Summary

- Technical Outlook: European stocks rise, close gap with US, Asia, despite miserable data, Russian invasion of Ukraine. Guess Why?

- Fundamental Outlook: The only market driver that really matters, how long the bull market can last, why, and what to monitor.

- The Key Questions: What to ask for the coming week and beyond.

How bullish and bearish forces align for stock indexes, forex and other global markets, both technical and fundamental outlooks, likely top market movers. Despite all the headlines, neither economic data nor the Russian invasion of Ukraine moved markets. Here's what did.

The following is a partial summary of the conclusions from the fxempire.com weekly analysts' meeting in which we cover outlooks for the major pairs for the coming week and beyond.

Technical Picture

We look at the technical picture first for a number of reasons, including:

Charts Don't Lie: Dramatic headlines and dominant news themes don't necessarily move markets. Price action is critical for understanding what events and developments are and are not actually driving markets. There's nothing like flat or trendless price action to tell you to discount seemingly dramatic headlines - or to get you thinking about why a given risk is not being priced in.

Charts Also Move Markets: Support, resistance, and momentum indicators also move markets, especially in the absence of surprises from top tier news and economic reports. For example, the stronger a given support or resistance level, the more likely a trend is to pause at that point. Similarly, a confirmed break above key resistance makes traders much more receptive to positive news that provides an excuse to trade in that direction.

Overall Risk Appetite Medium Term Per Weekly Charts Of Leading Global Stock Indexes

Weekly Charts Of Large Cap Global Indexes May 12 2013 To August 29 2014: With 10-Week/200-Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

Key For S&P 500, DJ EUR 50, Nikkei 225 Weekly Chart: 10-Week EMA Dark Blue, 20-WEEK EMA Yellow, 50-WEEK EMA Red, 100-WEEK EMA Light Blue, 200-WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

02 Aug. 31 11.06

Key Points & Lessons European Indexes Closing Performance Gap On Rising Stimulus Hopes

For Europe, the week brought more evidence of deterioration in both economic data and the Ukraine crisis. Nonetheless, European stocks made their third straight weekly advance. As a result they

· Broke or are close to breaking their 2-month old downtrend lines.

· Moved firmly into their double Bollinger® band neutral zones, signaling a bottoming is in as momentum is now firmly neutral rather than negative.

· Closed the performance gap with Asia and the US

So if everything is getting worse why did European stocks rise? For the same reason they've advanced in other regions in the face of sustained periods of bad fundamentals. It's another week of the "bad news equals good news trade." For those somehow still unfamiliar with this phenomenon, it means that because bad news implies more central bank stimulus is coming, stocks rise because that new cash injection into markets is expected to prop up stock prices.

The bad news equals good news trade needs to things to work:

· Consistently bad economic data showing stagnant or declining growth. Check.

· Investors interpret central bank comments to mean that they will add new stimulus programs if things don't turn around soon, or that such programs are already in the pipeline and that it's just a matter of weeks before they're announced. Check, ever since Draghi's impromptu Jackson Hole comments in which he admitted that deflation was not merely temporary but rather a longer-term problem.

Daily Charts / Short Term Coming Weeks

Key For S&P 500, DJ EUR 50, Nikkei 225 Daily Chart June 9 2014 to August 29 2014: 10-Week EMA Dark Blue, 20-WEEK EMA Yellow, 50-WEEK EMA Red, 100-WEEK EMA Light Blue, 200-WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange.

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

03 Aug. 31 12.22

Key Points & Lessons The Daily Charts

For the US and Europe, the big gains came early in the week on rising hopes for new ECB stimulus, fueled by ECB President Draghi's remarks that deflationary forces were proving more persistent than previously thought.

For the rest of the week, global stocks stayed in flat, tight trading ranges.

The big lesson here is that speculation on ECB easing was the big market mover, overriding data as well as news of Russia's increasingly overt invasion of Ukraine.

This is a key lesson because:

On Saturday Reuters reported that ECB Executive Board member Benoit Coeure had reinforced new ECB easing expectations, saying the bank was prepared to further boost funding to banks in order to encourage lending.

This alone could give global indexes, particularly European ones, a boost early in the week.

It also puts added focus on Thursday's ECB meeting and press conference. Although most analysts don't expect the ECB to announce new measures yet, this event would still be the likely venue for the ECB to feed or dampen stimulus speculation.

Germany has usually been the chief opponent of new stimulus, but a string of bad German data last week has raised suspicions that German leaders will become more receptive to it as their own economy shows signs of weakening. In particular we saw,

· A steep decline in German retail sales

· An increase in unemployment

· A deterioration in consumer, business and investor confidence

Together all of these indicate fading momentum in the Eurozone's largest economy. The cause isn't the Russian/Ukraine conflict, because even if there were material sanctions in effect, Russian exports represent only 1% of German GDP.

Instead, the problem for Germany and most of the EU is restrictive fiscal policy, that is, not enough spending. Low inflation remains a problem but Friday's increase in core CPI growth could give Mario Draghi enough reason to leave monetary policy unchanged at this week's ECB event. With the first TLTRO program expected in September, (and old LTRO loan repayments minimizing any net addition of liquidity until November or December), the central bank would probably prefer to see how the new TLTRO works before increasing stimulus further.

However, that doesn't mean the ECB won't try some "verbal stimulus" by raising expectations for some kind of new asset purchases. For example:

· -The ECB could announce ABS purchases, with the actual dates and details to follow later.

· -It could lower its GDP and inflation forecasts, both of which are due out next week.

· -It can simply continue with more of its usual statements of concern about EU stagnation and its willingness to do more to help, though there is cause to wonder if its ammunition is running low.

o ---Interest rates are already near zero

o ---QE's benefits, beyond inflating asset prices, remain unclear from the experiences of the US and Japan

o ---Encouraging lending helps only if there is actual demand for loans. That in turn requires optimism about the future. Business need to believe expansion is coming, and households need to have confidence in that their incomes will be stable and growing. However GDP continues to stagnate and most member states need to cut spending (another GDP drag) if they're to keep up with EU mandated debt/GDP reductions. In other words, the ECB alone cannot do enough to make up for a lack of economic reforms in the EU.

Fundamental Picture: Lessons & Top Market Drivers For This Week

Everything that has real influence over global asset prices and rates these days falls into one of three categories:

1. Economic data from the US, Europe, or China (ok, occasionally Japan or the UK).

2. Speculation about changes in policy, and ultimately, benchmark interest rates, from one of their central banks.

3. Geopolitical tensions, with the Russia/Ukraine conflict the only one seen as having potential to really hurt the global economy, mostly through the damage it does to the already shaky EU. Mideast turmoil hasn't affected energy prices and the "China versus all of its neighbors" tensions remain on slow simmer, so both remain irrelevant for investors.

The Lesson: Central Bank Policy Sentiment Overriding, Data, Ukraine Crisis Implications

Looking at last week's price action in global equities, one big screaming lesson stands out that everyone needs to learn. Speculation on major central bank policy changes, particularly from the ECB, Fed, and PBoC, (and thus key data most likely to influence them) is overriding all else.

Last week's data should have global indexes, at very least in Europe. Ditto Russia's now overt direct invasion of Ukraine. Yet the only thing that moved most global indexes was rising speculation of new ECB easing.

This isn't so surprising. Last week's data merely confirmed and supported the current outlook for the major economies. New economic sanctions against Russia appear to be coming, but the West remains vague on both their timing and extent. So markets have reason to doubt if and when these will materially impact anything.

Why This Matters So Much

It follows from the above that the big scheduled events for this week are those that tell us the most about policy changes from the central banks of the biggest economies. That means the scheduled events with the most market moving potential are:

Thursday's ECB meeting, rate statement and press conference. As noted above, while we don't expect new policy to be announced, at least not in any meaningful detail, it's quite possible that the ECB will want to offer something that suggests it's taking an active role in solving the mess that EU leaders have failed to resolve. The ECB meeting has the most market moving potential of any event on the calendar, because its policy is in flux. It will ease further, the only question is when and how. That means a big surprise here could move markets more because it could change expectations about ECB policy, EU liquidity, the Euro, interest rates, etc. the most.

The Fed continues to see too much slack in the labor market to allow for any material tightening beyond a minor rate increase sometime in the coming year, so the US August job reports have the most potential of any other calendar event to influence speculation on the pace and scope of Fed tightening. Unless this one really surprises and the ECB meeting does not, this has a bit less market moving potential because Fed tightening is happening more slowly than ECB easing. Therefore no matter what the result from the jobs reports, it's less likely that these will move expectations on policy changes as much as a surprise from the ECB meeting. Also, the ECB meeting will produce comments directly from the ECB itself, whereas the US jobs reports not as telling as a direct communication from the Fed itself.

Note that as always, reports earlier in the week that serve as leading indicators for the Friday official jobs reports could also be short-term market movers if they surprise up or down. Chief among these are:

The ISM manufacturing and non-manufacturing PMI surveys, particularly their jobs components. Services are the biggest employers by far, so the non-manufacturing PMI Thursday is more important.

The ADP non-farms payrolls report, a privately compiled version of the official report. ADP changed its methodology back in October 2012 in an effort to make the ADP report better predict the actual official BLS version. The ADP version continues to be a good indicator of general direction, but less effective in predicting the actual result. See here for details. Still, positive or negative surprises have been influential in the past, at least for the two days between the ADP report and official NFP release.

See below for other calendar events that could influence most global asset markets. Events that would influence a narrow range of assets or only regional indexes are omitted, so this summary would not be suitable for those dealing with currencies or bonds which tend to be more influenced by country or region specific news. For example, we omit most Bank of Japan or England events, although these would be of importance to investors in JPY or GBP currency pairs or those bond markets.

How Much Longer Will The Bull Market In Equities Last?

The short answer, obviously, is that few see signs that it will end any time soon, except for the perma-bears. That said, by definition, crashes are unanticipated by almost everyone.

Here's a brief roundup of the week's latest on the topic that I found useful

Bulls

The most compelling piece on the bullish side was Cullen Roche's summary of David Rosenberg's bullish forecast here, mostly because not only does Rosenberg focus on data that isn't as likely to be distorted by the prevailing unique levels of central bank intervention and low rates (unlike analyses based on historical valuation metrics), he's also a converted bear. That willingness to admit fault and stick to what the data tells him earns credibility.

Deutche Bank economist Torsten Slok argues that the stocks shouldn't fall because stocks don't fall unless there's a recession, and the normal causes of a recession aren't present. These include:

Bursting bubbles in capex (as in 2000) or consumption (2007-8) or when monetary policy is too tight, that is, well above its neutral level of about 3.75% on the US 10-year treasury note. He notes, similar to what we've said in the past, that with the Fed planning on a very gradual rate of increase, that could take about 5 years.

See here for further details.

Our Take: No Big Selloffs While Rates Low And No Imminent Contagion Risk

We disagree with Slok's assumption that stocks necessarily rise and fall with recessions, however the rest of his argument makes sense. As we've said all along, global stocks have continued to rise despite poor economic data. The key constants of the post March 2009 lows have been:

· Stimulus that keeps rates so low that yield seekers are pushed into equities

· Lack of a contagion threat

Agree or not, that HAS been the reality of the bull market. The only material pullbacks occurred when one of these was in doubt (EU crisis, taper tantrums, etc.).

Bears

Given the long bull market, supported by continued low rates from central banks and no contagion threats, recent bearish arguments are variations on:

Valuations are high by historical standards. True, but ultra-low rates make today less analogous given that investors have few options for yield, so investors are accepting higher valuations.

The rally is getting old by historical standards. Again, true, but it's far from record setting and while the conditions that created the rally remain it's hard to accept that there's a time limit on the bull market as long as the twin pillars of low rates and no contagion threats remain in place.

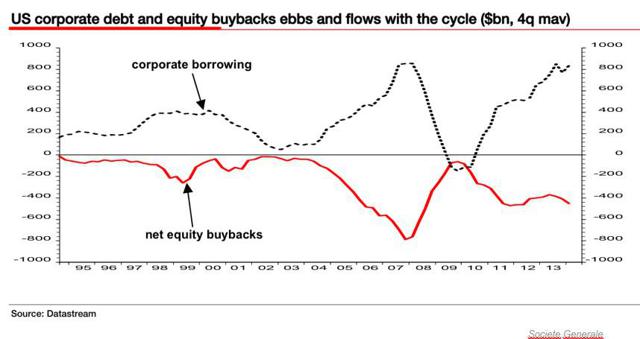

SocGen's Albert Edwards is arguing that with the end of QE, that will bring the end of the low rates that fund corporate stock buybacks, which he contends are a major prop of stock prices.

Below he shows the correlation between corporate borrowing and stock buybacks. The unstated implication is that the buybacks began at the same time as the bull market, which in turn suggests they're a key component of it.

Via Business Insider here

04 Aug. 31 16.40

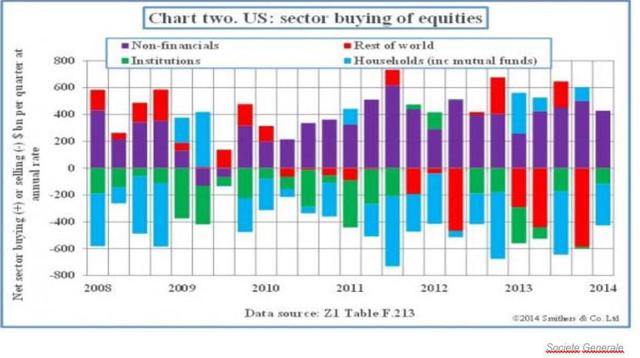

Below he shows the proportion of stock purchases from corporate buybacks, shown by the purple bars.

Via Business Insider here

05 Aug. 31 16.41

Edwards then asserts that the end of US QE, combined with an anticipated slowing of corporate profits, will end the buybacks and so cut demand, and prices, for stocks.

My problems with this thesis include:

The end of QE doesn't necessarily bring a material spike in interest rates, particularly when the Bank of Japan and ECB are moving towards further easing. That added liquidity should to some degree compensate for whatever effects come from planned tightening by the Fed and Bank of England.

A Big Long-Term Question: Net Effect of Divergent Central Bank Policies

Echoing many analysts, Citi's top economist Willem Buiter is forecasting that a big policy divergence among some of the world's leading central banks. In essence, he predicts:

· The economies of the EU and Japan, both burdened with low growth and inflation, will cause their central banks to start "major" new QE programs in late 2014 or early 2015.

· Meanwhile, the slow but steady recoveries in the US and UK will bring their central banks to begin some kind of gradual tightening at some point in 2015. Indeed the latest meeting minutes of both the Fed (two weeks ago) and BoE (last week) suggest show signs that these two banks are edging towards tightening.

This has significant implications for many kinds of global markets.

The most obvious effects are being seen, and will continue to be most obvious, in currency markets. Currencies trade in pairs, so literally, everything is relative. That is, even minor but persistent differences in economic performance can create significant long-term trends as long as the relative differences continue and continue to give one currency a higher benchmark interest rate than the other.

That rate difference would also be quickly seen in bond markets, as bonds from nations in tightening modes yield more and attract more demand. It's in the bond markets where the really interesting effects and questions come. Here are just a few:

What's The Net Effect?

First, will falling rates in the EU and Japan offset the effects of rising rates in the UK and US for global growth, stocks, and emerging market assets?

Remember how in early 2014 emerging market assets and currencies were hit hard by the mere hint of coming Fed rate hikes? These would have cut demand and prices for emerging market currencies, stocks and bonds because they would lose some of their yield advantage over US assets. It also forced their bond yields and borrowing costs up, which in turn hurt their growth prospects.

Will US And UK Tightening Undermine Easing Policies For The ECB and BoJ?

An equally significant question is whether rising rates in the US and UK, or at least the expectation of them, will force global rates higher and undo the very easing that the EU and Japan are trying to accomplish? Remember, bonds operate in a global market.

If investors can get higher returns on US and UK bonds from both currency appreciation (currencies rise as their benchmark rates rise) AND higher bond yields, why would they buy EU and Japanese bonds? They wouldn't, not until EU and Japanese bond prices fell and thus their yields rose enough to compete with bonds of the US and UK.

Sure, for a while the ECB and BoJ and just keep buying up their own bonds to keep their bond prices and yields stable. However even if we assume that the ECB would ultimately be allowed to do that (we do, see here for details) along with Japan, that's not a sustainable policy, as such unrestrained money creation (let's avoid technical definitions of money printing) risks creating a Weimar-like hyperinflation.

Theoretically if the US and UK hike slowly enough, with some kind of policy coordination with the ECB and BoJ, maybe they could avoid that mess. Frankly I lack the background and analytical skills to even attempt an answer.

I haven't even considered the impact of Chinese central bank policy, which could easily revert to easing mode despite intentions to move towards tightening.

Do you have any thoughts, dear readers?

Top Calendar Events To Watch

Other than the above mentioned events, here's a quick rundown of other potential market movers.

Monday

China: Manufacturing PMI (official data focused on big state owned firms), HSBC final manufacturing PMI (privately compiled, focused on smaller privately owned firms). Both are relevant for the EURUSD because China's status as leading global growth engine means top-tier reports like these influence overall risk appetite, with which the EURUSD usually moves (albeit not recently given ECB easing, bad EU data, and Russian tensions, all of which are undermining the EUR more than other assets).

EU: Italian manufacturing PMI

US: most markets closed for Labor Day

Tuesday

US: ISM manufacturing PMI (its labor component is seen as a leading indicator of the big monthly US jobs reports on Friday)

Wednesday

China: Non-manufacturing PMI, HSBC services PMI

EU: Spain, Italy, EU services PMI survey, EU retail PMI survey,

US: factory orders, Beige book

Thursday

EU: German factory orders, ECB rate statement and press conference (will it indicate new easing is coming?)

US: Trade balance, weekly new jobless claims, ISM non-manufacturing PMI (its jobs component is an even bigger leading indicator of the Friday monthly jobs reports than the mfg. PMI as services are a bigger employer)

Friday

EU German industrial production

US: NFP jobs report, unemployment rate, avg hourly earnings

Biggest Questions

1. Will Russia escalate? If so, will the West continue to delay imposing meaningful sanctions and thus allow markets to largely ignore the conflict?

2. Will the ECB September 4 meeting indicate new EUR dilutive easing coming sooner than expected?

3. Will key EU and US top tier data continue with the "US outperforming the EU" theme, and if so, will that raise expectations for faster ECB easing and/or Fed tightening? Again, it's changes in sentiment on central bank policy direction that move global stocks in general, and the EURUSD in particular, more than anything else these days. Also, Fed policy is no longer viewed as being on automatic pilot after the last FOMC meeting minutes for July suggested that the timing of the first rate hike is under discussion.

4. Will Friday's US jobs report feed expectations for faster Fed tightening? If so, will US bond rates remain low anyway as safe haven demand keeps rates low.

5. If indeed there is a coming divergence in central bank policies, with the Fed and BoE tightening while the ECB and BoJ are easing, what will be the net effect on global interest rates and markets?

6. Can the ECB, with its limited tools, continue to keep the EU crisis in hibernation, even as so many member states that are too big to bail out run unsustainably high debt levels that are likely to grow worse, as we discussed recently here?

No comments:

Post a Comment