by Greg Harmon

Last week’s review of the macro market indicators suggested, heading into September Options Expiration Week, that the equity markets look tired and ready for a pullback. Elsewhere looked for Gold ($GLD) to continue lower while Crude Oil ($USO) did the same. The US Dollar Index ($UUP) was strong and looked to continue higher while US Treasuries ($TLT) were biased lower. The Shanghai Composite ($FXI) was also strong and biased higher while Emerging Markets ($EEM) looked to continue their pullback. Volatility ($VIX) looked to remain subdued keeping the bias higher for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts showed more consolidation in the zone for the IWM and a possibility of consolidation or even a pullback for both the SPY and QQQ.

The week played out with Gold pushing lower to new lows on the year while Crude Oil caught a Dead Cat Bounce before falling back. The US Dollar continued its break out higher while Treasuries found support and consolidated. The Shanghai Composite consolidated around resistance while Emerging Markets continued their pullback. Volatility poked higher over the moving averages only to finish back below them. The Equity Index ETF’s had a mixed week with the IWM falling but the SPY and QQQ making new closing highs Thursday and then intraday highs on Friday before pulling back. What does this mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

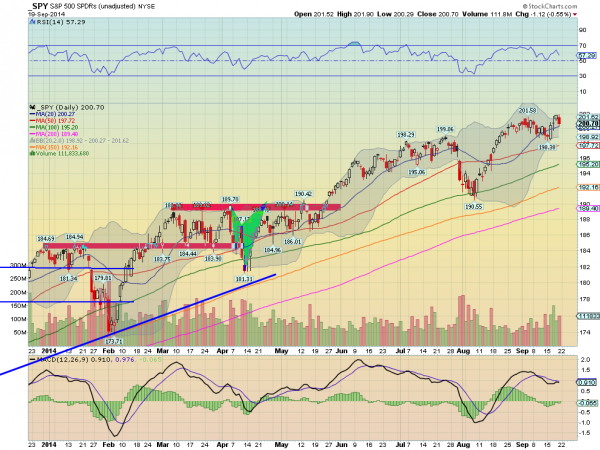

SPY Daily, $SPY

SPY Weekly, $SPY

The SPY had a roller coaster week. Sunday night the world was going to end and it opened lower Monday only to rally to new all-time closing highs by Thursday. Friday would have been another record if it had not paid a dividend. The price action on the daily chart is mixed. The price did hold over the 20 day SMA Friday, but with a red candle. The RSI on the daily chart is in the bullish zone but may be making a lower top, caution, with a MACD that is crossing up though, a good sign. On the weekly chart the picture is much more clear. There is consolidation at the highs with a strong RSI and a MACD avoiding a cross down by moving sideways. There is support at 200 and 199 followed by 198.30 and 196.50. Resistance stands at the new high at 201.85, with a 150% Fibonacci extension above that at 202.78 and Measured Moves to 208 and 209. Consolidation with an Upward Bias, in the Uptrend.

As we close the books on the September Options cycle and move into Fall, the equity markets still look strong but a bit tired. Elsewhere look for Gold to continue lower along with Crude Oil. The US Dollar Index continues to look strong while US Treasuries are bouncing in their downtrend. The Shanghai Composite is also strong and looks better to the upside while Emerging Markets are biased to the downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ look the strongest but on the weekly timeframe, with some cracks on the daily charts. The IWM looks weak in the short run and probably continues towards the bottom if its consolidation zone. Use this information as you prepare for the coming week and trad’em well.

No comments:

Post a Comment