By Nick Kalivas

Although the twin headwinds of economic and geopolitical uncertainty are buffeting international markets, stocks in developed international markets invite closer examination. Historically low interest rates, supportive central bank policy, relatively attractive valuation and the chance for returns to experience mean reversion - or a move back toward average - may frame an opportunity for international developed market equities to outpace the S&P 500 Index.

Catalysts for potential outperformance

Let's explore four reasons why international developed market equities appear attractive, in my view.

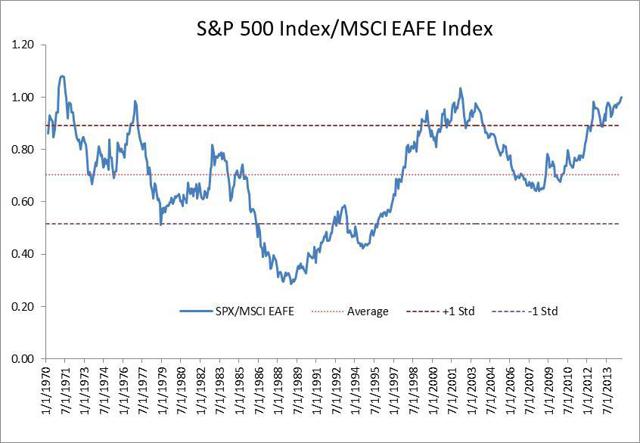

First, I believe the potential for mean reversion in price return argues for improved performance. The price return ratio spread between the S&P 500 Index and MSCI EAFE Index is flirting with highs last seen in 1971 and 2000, and is moving toward the upper end of the range seen since 1970. As the graph below illustrates, the price ratio spread is 1.04, which is 1.78 standard deviations above the mean.1 Normalization in the spread relationship could suggest stronger relative performance for the MSCI EAFE Index.

International Equities: Mean Reversion in Price Return May Signal Improved Performance

Source: Bloomberg L.P., as of Aug. 29, 2014

Second, monetary policy is diverging among the Federal Reserve (Fed), European Central Bank (ECB) and Bank of Japan (BOJ). There is speculation that the ECB will provide additional stimulus at a time when the Fed is tapering and ending its bond-buying program. Meanwhile, the BOJ is continuing to add liquidity to offset the impact of a sales tax hike and solidify a rise in inflation and economic growth. I believe this divergence in monetary policy argues for a strong dollar, which may benefit the profit outlook for European and Japanese exporters.

Third, historically low sovereign yields in the eurozone and Asia may improve the valuation proposition of Eurozone and Japanese stocks. Moreover, low rates could cause investors to look at equities for income. As of Aug 29, 2014, the German and Japanese 10-year treasury yields were trading at less than 90 basis points and 50 basis points, respectively.1

Finally, valuation appears attractive.The MSCI EAFE Index is trading at a discount price/earnings ratio of about 1.25 versus the S&P 500 Index, and it has a dividend yield of 3.35% -more than triple the yield on a German one- year note.1

Accessing international developed markets

Against the backdrop of ongoing geopolitical tensions, uncertain growth prospects in Europe and Japan and a likely search for yield, investors may want to talk with their financial advisors about gaining access to these markets through a combination of momentum and low volatility stocks. Here's why:

- The momentum factor may give investors exposure to the potential upside in a bull market.

- The low volatility factor may help mitigate the downside during periods of market turbulence.

A combination of the two factors may offer investors a way to better manage what could be a friendly environment for equities, while helping them to control risk.

Learn more about PowerShares S&P International Developed Low Volatility Portfolio (NYSEARCA:IDLV) and PowerShares DWA Developed Markets Momentum Portfolio (NYSEARCA:PIZ), which offer exposure to these factors in international markets.

Source

- Bloomberg L.P., as of Aug 29, 2014

Important Information

There are risks involved with investing in ETFs, including possible loss of money. Shares are not actively managed and are subject to risks similar to those of stocks, including those regarding short selling and margin maintenance requirements. Ordinary brokerage commissions apply. The fund's return may not match the return of the underlying index.

Shares are not individually redeemable and owners of the shares may acquire those shares from the funds and tender those shares for redemption to the funds in creation unit aggregations only, typically consisting of 50,000, 75,000, 100,000 or 200,000 shares.

Investments focused in a particular industry are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Equity risk is the risk that the value of equity securities, including common stocks, may fall due to both changes in general economic and political conditions that impact the market as a whole, as well as factors that directly relate to a specific company or its industry.

A basis point equals 1/100th of 1% and is used to denote the change in a financial instrument.

No comments:

Post a Comment