by James Gruber

Asset returns were all over the map in the first half of 2013. Stocks outperformed bonds. But within equities, developed markets pummelled emerging markets, with the U.S. and Japan leading the way. A similar trend happened in bonds, where investors who’d poured money into emerging markets promptly fled in May and June of this year. Of course, commodities were the biggest loser, and among these, precious metals trailed the pack on worries over QE tapering and Indian demand.

What then can we look for the second half of the year? Broadly, I expect deflationary concerns to take centre stage again as the U.S. economy stagnates, Japan intensifies currency wars and thereby exports deflation while Chinese GDP dips below 7% by the fourth quarter. This will take any talk of significant QE tapering in the U.S. off the table while Europe and Japan continue to provide ample liquidity amid weakening economies. China will be the only country tightening policy as it resists calls to reflate its credit bubble.

If this is right, bonds will be the big winners in the second half. Emerging market bonds may see more volatility with outflows intensifying in July before picking up as global stimulus ramps up. Stocks should have a sharper correction, possibly from September, as the U.S. economy stalls and China worsens. The “Bernanke put” will limit the correction though. Meanwhile, commodities should dip before bouncing hard as stimulus picks up again, with gold and agriculture significantly outperforming industrial metals.

That’s a broad, tentative roadmap, but let’s break it down a bit further:

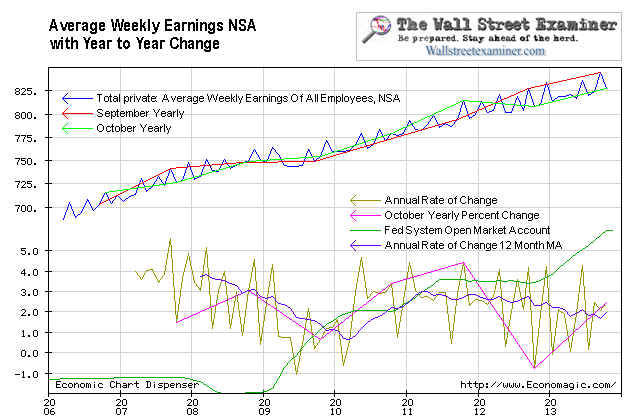

1. The U.S. – The Fed will take fright at rising bond yields. It knows higher interest rates would stifle any housing recovery and lead to much higher interest costs on government debt, something the U.S. can ill afford. Not to mention that rising yields in the U.S. puts upward pressure on rates around the world. With much of the developed world economies near or at recessionary levels, increased yields are the last thing that they need. This will limit any QE tapering, if it happens this year at all.

Meantime, the U.S. economy will stagnate as European economies fail to recovery, Japan depreciates the yen more aggressively and exporting deflation while China’s credit bubble pops. Yes, the U.S. will be better off than the rest of the developed world, but increasing talk of “recovery” will be put to bed.

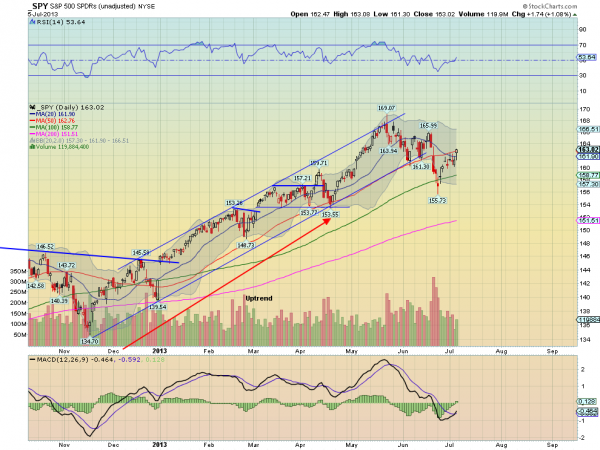

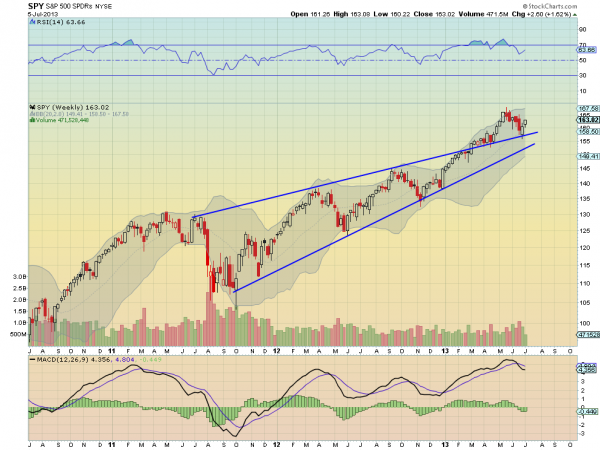

Given the above, and the extraordinary performance of the S&P 500, I expect a more significant pullback in the stock market in the second half. Globally, equities should struggle but Europe may well outperform the U.S. given much cheaper valuations and lower expectations.

2. Europe – Crudely, you should expect more of the same. That is, weak economies burdened by the Euro and extraordinary debt loads. Partially offset by the European Central Bank and Bank Of England wearing out the world’s money printing machines by providing more and more stimulus.

France will become the big concern as investors realise that it is the next Greece, but this is probably a 2014 issue. A significant, compounding debt burden, extravagant social welfare system, stifling regulations limiting the private sector, worsening tax revenues and a clueless Socialist President make France the next domino to fall in Europe.

3. Japan – After this month’s elections for the upper house, Shinzo Abe should have a stronger mandate to pursue reform, the so-called third arrow of his strategy to defeat deflation. He may provide broader reform, perhaps including badly need changes to the labor market and the agricultural sector. But any reform will be limited by the influence of powerful lobby groups. Given the low expectations for reform, there may be another temporary leg up for the Japanese stock market.

If the reforms do positively surprise, bond yields will spike, raising concerns again about the impact on interest costs of the government’s unprecedented debt levels. This will bring further government buying of bonds, crowding out private players, thereby leading to increased volatility. The stock market should again sell off when this happens.

The long-term picture remains that Japan is a train wreck waiting to happen. Given government debt of 245% of GDP or 20x government revenues, Japan has only two bad choices left: 1) Cut back on government services to such an extent that would cause an immediate depression or 2) Print truckloads of money to inflate the debt away. The government’s chosen no. 2, which will lead to significant yen depreciation and a blow-up in the bond market at some point. It’s a matter of when, not if this happens. 2014, perhaps?

4. China – It’s become clear that the China’s credit bubble is bursting. And the new government doesn’t want to risk reflating the bubble, preferring to deal with the mess now rather than later. This is a political choice, but a wise one. This way, blame for the economic downturn can be sheeted home to the previous government.

The choice though means that there’ll be a significant slowdown in economic growth, probably below a 7% GDP rate by the fourth quarter. At the same time, however, the government may significantly surprise markets by announcing deep structural reforms to restructure the economy. The changes may include the widespread privatisation of state assets, extensive financial de-regulation, broad-based tax reform and increased incentives for foreign investment.

In the opinion of this author, Xi Jinping is both a pragmatist and a likely reformer. He’s thinking about the next 10 years, not the next three months. That means he’s willing to take short-term pain to reap the benefits later on.

How will China’s stock market react to all this? It’ll probably focus on the economic pain rather than structural reform, at least initially.

5. India – A depressed investment cycle needs to restart if India is to turn around. There are tentative signs that this may be starting to happen. Combined with a bounce in the rupee as the current account deficit stabilises from lower commodity prices, and India’s stock market could be one of the best performers in Asia in the second half.

The risk is around general elections next year and the pork barrelling which will occur before that. The positive thing about the large current account deficit is that it keeps pork barrelling in check to a certain extent. At least investors should hope this is the case.

6. South-East Asia – Foreigners have poured into this market since 2009 as it’s one of the few regions with genuine growth prospects. At the first recent hint of trouble though, this money headed for the exits. With more QE tapering talk over the next month or two, there’s more downside for South-East Asia. However, when this talk dies down, the region should once again attract foreign money.

That money is likely to head to Thailand and the Philippines. Indonesia will underperform as commodities suffer, its current account deficit deteriorates and attention turns to who will govern the country, with general elections set for next year. Meantime, Malaysia may attract investors with reasonable market valuations and a potential bounce in commodities later this year.

7. Commodities – I am among a significant minority of investors who believe that the commodities super-cycle isn’t over. To be specific, the best days of industrial commodities are behind it. But for precious metals and agriculture, they’re likely ahead. Precious metals remain an attractive hedge against central bank profligacy and currency debasement. While agriculture’s supply and demand situation is extremely tight, meaning any future supply disruptions should drive prices higher.

For the second half, you’re likely to have the continuing headwind of softening demand out of China. On the other hand, quietening taper talk will prove a nice tailwind. Many commodities are now seriously oversold and when it becomes clear that the U.S. will continue stimulus for several years to come, many of them will bounce hard. Pencil in the fourth quarter?

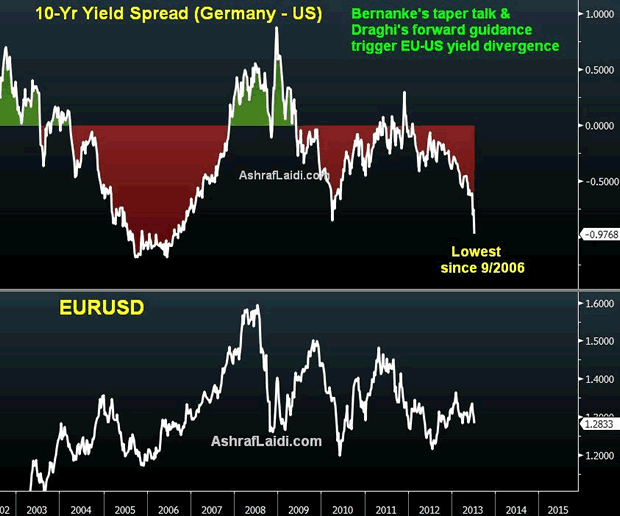

8. Currencies - I did a piece that attracted a fair amount of interest earlier this year called “Who will win the currency wars?” In it, I looked at potential currency winners and losers in the long term (3-5 years). I suggested commodity currencies would be significant losers, highlighted the Aussie dollar as being particularly at risk. My preferences were the Singapore dollar, Thai baht and Malaysian ringgit due to the strong balance sheets and relatively attractive growth profiles. The call on commodity currencies has been correct, while my favoured currencies have performed ok on a global basis, less so versus the U.S. dollar.

I still see significant risks to commodity currencies, with the Aussie dollar heading towards 80 cents to the U.S. dollar this year, on its way to 60 cents in a few years. As China slumps, Australia should enter recession by the end of the year, as mining investment cutbacks deepen and the housing market stalls or declines as unemployment rises.

I still like the Singapore dollar, Thai baht and Malaysian ringgit. However, the U.S. dollar could well strengthen in the next 8 weeks before re-commencing its steady decline. That means my preferences should once again catch bids towards the fourth quarter. Having some money in U.S. dollars may make some sense, bearing in mind that it’s heading for trouble in the long-term given the country’s continued commitment to currency depreciation via money printing.

The Chinese yuan is a tricky one. I’ve been dead wrong calling for a yuan decline earlier this year. It’s been a great performer. But as China’s credit bubble unwinds and the Japanese yen weakens further, I can’t help but think that the government will want a weaker currency, and soon.

Lastly, the Japanese yen remains probably the world’s biggest short (yes, more than the Aussie dollar). Japan needs a significantly weaker yen to deflate its debt in yen terms.

9. Bonds – U.S. long-term government bond yields should head higher in the very short-term before heading down towards 2% by year end. That’s if my view of a renewed commitment to QE proves correct.

Emerging market bonds may experience more pain over the next couple of months given continued QE tapering talk, accentuated by heightened political risk in some countries (Turkey & Egypt). But they should see some money flowing back in by the fourth quarter.

Understand that all predictions are fraught with danger and the ones above are no exception. What I call a tentative roadmap, others may just see as wishful thinking. Either way, it’s meant to be the starting point for a discussion. Please feel free to agree or disagree with any or all of it.