is in hot water over its unwanted occupation of Ukraine, but South Africa is currently in the throes of an ongoing mining-strike where unions are demanding entry-level wages be doubled. Even under fairly standard operating conditions in 2013, the palladium market operated at a supply deficit equivalent to 9% of demand. With such a huge percentage of supply in jeopardy there is no telling how high prices could run.

In addition to the compelling fundamentals, palladium, like gold, is a real asset that should continue to benefit from the global monetary experiment still in progress.

by GoldCore

Today’s AM fix was USD 1,334.25, EUR 971.57 and GBP 798.00 per ounce.

Yesterday’s AM fix was USD 1,333.50, EUR 971.94 and GBP 799.84 per ounce.

Gold rose $2.30 or 0.17% yesterday to $1,337.40/oz. Silver fell $0.02 or 0.09% at $21.17/oz.

Gold in U.S. Dollars, 1 Year - (Bloomberg)

Gold traded below the highest level in more than four months as investors weighed the crisis in Ukraine against the weakening U.S. economy.

Prices rose 0.3% after a report showed that U.S. companies added much fewer workers than projected in February. The metal climbed to $1,354.87 on March 3, the highest since October 30, as tension between Ukraine and Russia escalated. Bloomberg reports that gold in Singapore for immediate delivery was at $1,334.86/oz at 2:30 p.m. in from $1,336.90/oz yesterday.

Must read guide to and research on Bail-ins can be read here:

Guide: Protecting your Savings In The Coming Bail-In Era

The move towards "bail-ins" and away from government "bailouts" continues to evolve

and yesterday credit rating agency, Standard and Poor's (S&P) warned that this could lead to credit ratings for European banks being slashed by one or two notches.

Following similar moves in the U.S., European banks could see ratings downgrades if regulators continue to move towards depositor and bondholder “bail-ins.” S&P signaled that it would review its ratings on banks by the end of April this year.

In the future, rather than banks becoming insolvent and being liquidated and wound up as has happened throughout history, “bail-ins" will force losses on bank's creditors including depositors as was seen in the testing ground for bail-ins that was Cyprus. Central banks and regulators now think that rather than governments and taxpayers bearing the cost of rescuing failing banks, now creditors including depositors will suffer losses.

"Bail-ins" target both depositors and bondholders. In some cases, bondholders are asked to defer repayment deadlines and can even agree to reduce their claims. If this becomes practice, it could drive up the interest charged by bondholders and have a negative feedback loop.

Some have warned that bail-ins could also damage the wider economy as it could mean that banks have to charge higher interest on their lending as a result. In our research, we have highlighted that bail-ins may have a very negative impact on consumer and business confidence as people’s life savings and cash balances of companies are confiscated as seen in Cyprus.

S&P said developments in the U.S. towards "bail-ins" meant that its rating outlook on eight U.S. banks had already been impacted and now they are turning their focus on European banks.

The coming bail-in regimes will pose real challenges and risks to investors and of course depositors - both household and corporate. Return of capital, rather than return on capital will assume far greater importance.

Evaluating counterparty risk and only using the safest banks, investment providers and financial institutions will become essential in order to protect and grow capital and wealth.

It is important that one owns physical coins and bars, legally in your name, outside the banking system. Paper or electronic forms of gold investment should be avoided as they could be subject to bail-ins.

The weekly continuation chart of CME Group Henry Hub Natural Gas Futures(NYMEX:NGJ14) offers a longer-term perspective of the volatility which accompanied the recent expiration of the March 2014 contract. At first glance, the expiration led to a huge bearish reversal and the destruction of the multi-month bull trend. First, there was a crucial failure to breach the psychologically important $6.50 level. More importantly, that failure was accompanied by a dramatic bearish key reversal on both daily as well as the weekly rolling front-month chart (see chart below).

Nevertheless, the weekly key reversal occurred on anemic volume, suggesting a lack of conviction by longer-term players. Also, the $4.50 level acted as support throughout the decline (so far). This $4.50 level served as important resistance throughout 2013 and was therefore a logical spot for longer-term bulls to re-establish bullish positions.

While it remains extremely doubtful that we will retest the $6.50 resistance with spring (and it’s seasonal weakness) looming in our immediate future, it could be that the market established both highs ($6.50 resistance) and lows ($4.50 support) during the Feb. 24 weekly key reversal. That stated, if we can break $4.50, the $3.50 support level which held throughout 2013 should serve as longer-term support.

Venezuela commemorated the late 'Commandante' Hugo Chavez on Wednesday – as is so often the case, the fact that the dear leader of the revolution is no longer among the quick probably helped with a good bit of nostalgic transmogrification.

One feels reminded of the many crying babushkas in the streets of Moscow when news of Stalin's departure from this earthly plane hit, even while his former colleagues in the party probably got ready for a week of vodka-drenched partying to celebrate the psychopathic tyrant's demise. No longer did they have to worry about who was going to be purged next.

Chavez was of course no Stalin (not by a long shot), we merely want to highlight that no matter how bad a ruler, once he goes to his eternal reward, many of those left behind begin to see him in a better light than he probably deserves. Chavez did of course shower some of Venezuela's oil riches on the poor, and they loved him for it. However, he incidentally ran the country's oil industry into the ground, so it was a decidedly mixed blessing, by dint of being completely unsustainable and leaving everybody poorer in the end.

Anyway, there may be a subtle subconscious message in the fact that the rulers of Venezuela have decided to commemorate Chavez's death rather than his birth. Just saying.

As it happens, the timing was fortuitous from president Maduro's perspective, as he has an ongoing counter-revolution problem on his hands. He used the opportunity to try to imitate the dear departed “Commandante” by declaring Panama a lapdog of the capitalist enemy deserving to be banned from polite socialist company. Chavez' cousin meanwhile spontaneously dispensed some valuable advice to Maduro.

“Followers of late socialist leader Hugo Chavez flooded the streets of Venezuela on Wednesday for the anniversary of his death, an emotional but welcome distraction for his successor from violent protests raging for the last month.

A year after Chavez succumbed to cancer, his self-proclaimed "son," President Nicolas Maduro, faces the biggest challenge to his rule from an explosion of anti-government demonstrations that have led to 18 deaths since February.

Though the protests do not appear likely to topple Maduro, neither do they seem to be going away. A hard core of students are determined to maintain street barricades and militant opposition leaders organize daily rallies around Venezuela. Wednesday's military parade and other events to honor "El Comandante" gave Maduro, 51, an opportunity to reclaim the streets and show that he too can mobilize his supporters.

"This anniversary is enormously sad. There's not a single day I don't remember Hugo," Chavez's cousin, Guillermo Frias, 60, said from Los Rastrojos village in rural Barinas state, where the pair used to play baseball as kids.

"He changed Venezuela forever, and we cannot go back. Maduro also is a poor man, like us. He's handling things fine. Perhaps he just needs a stronger hand," he told Reuters.

Tens of thousands of red-clad "Chavistas" gathered for rallies in Caracas and elsewhere in honor of Chavez, whose 14-year rule won him the adoration of many of Venezuela's poorest, while alienating the middle and upper classes. Cannon-shots marked the precise time of his death, 4:25 p.m.

Maduro used the occasion to announce the breaking of diplomatic and commercial ties with Panama, whose conservative government he accused of joining the United States in "open conspiracy" against him.

"We're not going to let anyone get away with interfering with our fatherland, you despicable lackey, president of Panama," Maduro said in fiery language reminiscent of Chavez.”

(emphasis added)

Poor Maduro just 'needs a stronger hand'. Doesn't every good leader? Well, he sure showed that 'despicable lackey', the president of Panama. We have no idea what the latter actually did to become the target of such opprobrium. However, Panama reportedly has a great deal more economic freedom than either Venezuela or the US. You may therefore regard us as part of the despicable lackey's fan club.

Meanwhile, although there seems to be widespread agreement that Maduro cannot be toppled by the protests, the demonstrations actually seem bigger than those seen in Kiev recently (judging just from a quick glance at the pictures, mind). The Kiev protests were probably only more visually arresting due to the constant Molotov cocktail throwing. Here is a picture from an anti-government march in Caracas last Saturday:

A tiny handful of counter-revolutionary malcontents disturbs traffic in Caracas last Saturday. Yes, Maduro may need a 'stronger hand'.

(Photo by Juan Barretto / Getty Images)

Elsewhere, currency traders on the black market seemed to celebrate Chavez' death day as well, by temporarily pushing the bolivar's true exchange rate higher:

The 'parallel' bolivar strengthens to 79,50 to the dollar from its recent record low of about 90.

The 'parallel' bolivar strengthens to 79,50 to the dollar from its recent record low of about 90.

We have little doubt it is a selling opportunity, given that Maduro is demonstrably utterly clueless about matters economic.

For all its faults, Venezuela still has a stock market though, which gives those with assets to protect a chance to escape the effects of the inflation of the currency. Recently, the index was subject of a cosmetic 1000:1 split (an index value of 2,700 looks more credible than one of 2,700,000):

A bubbly decade on the Caracas Stock Exchange. A similar stock market boom occurred in Zimbabwe, in spite of the economy imploding completely, with formal economy unemployment reportedly soaring to 80%. As Kyle Bass remarked about that particular boom: 'In the end, you could buy three eggs with your gains' – click to enlarge.

A bubbly decade on the Caracas Stock Exchange. A similar stock market boom occurred in Zimbabwe, in spite of the economy imploding completely, with formal economy unemployment reportedly soaring to 80%. As Kyle Bass remarked about that particular boom: 'In the end, you could buy three eggs with your gains' – click to enlarge.

The celebrations were apparently not exactly lacking in unintentional comedy either:

“Maduro presided over a parade in the capital before leading crowds up to the hilltop military museum where Chavez led a 1992 coup attempt that launched his political career. His remains have been laid to rest in a marble sarcophagus there.

"Hugo Chavez passed into history as the redeemer of the poor," the president said, comparing his mentor to both Jesus and South American independence hero Simon Bolivar.

Prominent leftist allies including Cuban President Raul Castro joined the lavish ceremonies in Caracas.

[…]

State media have rolled out round-the-clock hagiographical coverage of the late president. Some Chavez loyalists seem barely able to use the word "death," preferring euphemisms such as his "physical disappearance" or "sowing in the sky."

"Chavez didn't die; he multiplied!" said state TV.

(emphasis added)

Well, if he is comparable to Jesus, then it is presumably no wonder that he 'multiplied'. Look at it as a kind of Chavista selfie version of the luxury miracle at the Wedding of Cana.

What is less funny is that so far, 18 people have died in the protests. The government meanwhile tried to take the edge off the demonstrations by declaring a 6 day-long carnival holiday. As one protester remarked:

“A long six-day national holiday for Carnival and now the anniversary of Chavez's death have taken some wind out of the protests, but a rump of demonstrators stay out daily.

"Various presidents are here and we want to show them that Venezuela is sick," said Silvana Lezama, a 20-year-old student, standing in front of a Venezuelan flag as she stood guard at a barricade in the upscale El Cafetal district of Caracas.

"We're not insulting Chavez, but when he died last year there was a week of mourning. Now we have 18 people dead from protests and they declared five days of Carnival holiday."

(emphasis added)

Evidently, not everybody feels like there is a good reason for celebrations at this time.

One wonders what the malcontents are complaining about. After all, Maduro promises the provision of endless material delights, the establishment of the long promised socialist Land of Cockaigne in our lifetime:

In order to combat the country's massive inflation of over 50 percent, Maduro has introduced price controls. Shops that demand prices that he believes are too high are simply occupied. "We will guarantee everyone has a plasma television," the president has said, and has forced stores to sell them cheaply.

"It is plundering under the aegis of the state," says Diego Arria, formerly Venezuela's UN ambassador. "Maduro is destroying the private sector."

Many shops are empty, with even corn flour, milk and toilet paper subject to shortages. Lines like those seen in Cuba have become common and people are desperately trying to get their hands on dollars. "A perfect storm is brewing in Venezuela," says Arria.

The government has been having difficulties supplying even the basics in the slums of Caracas. In the vast quarter of "23 de enero," people stand in long lines in front of the state-run supermarket; they are issued numbers on strips of cardboard. Chavistas control entry to the store and glorify Maduro and the revolution to shoppers. Most of those waiting remain silent. Every three days, they mumble quietly when the guards aren't paying attention, their food coupons will get them chicken from Brazil and two kilograms of flour, but nothing more.

(emphasis added)

No wonder Arria is a 'former' ambassador, he obviously doesn't properly grasp the wisdom of supplying everybody with a Plasma TV with a wave of the presidential magic wand (but not, apparently, with toilet paper and other staples). Those silent shoppers who only “mumble quietly when their guards aren't paying attention” would make us nervous if we were a guard…

Here is a recent photograph of a store in Maracaibo:

Maracaibo, Super Lider store. Image via @orlandobuesomir: Empty shelves in a PDVAL store in Venezuela.

Maracaibo, Super Lider store. Image via @orlandobuesomir: Empty shelves in a PDVAL store in Venezuela.

Maracaibo! In the early days of personal computing we regularly conquered its fortress as one of the freebooters in Sid Meyer's 'Pirates' game. Don't worry, it was all legal, we had a letter of marque. Moreover, we managed to win the hand of the governor's daughter after convincing her of our dancing prowess (it was a simple, but really funny game).

For some reason not all Venezuelans seem equipped with Plasma TVs yet, so something has apparently gone wrong. Could it be the fault of global warming? After all, it was just identified as being responsible for the budding 'guacamole crisis', among approximately 5,000 other things it is held to be the cause of. So why not the appalling lack of Plasma TV saturation in Venezuela? Makes more sense than the old 'socialism just doesn't work' canard, right?

We can however confidently state that Maduro is not completely without cunning. He sure knows whom he needs to keep on his side, even it that is allegedly not really working out the way it was supposed to either:

“Venezuela's military has more power under Maduro, a civilian, than it did under the former officer Chávez. Maduro has handed out senior jobs to some 2,000 soldiers and the military now occupies key positions in business and controls entire companies. Late last week, Maduro sent a parachute battalion to Táchira to curtail the protests there.

But even in the military, dissatisfaction is spreading. "The soldiers just haven't yet had the courage to open their mouths," says one administrative employee who works in Fuerte Tiuna, a military base on the outskirts of Caracas.

Even Chávez had begun to realize that the enemy was within. He had officers and a former defense minister who had been critical of him arrested and imprisoned on charges of corruption. Some of them remain locked up in the Ramo Verde military prison not far from Caracas — just a few cells away from Leopoldo López.”

(emphasis added)

Still, buying off the military by handing its leaders 'senior jobs' and letting them occupy key positions in business is a strategy that has e.g. worked extremely well in Egypt, where the military controls 40% of the economy and in spite of a temporary setback continues to rule as if Mubarak had never gone away.

Policemen during protests in Caracas. So far, they are being hit with stuff that looks a lot more harmless than the Molotov cocktails thrown in Kiev.

Policemen during protests in Caracas. So far, they are being hit with stuff that looks a lot more harmless than the Molotov cocktails thrown in Kiev.

(Photo by Juan Barretto / Getty Images)

As one Chavista told reporters (also dispensing advice to the hapless Maduro, so that he may 'find his own voice' one day):

“Maduro's had it tough. He has to find his own path, his own ideas, his own speech. He's not Chavez. The commander is gone; we can't mourn him permanently. There's so much work to do, errors to correct," said Marisol Aponte, a diehard "Chavista" and community activist from a poor zone of west Caracas.

She urged Maduro to purge his cabinet and modernize Chavez-era social programs.”

(emphasis added)

There you go! A good, old-fashioned purge! Even if Chavez failed at this task, Maduro has an opportunity to one-up him that he only needs to firmly grasp, by ruthlessly employing that 'strong hand' Chavez' cousin is pining for. Can he perhaps become like Stalin?

Naah. Not with that attire:

Nicolas Maduro, wearing a landing pad for errant birds.

In trying to assess the trajectory of the US economy, one is struck by the recent divergence between the manufacturing and the services sectors. Manufacturing in the United States has picked up steam recently in spite of some weather-related headwinds (see chart). The service sector on the other hand took a turn for the worse, which is negatively impacting the labor markets in this service-oriented economy (see story). A couple of key indicators point to slower non-manufacturing activity:

1. The ISM non-manufacturing PMI came in at the lowest level in years.

Source: Investing.com

The detail behind the decline shows the big hit to employment in the service sector, which is what we see in the ADP private payrolls today.

Source: ISM

2. The Markit PMI measure paints a similar picture.

Markit: - Adjusted for seasonal influences, the final Markit U.S. Services PMI™ Business Activity Index dipped sharply to 53.3 in February, from 56.7 in the previous month. Although the index was above the 50.0 no-change mark and signalled a solid pace of expansion, the latest reading was the lowest since October 2013 [US government shutdown]Most analysts blame this weakness in the service sector and the resulting softness in the labor markets on the weather.

ISI: - There’s hardly a lamer excuse than weather, but that’s probably the case for ADP’s +139k for Feb. It presents downside risk to our best guess for payroll employment of +185k.

Markit: - With the exception of last October, when the government shutdown hit the economy, the service sector grew at its slowest rate since March of last year. This time, the extreme weather was to blame for the slowdown.If that is indeed the case, as temperatures cimb, we should see a material rebound in service oriented businesses and therefore some big improvements in the jobs picture later this spring. That would mean more Fed taper and higher yields.

For those who subscribe to the weakness in the services sector being mostly weather related and therefore transient, now may be a good time to get back into that treasury short trade.

By: P_Radomski_CFA

Briefly: In our opinion short speculative positions (half) in silver and mining stocks are justified from the risk/reward perspective. We are closing half of the long-term investment position in gold.

As you know, we had been expecting the tensions in Ukraine to cause a significant rally in gold (not necessarily in the rest of the precious metals sector). Not only wasn't that the case on Monday - the rally indeed took place, but it was rather average, but gold managed to decline on Tuesday while there was no visible improvement in the situation in Ukraine and on the Crimea peninsula.

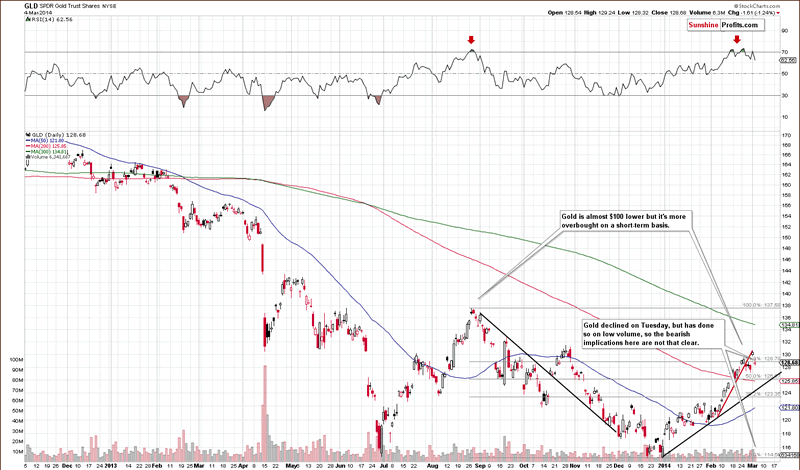

Gold is not performing as strongly as it should. That is a major bearish factor. Let's examine the situation more closely (charts courtesy of http://stockcharts.com):

The move above the 61.8% Fibonacci retracement level was invalidated yesterday. The move lower took place on low volume, which doesn't confirm the rally. However, that's not the most important thing to focus on - gold's performance in light of the most recent events is. As mentioned earlier, it didn't rally. In fact it's more or less where it was a week ago. The implications are bearish.

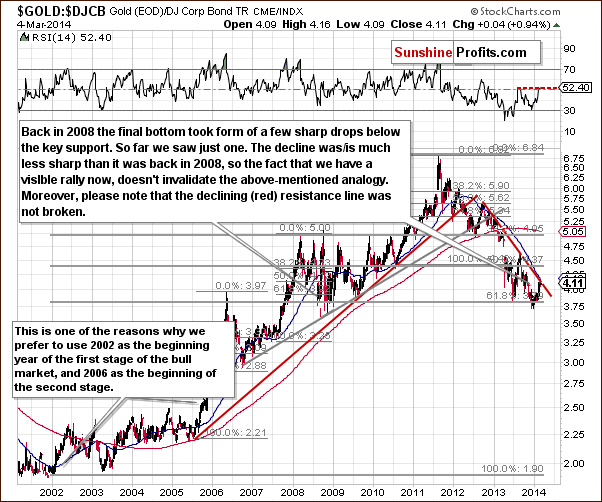

From the gold to bonds perspective, the downtrend simply remains in place. There has been no breakout above the declining resistance line (marked in red), so the precious metals market is still likely to decline once again.

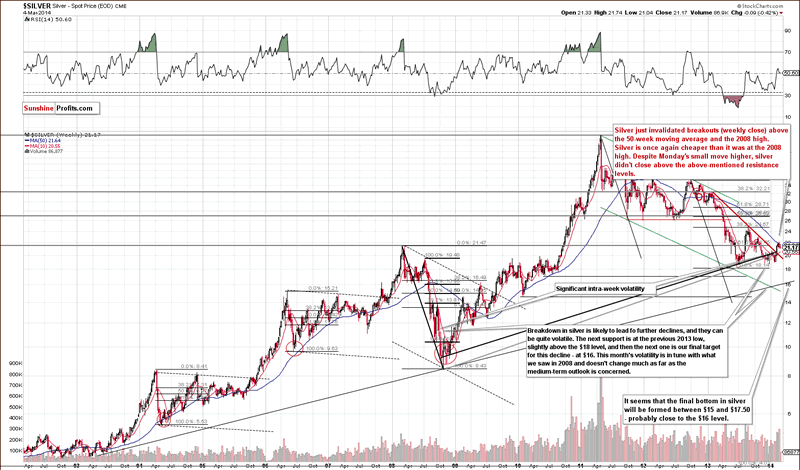

Silver's performance has been weak, if not very weak. Not only did it not really rally on Monday, but it declined more on Tuesday than it had rallied on Monday and it's now 0.42% lower than it was last week.

Some might say that the white metal is almost flat, and that is correct, but the point is that it's almost flat (on the south side of being flat) when the geopolitical tensions are rising significantly. This is a significant underperformance relative to what's going on in the world.

What we wrote yesterday remains up-to-date:

Meanwhile, silver invalidated the breakout above the 50-week moving average, the 2008 high and the 61.8% retracement level based on the entire bull market. The weekly volume is highest in months, which confirms the significance of the invalidation. Actually, the last time we saw volume that was similar was at the beginning of the previous decline in mid-2013.

Silver is still above the declining red support line, but drawing an analogous line in mid-2013 would also have given us a breakout that turned out to be a fake one.

The situation in silver was bearish based on Friday's closing prices and it has further deteriorated based on the lack of rally this week despite reasons to make a move higher.

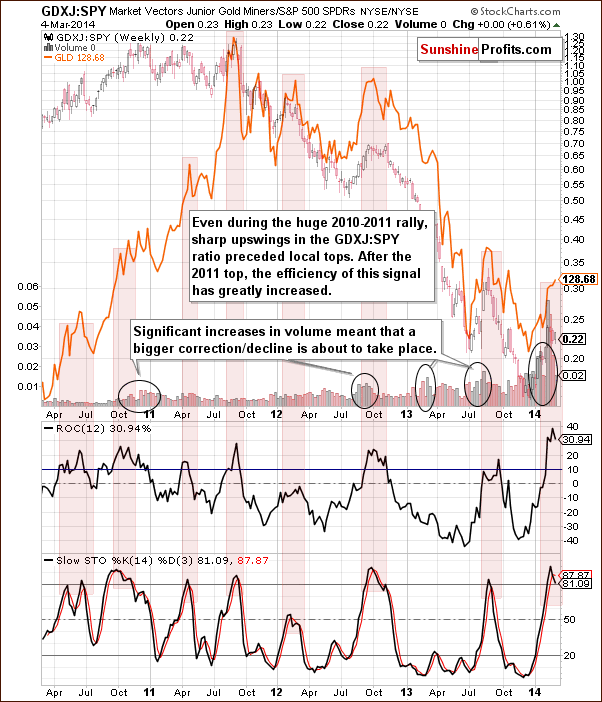

Not too long ago we wrote that the juniors to stocks ratio could indicate local tops in the precious metals market if one looked at it correctly. The things that we were focusing on were spikes in volume (we have seen a major one) and sell signals from the ROC indicator (a decline after being above the 10 level) and the Stochastic indicator. We have seen both recently. Consequently, it seems that the precious metals market will move lower sooner rather than later.

The USD Index moved a bit higher and mining stocks declined, both of which confirm the above bearish indications.

All in all, it doesn't seem that keeping the full long position in the investment category is justified at this point in our view. Based on this weekend's events it was likely that gold would move much higher - but its reaction has been very weak. It looks like there will be no rally in gold before a bigger decline. We are keeping half of the funds in gold, though, just in case the next days bring improvement. If not - things will become even more bearish and we will likely adjust the position once again.

We might suggest changing the short-term speculative position and / or the long-term investment one shortly, based on how the markets react and what happens in Ukraine.

By: Chris_Vermeulen

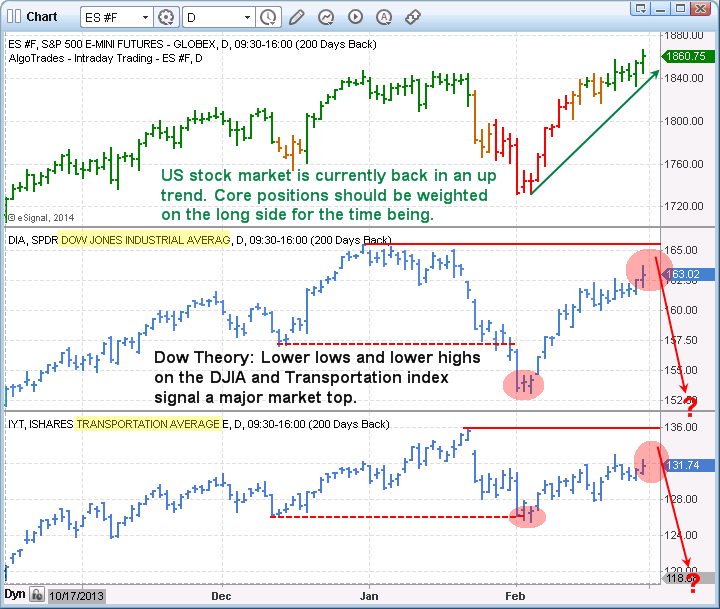

Over the past few weeks I have been watching the DOW and Transportation index closely because it looks and feels like the Dow Theory may play out this year and the stock market could take a 15% haircut.

But what if you skipped on the haircut and opted for a 40% refund? What? Keep reading to find out how.

Keeping this post short and sweet, I think the US stock market is setting up for a sharp selloff. And it will look a lot like the July 2011 correction. If my calculations are correct this will happen in the next 3-9 weeks and we will see a 15% drop from our current levels. Only time will tell, but I have a way to hedge against this with very little downside risk to you ETF portfolio.

The daily chart of the SP500 index below shows our current trend analysis with green bars signaling an uptrend, orange being neutral, and red signaling bearish price action. Currently the bars are green and we can expect prices to have an upward bias.

The Dow Theory could be in play. When both the Transports (IYT) and the Dow Jones Industrial Average (DIA) cannot make higher highs and start making lower lows, according to the Dow Theory the broad stock market is topping.

We are watching the market closely because they have both made lower highs and lows. This rally could stall in the next couple weeks and if so we expect a 15% correction.

The chart above shows how fearful traders have a delayed reaction to moving money from stocks to a mix of risk-off assets.

The choppy market condition during August and September clearly helped in frustrating investors and created more uncertainty. This helped prices of this ETF portfolio fund rally long after the initial selloff took place. This is something I feel will take place again in the near future and subscribers of my ETF newsletter will benefit from this move.

Because we have a Dow Theory setup, our risk levels are clearly defined as to when to exit the trade if it does not play out in our favor. But with the potential to make 40% and the downside risk only being 4%, it's the perfect setup for a large portion of our ETF portfolio. And just so you know this is not a precious metals trade as we are already long that sector and up 10% in that position already.

By Rich Allen

: Buy the rumor, and sell the fact. For weeks the market has been speculating on how low this year’s hog kill would be. During this period, the trade moved up its viewpoint on when PED would hit. Initially it was a summer-only thought. Then it moved up to a spring problem. The last phase of this rally, the general perception changed into a March-and-beyond problem. Wednesday morning, our cash hog sources were raising the alarm with a “it is here right now and there are no hogs” alarm. The limit up trade for the first six contracts on the electronic session may have been a signal to us that enough was enough.

We are not saying that the hog market is now bearish, not at all. We still have a completely unknown supply for March all the way out through October. What has changed is likely that the market’s perception of where futures need to go may have changed. Realistically, a $112 April hog is just plain ridiculous. How much more premium over last year do you need? That is 39% over last year!

Thursday we will release our estimates for quarterly cash hog and futures projections. Additionally we will release a breakdown of various production scenarios compared with where futures would be. This way you can break down the current futures action and see if the market is pricing in some unreasonable assumptions. For now, it is time to turn neutral to hog futures. Enough is enough until we actually see PED hit for a few weeks…Rich Nelson

Cattle: Has the worm turned? We started Wednesday with electronic futures for hogs and cattle implying another big rally would be seen. Limit up trade in the first six hog contracts would certainly imply the next place to buy would be cattle. April futures got up to $2.50 higher for the day at one point before closing $1.70 lower. The clear rejection of the early strong price action is seen with many major market tops.

This may have been the big move we have been seeking. Beef fundamentals are still officially supportive. The morning boxed beef report showed a $2 to $3 gain. Cash cattle has not traded lower yet. You could argue that some were disappointed that packer bids were at $148 this morning. While know the next move in live cattle supplies (more) and price (down) the question here is about picking the top. Even without the short-term beef stats turning bearish, Wednesday's trade may have been an important one psychologically.

Keep in mind the smallest kill of the year was posted two weeks ago. Packers will see a few extra cattle show up at the front door going into April. In the later part of April we will see sharp increases steamroll into a bearish position. As noted before, Q1 is the smallest kill of the year. This year’s Q1 will see 5% to 6% lower than last year. Summer is the biggest supply of the year. This year’s summer, due to Sep–Jan placements, will run around 1% higher than previous year. For trading, looking at the 1 minute charts of our spread positions the risk point was just filled on this morning’s higher trade in futures.

While we are still net ahead on the year for cattle trading positions, this Feb/Mar run up has offset most of those incredible gains made in January. We would certainly like to have those short positions on but a risk point is a risk point. Our market opinion certainly has not changed (bearish into summer). We simply sold too early on this rally. For hedgers, hold all positions and sell anything not yet hedged…Rich Nelson

by Charles Hugh Smith

Why is our government so incompetent? Short answer: because incompetence has been fully institutionalized in every branch, every agency and every nook and cranny of the state.

Though many may reckon the U.S. government (and its Deep State) are not so much incompetent as merely evil, I suggest incompetence sows the seeds of evil consequences.

It's easy to lay the responsibility for the state's incompetence on its staggering size and complexity, and there is much truth in the notion that no system of this scale and complexity can possibly be governable or accountable.

But I think we owe it to ourselves to dig a bit deeper than this to understand why our visible government (executive, Congress, regulatory agencies, the Federal Reserve, etc.) and the Deep State (everything that's decided and run behind closed doors) is so monumentally incompetent.

The policies and decisions of the past 15 years can be reduced to three catastrophic blunders: the discretionary war in Iraq and "nation-building" in Afghanistan; allowing those responsible for the 2008 financial meltdown to become even more invulnerable and predatory, i.e. enabling a "too big to fail" banking sector, and Obamacare, the Orwellian-named Affordable Care Act (ACA).

Each of these policy decisions has been enormously destructive to the nation, and the opportunities lost in their wake are irreversible.

I have covered the systemic reasons for incompetence and failure many times.These boil down to the accumulating sclerosis of bureaucracy and the ratchet effect.

I have addressed The Lifecycle of Bureaucracy on a number of occasions:

Our Legacy Systems: Dysfunctional, Unreformable (July 1, 2013)

The Way Forward (April 25, 2013)

When Escape from a Previously Successful Model Is Impossible (November 29, 2012)

Complexity: Bureaucratic (Death Spiral) and Self-Organizing (Sustainable) (February 17, 2011)

The ratchet effect can also be visualized as a rising wedge, in which costs and inefficiencies continue rising until any slight decrease in funding collapses the organization.

Dislocations Ahead: The Ratchet Effect, Stick-Slip and QE3 (February 14, 2011)

The Ratchet Effect: Fiefdom Bloat and Resistance to Declining Incomes (August 23, 2010)

I think we can add a few other factors:

1. That which is cheap and abundant will be squandered until it is no longer cheap or abundant. Our default programming is to squander what is easily available and abundant. This is true not just of resources such as food and energy but of health, trust, power and all sorts of other intangibles.

For example, when the Soviet Union collapsed, the U.S. was left with an abundance of soft and hard power on the global stage. The natural response was to squander it on misadventures instead of investing it wisely.

When we're young and healthy, we squander this reservoir of vitality rather than invest it wisely in habits that will maintain our health as we age.

There are countless examples of this dynamic. The irony of this dynamic is tragic: by the time we realize we've squandered an irreplaceable resource, it's too late.

2. The prime directive of any bureaucracy is to eliminate all accountability. The raison d'etre of bureaucracy, the very reason for its existence, is not to manage complex affairs but to dissipate accountability into a formless cloud so that no member of the bureaucracy will ever face any consequences for his/her actions.

In other words, the prime directive of any bureaucracy is to enforce the perfection of moral hazard, i.e. those making decisions suffer no consequences when the decisions are disastrous.

The entire structure of a bureaucracy boils down to this: we followed the rules, and therefore we are blameless.

Obamacare and the Pentagon are both perfections of this purposeful loss of accountability. I recently saw a video clip of a journalist who had asked 12 different government functionaries who was in charge of implementing the Obamacare website before its flawed launch and he'd received 12 different answers.

In other words, accountability had already been extinguished well before the site was even launched.

3. Bureaucracies are intrinsically prone to group-think. The more closed the bureaucracy, the greater this tendency to eliminate skeptics, heretics, independent thinkers, etc.: Who Gets Thrown Under the Bus in the Next Financial Crisis? (March 3, 2014).

The foundational group-think concepts behind each of the three policy disasters listed above have all been discredited, but only after group-think insured the destruction of vital national interests: for example, the neo-conservative "failed-state" concept that guided a decade of foreign policy misadventures: The Rise and Fall of the Failed-State Paradigm: Requiem for a Decade of Distraction (Foreign Affairs).

4. As correspondent Lew G. has pointed out, bureaucracies are not designed to be fail-safe; their complexity and lack of accountability lead not to resilience but to fragility and vulnerability.

5. One systems-level consequence of tightly connected, interactive complex systems is that they generate routinely failures known as "normal accidents," catastrophes that result from seemingly small miscalculations and miscues that cascade into systemic crises. When accountability has been lost, there are no feedback loops left to correct these "normal accidents," so the damage piles up within the organization until it collapses in a supernova model of accumulated incompetence.

6. The moral-hazard-riddled leadership of bureaucracies will choose whatever short-term politically expedient fix reduces the immediate political pain (also known as "kicking the can down the road") rather than risk shaking up the organization by imposing accountability and clearing out the deadwood. This dependence on short-term politically expedient "fixes" that ignore the real problems piles up more moral hazard, failed policies, ineffective deadwood and cost, increasing the system's fragility and vulnerability to any shock that cannot be dissolved with another short-term can-kicking "fix."

Why is our government so incompetent? Short answer: because incompetence has been fully institutionalized in every branch, every agency and every nook and cranny of both the visible state and the Deep State.

ADMIN. NOTE: Dwolla donor Stuart L., please email me so I can begin your weekly Musings Reports subscription. Thank you.

by GoldCore

Gold fell $2.36 to $1332.74 in late Asian trade before it rallied back to $1341.79 by early afternoon in New York, but it then fell back off into the close and ended with a gain of just 0.17%. Silver climbed to $21.314 in London, but it then fell back off in late trade and ended with a loss of 0.09%.

Gold traded below its highest level in more than four months as tension between Ukraine and Russia eased leading to traders taking profits on gold.

Palladium, 1994 to March 2014 - (Bloomberg)

Palladium climbed for a fifth day and jumped to an 11 month high. Palladium for June delivery rose 0.7% to $769/oz. Palladium has gained 5.5% during the last five days of the crisis and is up 7.9% year to date. There are real concerns that that any economic sanctions against Russia could disrupt exports of the precious metal from the world‘s largest producer and exacerbate an already tight supply situation.

The risk of supply disruptions from Russia come at a time when the market was already dealing with reduced palladium supply as a result of a nearly six week-old strike in South Africa’s platinum-group-metals mining sector.

According to Bloomberg Industries analysts Kenneth Hoffman & Oliver Nugent, “any sanctions imposed by the EU and the U.S. on the export of Russian palladium group metals would create a serious supply shortage that may be difficult for industries to replace.”

This year will show the third consecutive deficit year in global palladium supply, according to a BI survey of analysts. Russia provided 44% of global palladium supply and 13.6% of platinum last year, according to Johnson Matthey.

According to BI, “a pick up in China's demand for platinum group metals may offset any sanctions imposed on Russia by the U.S. and European Union. An increase of 26% sequentially in platinum imports by China in November suggests that domestic supplies are depleting. Russia has typically provided about 30% of China's palladium imports and China may need to increase imports from the country as labor disputes in South African mines continue to affect production.”

Tensions have eased but the crisis is far from over. Russia is the world's largest energy producer and Ukraine hosts a network of strategic pipelines that carry more than half of Russia's gas exports to the EU. So, any conflict between the two countries threatens oil and gas supplies and puts Europe's energy security and indeed economic recovery at risk.

Russia and Ukraine together account for roughly 40% of global grain exports, mainly wheat. Russia is also a large corn exporter and a conflict would likely lead to food and energy price inflation.

Ore deposits of palladium are rare and are mostly located in Russia and South Africa. Russian resource nationalism, as has been seen with natural gas, could lead to supply disruptions and to palladium going higher in the coming months. Some analysts believe palladium may be in deficit for most of the next decade as Russia depletes stockpiles. Also, industrial uses and investment demand for the precious metal looks set to increase.

The 7 Key Bullion Storage Must Haves

A diversification into precious metals remains prudent and will again protect investors, both retail and institutional, pensions owners and savers, over the medium and long term. However, this is only the case if bullion owned is physical bullion coins and bars and not digital, pooled, or paper formats. Fully segregated and allocated coin and bar storage remains the safest way to own bullion.

by Yao Yang

BEIJING – The US Federal Reserve’s decision to exit from so-called “quantitative easing” – its massive monthly purchases of long-term assets – is stoking fears of a hard economic landing in China. But China’s strong economic fundamentals mean that policymakers have the space to avoid such an outcome – as long as they bring the country’s shadow banking system under control.

As it stands, Chinese consumption and investment growth is expected to remain at roughly last year’s levels. Meanwhile, economic recovery in the advanced economies, especially the United States and Europe, is reinvigorating external demand, leading analysts to project annual Chinese export growth of more than 10% this year – 3-4 percentage points higher than in 2013. This would bring annual GDP growth in 2014 to a very healthy 7.5-8%.

The problem is that China’s financial sector has accumulated considerable risk in recent years, with broad money (M2) having ballooned to ¥110.7 trillion ($18 trillion) – almost twice the country’s GDP – at the end of last year. In an attempt to rein in M2, which could indicate that the economy is overleveraged, the central bank tightened conditions for commercial bank lending, so that, for any given increase in M2, less credit is extended.

But the move failed to contain M2 growth; on the contrary, M2 grew faster last year than in 2012. Worse, restricting commercial banks’ role as financial intermediaries and encouraging the growth of unregulated shadow banking has generated even more risks for China’s economy. Clearly, a new approach is needed – one that is based on a deeper understanding of the dangers inherent in China’s banking system.

While it is true that surging M2 can reflect excessive leverage, it is not a particularly accurate gauge in China, where commercial banks can easily circumvent high reserve requirements and quantitative controls by moving loans off their balance sheets to wealth-management products – practices that fuel artificial credit expansion that looks like M2 growth. In this sense, it is the Chinese monetary authorities’ reluctance to open up the formal financial sector to domestic private capital, or to liberalize the deposit rate, that is fueling the expansion of shadow banking.

With small and medium-sized enterprises (SMEs) – by far the economy’s most important growth engine – unable to acquire sufficient funding from the formal financial sector, they have been forced to turn to informal channels. As shadow banking has become the primary source of finance for SMEs – which tend to be higher-risk borrowers – the financial risks in China’s economy have grown exponentially.

Exacerbating matters, the central bank’s repeated efforts to tighten the money supply raises the cost of capital. Last June, the annualized interbank lending rate surged to more than 10% – a level that it almost matched in December. SMEs ultimately shoulder these costs, diminishing their ability to contribute to overall economic growth.

Consider the Internet giant Alibaba, which began using Zhi-fu-bao, the Chinese equivalent of PayPal, to raise money last year. In just a few months, it received ¥400 billion from 85 million small investors. Tencent, China’s largest Internet company, is now using the same strategy to compete with Alibaba, with both companies offering high rates of return – often 6-7% annually – to attract as many investors as possible.

The problem is that most of this investment is in the interbank market, meaning that SMEs ultimately face interest rates of more than 10% – and that does not include the added 3% for SMEs’ loan guarantees. These unsustainable high rates are transmitting major risks to the real economy.

Nowhere is this more apparent than in the real-estate sector. Liquidity-thirsty developers, unable to acquire financing through the formal banking sector, have been taking out massive loans at extremely high interest rates. But, in many cases, housing demand has not grown as expected, raising the risk of default – the effects of which would be transmitted to the entire financial sector.

The fact is that China has never been closer to a major financial crisis than it is today. Yet China’s monetary authorities do not seem to understand the scale of the risk – or its root causes.

The Chinese economy may well need to be deleveraged. But, instead of blindly tightening the credit supply, policymakers must pursue deep financial-sector reform to liberalize the deposit rate, eliminate quantitative controls, and, most important, allow for the establishment of domestic private financial institutions.

Pursuing this agenda is essential to China’s long-term financial and economic health. But doing so presupposes a major shift in Chinese monetary authorities’ mindset. Therein lies the real challenge facing China today.

by Michael Meyer

NAIROBI – Now that Russia has occupied the Crimea Peninsula, the blame game has begun. US President Barack Obama has allowed yet another “red line” to be crossed, critics say. And everywhere there is loose talk of a “new Cold War” and the “price” to be paid by the Russian aggressors. But, in this fraught environment, we would do well to recall two historical precedents.

Twenty-five years ago, this month, Hungarian Prime Minister Miklos Nemeth traveled to Moscow to seek Soviet President Mikhail Gorbachev’s blessing for a radical experiment. Nemeth, barely 40, had been appointed by the ruling Hungarian Socialist Workers’ Party only four months earlier. He was seen as a naïve young technocrat, charged with reforming the ailing Hungarian economy. He was expected to fail. Then he and his “reforms” could be blamed for the country’s troubles.

Nemeth, however, was anything but naïve. And he had a secret aim: to take Hungary out of the Soviet bloc and steer it to the West. His weapon of choice was democracy. Within a few months, he planned to hold Hungary’s first free election. What would happen, I asked him at the time, if the communists lost? “We would step down,” Nemeth replied, “as in any other civilized democracy.”

In communist Eastern Europe, that was apostasy. And Gorbachev, hearing of the young Hungarian’s plans, was outraged. Communist leadership in Hungary was not something for the mere people to decide, he spluttered. A full, free, and fair election? It would set a terrible example for the rest of the Soviet bloc.

Nemeth saw his reforms failing and an uncertain future for himself. Then Gorbachev abruptly ended his lecture. But of course, he said, “this is for you to decide.”

Almost not believing his good fortune, Nemeth asked the million-dollar question. If Hungary were to hold a genuinely democratic election, and if the communists lost, would Moscow intervene, as in 1956? “Nyet,” said Gorbachev, and then added a caveat. “At least, not as long as I sit in this chair.”

This nyet was of fundamental importance. With it, Nemeth was able to return to Budapest and proceed with the election, marking a turning point in the tumultuous events that would end with the fall of the Berlin Wall in November 1989 and the breakup of the Soviet empire.

Fast forward to the present, and contrast Nemeth’s deft diplomacy with what we see in Kyiv. Instead of recognizing (and dealing with) Russia’s inevitably outsize role in the region, Ukraine’s revolutionary government defied it. Instead of speaking reasonably of finding solutions to the country’s problems that would accommodate the needs and interests of all of its citizens, the new government abolished Russian as eastern Ukraine’s official second language and intimated that it would soon eliminate its traditional autonomy as well.

It should surprise no one that Russia has intervened. If Nemeth had handled matters as badly in 1989, the map of Europe might look very different today.

Consider another historical echo. President Jimmy Carter spent New Year’s Eve, 1979, phoning Democratic Party leaders in rural Iowa. Carter was facing re-election, and he enjoyed a comfortable lead over rival Ronald Reagan. But, just days earlier, the Soviet Union had invaded Afghanistan. Neither the United States nor anyone else was in a position to stop it. What to do?

So Carter worked the phones, trying to persuade Iowa’s farmers to endorse an embargo on grain exports to the Soviet Union. It would deliver a financial body blow to the Midwest’s economy, Carter feared, and jeopardize his prospects for a second term. Along the way, an embargo might well accomplish nothing except to deepen Cold War animosities.

And that is exactly what happened. Carter lost the 1980 election, and the Soviet Union barely felt the embargo. Instead, the US found another way to penalize Soviet aggression: arming the Afghan mujahedeen. A decade later, the Red Army had withdrawn its forces, the US packed up and went home, and Al Qaeda set down roots.

Today, we are at another historical turning point. Once again, Western leaders face a challenge for which there is no good response. Once again, they feel they must do something, anything – even if they have no sense of the ultimate consequences.

Rather than react blindly, as Carter did, it would be better to follow Nemeth’s lead and think strategically about aims and means. In the face of passion and pressure, cool heads must prevail and force the firebrands in Kyiv to think carefully about Ukraine’s future and negotiate solutions for all of its citizens.

Now is the moment for dispassion. We know from past experience that the law of unintended consequences can be harsh.

The outcome of the ECB meeting today and Draghi's press conference are the most important events of the day. We suspect those looking for bold action will be disappointed and the euro's recent uptrend (since early February) will remain intact.

Yet there five other developments to digest. The first and more significant is the fact that there has been no escalation to the two immediately vexing issues for market participants: Russia's invasion of Crimea and the relatively rapid fall of the Chinese yuan. The EU is debating sanctions today, but they seem largely focused on the former Ukranian president.

Fears that this was the first domino and Putin was beginning WWIII never struck us as plausible, or that without a firm (military ) and resolute (NATO) response Russia would march on. References to Hitler seem over the top, hyperbolic and gratuitous. At this juncture parallels to Reagan's move on Grenada in the thirty years ago seems a greater historical relevance the WWII.

After reaching almost CNY6.18 at the end of last week, the dollar has eased back to CNY6.11 today and now holding just below CNY6.12. It is in the range seen on February 25. Here too we thought the markets were exaggerating and read it more as teaching a lesson than a prelude to a new policy, though admittedly the jury remains out. We suspect the same is generally true the potential corporate failure (tomorrow) of a small solar company. It would be the first bond default in modern times and its significance is likely more in terms of moral hazard rather than spark that triggers a re-assessment of China risks.

Second, after extending its losses on Monday, the Australian dollar's recovery has been extended and is trading near last week's highs after two incredibly strong reports. The January trade surplus was 14x larger than economists expected. The A$1.43 trillion surplus was the third consecutive surplus. Exports rose 3.7% and imports rose 0.87%. On top of that, the December surplus was revised up by a little more than A$120 bln, which itself was more than the consensus expectation for January. Retail sales jumped 1.2%, three times greater than the consensus expected and the December series was revised to 0.7% from 0.3%.

The Aussie shorts are being squeezed. The next target is near the 100-day moving average ($0.9080), which it has not been above since last November, which corresponds to a retracement objective of the decline since the late-Oct high near $0.9760.

Third, the dollar-bloc is the strongest (AUD, NZD, CAD, in that order and with about a 0.5% difference between them after Aussie's 1.4% advance). The Bank of Canada sounded more neutral than dovish, but a soft IVEY today may prevent additional Canadian dollar gains today, ahead of tomorrow 's employment report. The consensus calls for a decline to 53.1 from 56.8 in this volatile series. Tomorrow it is expected to report a 15k increase in employment, about half of the January gain. Separately, the January trade balance will also be reported and a small improvement in the deficit (to C$1.2 bln from CAD1.66 bln) will still it about twice as high as a year ago.

Fourth, the Bank of England meets and no one is expecting a change in policy. Yet, it does face an interesting decision. About GBP8.2 bln of a bond that it bought in its QE operations is set to mature soon (March 14). It must decide what to do with the proceeds. It needs to make a deliberate choice to reinvest it, otherwise its GBP375 bln of holdings will decline. Its balance sheet will shrink. Market participants would likely see this as the beginning of the passive unwind of QE and a prelude to a rate hike and possibly push back against BOE's forward guidance. If it does announce it will reinvest the proceeds to maintain its current holdings, sterling may initially retreat.

Fifth, the Japanese yen and Swiss franc are the poorest performers this week. The weaker yen and news that yet another government panel has recommended that the large Government Pension Investment Fund (GPIF) diversify away from its domestic bond focus, help lift the Nikkei 1.6% and to its best closing level in over a month. The dollar is flirting with the upper end of its recent range against the yen in the JPY102.80 area. Similarly, owing primarily to yen weakness, the euro is knocking on a corresponding level near JPY141.30. We anticipate the weak yen story has more room to play. Our next dollar objective is JPY103.10-60 for the dollar and JPY142.00-50 for the euro.

by Daniel Gros

BRUSSELS – The euro crisis seems to be largely over. Risk premiums continue to fall across the board, and two countries – Ireland and Portugal – have already exited their adjustment programs. They can now finance themselves in the market, and their economies seem to have started growing again.

By contrast, Greece is still having problems fulfilling the goals of its adjustment program and is engaged in seemingly endless negotiations over yet another multilateral financing package. The problem can be summed up in one word: exports (or, rather, lack of export growth).

The news from Greece these days has been dominated by the announcement that the government achieved a primary budget surplus (the fiscal balance minus debt service) in 2013. For the first time in decades, the Greek government has been able to pay for its expenditure with its own revenues.

This is indeed a milestone. But another, much more important news item has received much less attention: Greece exported less in 2013 than in 2012.