by Eric Parnell

The European Central Bank (ECB) brought fireworks to their latest press conference this past Thursday. Not only did ECB President Mario Draghi announce a cut of its main lending rate to the "lower bound" of 0.05%, he also revealed that the central bank's intent to enter into its own form of quantitative easing (QE) by purchasing asset backed securities (ABS) and covered bonds at totals estimated between $500 billion to $1.3 trillion as early as October. This targeted long-term refinancing operation (TLTRO) is being done with the stated objective of trying to more directly promote lending activity to small and mid-sized businesses across the euro zone. Given that we have seen so many of these monetary stimulus programs initiated by global central banks over the past few years, it is reasonable to consider whether a portfolio strategy is well positioned for this latest ECB stimulus plan.

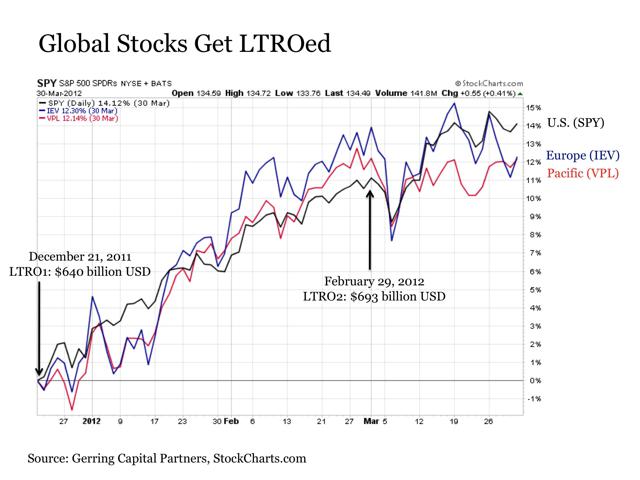

Of course, we have seen the ECB engage in long-term refinancing operations once before. Back in December 2011, then newly seated President Draghi announced the first LTRO that resulted in the ECB not necessarily purchasing assets outright but instead making low interest loans to European banks in exchange for collateral from the banks. Over $1.3 trillion worth of loans were distributed to European banks in two major tranches first on December 21, 2011 and again on February 29, 2012.

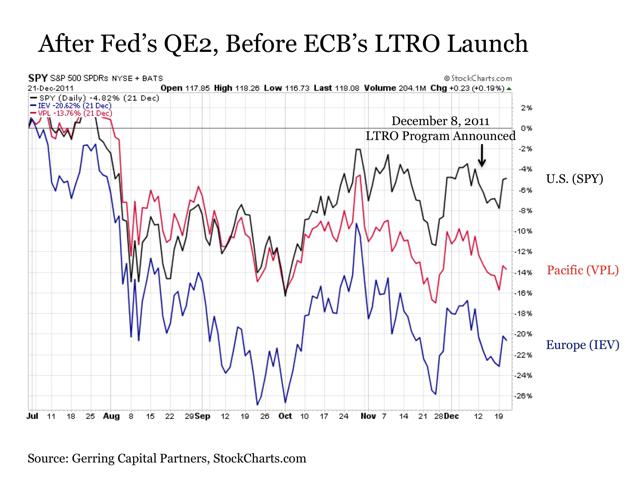

It is worth noting that in the months leading up to the ECB's LTRO stimulus program, global stock markets including those in the U.S. (NYSEARCA:SPY), Europe (NYSEARCA:IEV) and Asia (NYSEARCA:VPL) were struggling. Following the completion of the U.S. Federal Reserve's QE2 stimulus program at the end of June 2011, global stock markets retreated in varying degrees by double-digits through October and struggled to regain their footing into December.

But from the day that the ECB initiated their LTRO program right before Christmas 2011, global stock markets exploded into a uniform and sustained rally over the next three months, posting very similar double-digit advances across the board. Global stock markets clearly found at least some cheer in the ECB's stimulus plan.

This seemingly notable response from global stock markets to the ECB's LTRO raises a natural question. Should we expect to see a similar positive response from global stock markets upon the launch of the upcoming TLTRO by the ECB? Taking this one step further, does the TLTRO effectively represent a passing of the QE baton from the Fed to the ECB and with it the juice to keep pushing global stocks to new highs?

Not All QE Is Created Equal

To begin with, attempting to draw conclusions about the response by global stock markets to the upcoming TLTRO based on observations about the past LTRO is clouded by several factors.

First, the ECB's LTRO is just one past instance that took place over a relatively short period of time and does not represent a sufficiently large sample size to draw any definitive conclusions.

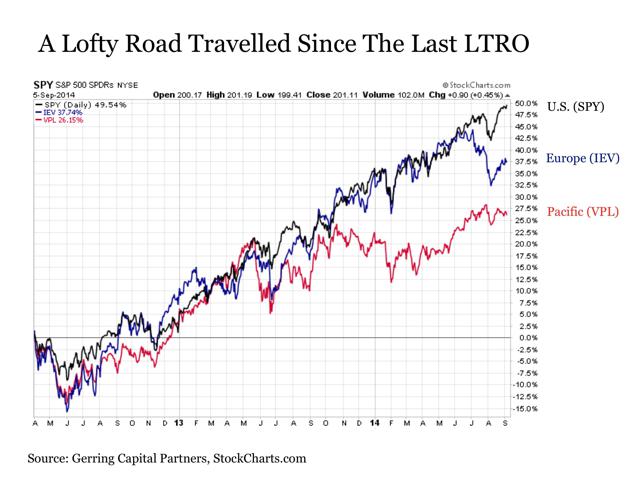

In addition, all else is not being held equal in these instances, as global economic and market conditions are decidedly different in late 2014 than they were in late 2011. More specifically, stocks have risen a long way from where they were in early 2012. Back then, stocks as measured by the S&P 500 Index were trading at 14.5 times trailing 12-month as reported earnings, which is far more reasonable than the 19.4 times as reported earnings that stocks are trading at today.

Lastly, the TLTRO program being carried out today is structured differently than the LTRO program that came before it in late 2011 and early 2012. As a result, one should be cautioned in attempting to draw any concrete conclusions on how global markets might react to TLTRO based solely on observations about the past LTRO.

Instead, it is worthwhile to stand back more broadly and explore how the various stimulus programs instituted by global central banks over the last several years have influenced global markets along the way.

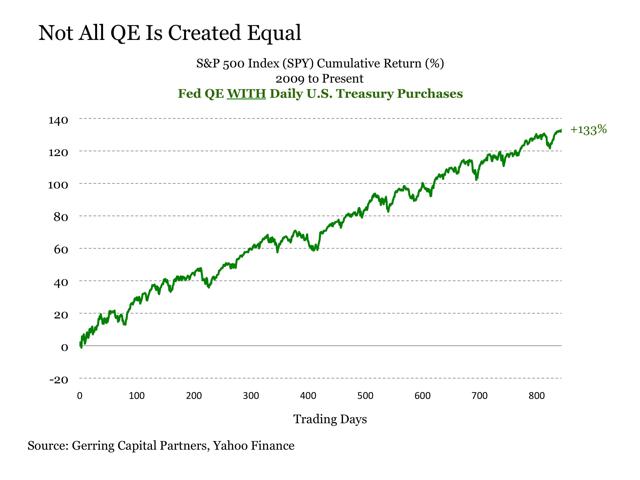

The first observation that can be made about these collective stimulus programs by global central banks is that not all QE is created equal. Market performance during the post crisis period suggests that exactly how QE is implemented may have a meaningful effect in determining whether the stock market response is positive, indifferent or negative.

More specifically, two characteristics about these monetary stimulus programs have stood out more than any other in terms of the stock market impact in the over 1,400 trading days since QE was first initiated in the midst of the financial crisis. The first is the periodicity of how these asset purchases are carried out and subsequently how this liquidity is injected into the financial system. The second is the specific assets being purchased from the banks.

For example, the U.S. Federal Reserve has implemented various forms of stimulus since the outbreak of the financial crisis. The following is a chart of the S&P 500 Index over the 843 trading days when the Fed was actively engaged in daily U.S. Treasury purchases. Overall, the stock market has gained a cumulative +132% over the 843 trading days when the Fed has been purchasing Treasuries on a daily basis. This, of course, is the program that has been scaled down for months and is about to draw to a close.

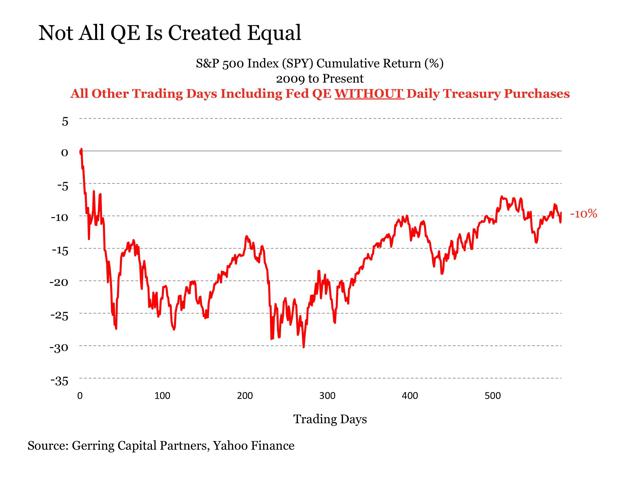

In contrast, the following is a chart of the S&P 500 Index over the 583 trading days when the Fed was doing anything other than purchasing Treasuries on a daily basis. This includes the Fed doing nothing at all, the Fed engaged in Operation Twist, the Fed announcing to the market that QE is soon coming but has not been officially implemented yet and the Fed actively engaged in QE that includes only mortgage backed securities (MBS) purchases instead. Overall, the stock market has posted a cumulative decline of -10% over the 583 trading days when it was doing anything other than buying Treasuries on a daily basis.

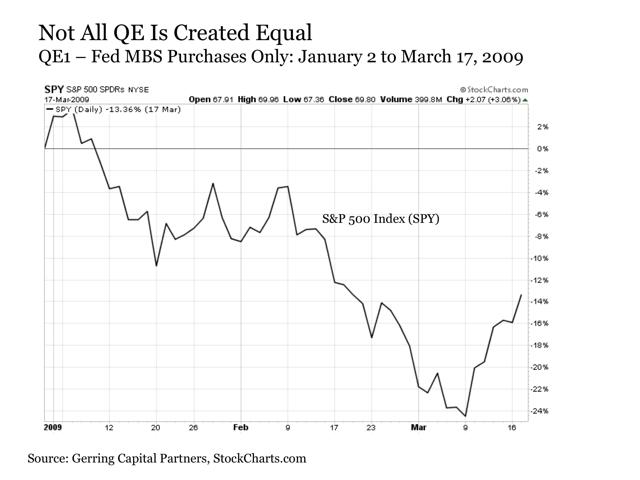

Taking this one step further, one point that is notable about the ECB's proposed TLTRO program is that it is like QE in many ways but the asset purchases are likely to occur in broader tranches instead of daily. While the LTRO did serve global markets well in this regard back in late 2011 and early 2012, the same cannot be said of other stimulus programs where asset purchases associated with QE were lumpy instead of daily. To this point, the two charts below show the performance of the S&P 500 Index specifically during the two periods when the Fed was actively engaged in QE but was purchasing MBS only. The performance is mediocre at best and lousy at worst.

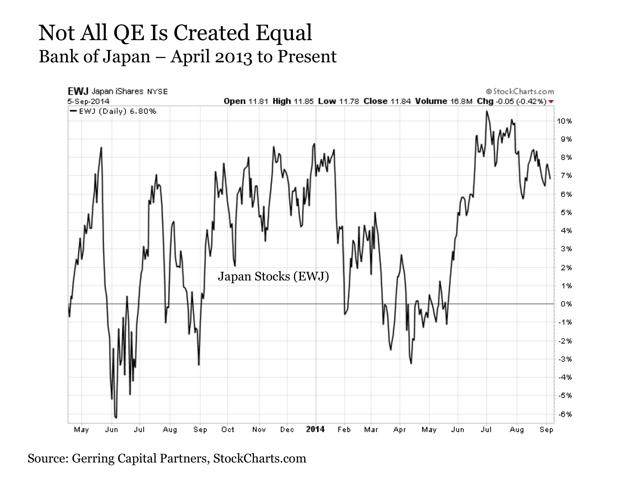

Even if a central bank is fully engaged in outright asset purchases, it does not mean that it is an automatic ticket to a stock market that is steadily floating higher. For example, the Japanese stock market (NYSEARCA:EWJ) has been grinding in a sideways pattern since the Bank of Japan's super aggressive monetary policy experiment was first revealed back in April 2013. Adding to this point, it is worth noting that the Japanese stock market is currently trading below its May 2013 peaks, and this comes despite all of the rampant printing of yen under QE in Japan.

Conclusions

Whether the ECB's TLTRO program serves the purpose of propelling global stock markets to fresh new heights remains to be seen. But recent history has shown that a central bank QE program does not automatically mean that global stock prices are going to rise in response. In fact, it has largely been only one specific type of QE stimulus application in the form of daily U.S. Treasury purchases that appear to have this sustained positive effect on global stocks. Beyond that, other central bank QE stimulus programs have been a wash at best for the stock market.

When considering the specific details about the program that have been revealed so far, it suggests that the stock market impact may be considerably less than many are hoping. The difference this time around is the "T", which is for "Targeted" in "TLTRO". The intent of the program is to effectively bypass the structural obstacles in the European banking system in an effort to get the funds more directly to small and mid-sized businesses.

Put differently, it seems that the ECB this time around does not want to turn over the funds to the banks in a more general way only to find that the capital ends up not going into improving the economy but leaks out into other less productive places (i.e. the stock market). Instead, they are seeking to get as much of the funds as possible directly to the destination that they believe may help stimulate the European economy best. This in the end may leave little left over for leakage into the stock market.

It is also notable that Draghi's announcement came only days after his speech in Jackson Hole where he essentially teed up Thursday's announcement. During his stay in Wyoming, he of course was hobnobbing with those at the Fed that are not only in the process of winding down their own QE stimulus program in the next month, but was hanging with a group that has recently been vocal on topics such as income inequality, potential asset bubbles in selected stock sectors and the need to raise interest rates sooner rather than later. All of these suggest that the Fed may have concluded that a policy approach that moves away from promoting higher stock prices may be more beneficial to the economy as a whole in the future. And it would be hard to believe that at least some of this thinking might not have rubbed off on Mr. Draghi during his stay in Wyoming.

Portfolio Implications & Positioning

Putting all of this together suggests that the benefits for global stock markets resulting from the ECB's TLTRO program may end up being much less than investors may currently be anticipating. But whether the program does provide a boost to share prices in the end or not, the history of central bank stimulus including QE since the financial crisis has shown that when stocks are benefiting, they are typically doing so universally across the globe with U.S. markets either matching or outperforming along the way. In the end, this suggests that sticking to one's existing stock strategy and focusing on high quality stocks trading at discounted valuations where possible should provide a portfolio with exposure to any spillover benefits on global stock markets if such effects do indeed come to pass. In short, no need exists at least at this point to modify one's existing stock strategy in any meaningful way in response to the ECB's latest policy actions, as current allocations should provide sufficient exposure at least for now.

No comments:

Post a Comment