By Jeff Wilson

Traders’ forecasts for U.S. corn stockpiles are missing official estimates by an amount equal to China’s annual imports, driving swings in futures markets to exchange-imposed limits.

The average gap in the past 12 quarters was 5.28 million metric tons, twice the error rate in the previous five years, data compiled by Bloomberg show. The U.S. Department of Agriculture updates its estimates tomorrow.

Reserves are getting tougher to predict because of an expansion of storage capacity on farms that isn’t tracked by government inspectors and increased use of alternatives to corn in animal feed. The widening gaps spurred the USDA in September to commission a one-year review of its methodology. Limits on price moves set by the Chicago Board of Trade were reached after nine of 12 reports since March 2010, with an average swing of 5.6%, data compiled by Bloomberg show.

“USDA, traders and consumers are all frustrated by the volatility of the numbers,” said Diana Klemme, a director at Grain Service Corp., an industry consultant in Atlanta, Georgia. “Everyone is going to fasten their seat belts and react to the numbers. I don’t think anyone feels confident.”

Inventories were 2.862 billion bushels (72.7 million tons) on June 1, the smallest for the date since 1997, according to the average of 30 analyst estimates compiled by Bloomberg. The USDA’s last estimate for March 1 was 8.1% above expectations and drove a drop in prices that erased $4.9 billion from the value of stockpiles in two days.

Output Rebounds

Futures for delivery in December, after the harvest, fell 4.5% to $5.4175 a bushel this month. The USDA is forecasting a record crop as output rebounds from last year’s drought, the worst since the 1930s. Goldman Sachs Group Inc. expects corn to drop as low as $4.25 this year while Deutsche Bank AG is forecasting $4.30.

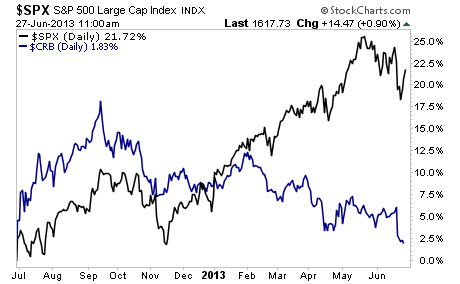

The Standard & Poor’s GSCI Agriculture Index of eight commodities fell 7.8% this month, and the MSCI All- Country World Index of equities dropped 3.5%. Treasuries lost 1.6%, a Bank of America Corp. index shows. Declining crop prices are helping to keep a check on global food costs, which the United Nations estimates rose 2% this year.

U.S. farmers earned more than $112 billion in each of the past two years, with a record $128.2 billion expected in 2013. That compares with $67.7 billion on average in the previous decade, government data show. Some of the cash was used to expand storage, with on-farm capacity of 12.98 billion bushels by Dec. 1, the most since at least 1989, the USDA estimates. The 12% expansion since 2006 compares with a 17% advance in commercial storage to 10.25 billion bushels.

Actual Inventory

On-farm storage gives producers more options for when they sell crops. About 61% of corn is marketed in the first six months of the season that starts Sept. 1, with about 19% sold in each of the next three-month periods, nine years of government data show.

“Farmers are holding more supplies than usual this year, making it more difficult to determine the actual inventory,” said Jason Marthaler, the senior corn merchandiser for CHS Inc., the biggest U.S. cooperative, in Inver Grove Heights, Minnesota. “It’s going to stay volatile until we get to the harvest.”

With reduced supply from 2012, higher-than-average income and planting for this year’s crop delayed by rain, farmers have been reluctant sellers, said Chad Henderson, the president of Prime Agricultural Consultants Inc. in Brookfield, Wisconsin.

Growing State

Corn futures for delivery in July, reflecting grain from 2012, rose 9.1% to $6.6525 since reaching a 10-month low of $6.10 on April 24. Cash prices in parts of Iowa, the biggest growing state, averaged the highest ever this year, according to Roger Fray, the executive vice president for the farmer-owned West Central Cooperative based in Ralston, Iowa.

Tightening supplies before the 2013 harvest are boosting the cost of feed, the single biggest use of corn, Joe F. Sanderson Jr., the founder of Laurel, Mississippi-based Sanderson Farms Inc., the third-largest U.S. poultry producer, told analysts on a conference call June 4.

Inventory-forecasting errors occur mostly because of a lack of information on feed, which the USDA doesn’t track directly. Analysts surveyed by Bloomberg said they estimate stockpiles based on USDA production and export data, as well as the Department of Energy’s estimates of ethanol output. They also take into account seasonal demand patterns for starch and other corn-based food products.

Compound Feed

Prices rose to a record in $8.49 in August, forcing buyers to seek alternatives or shut operations. Hog producers have been able to cut corn use in some cases by 18% by substituting wheat, rice and other food byproducts, said Mark Tarter, the general manager of Effingham Equity Cooperative in Effingham, Illinois, which makes more than 200,000 tons of feed a year. It takes 670 pounds of compound feed, a mix of protein, starch and nutrients, to raise a hog to slaughter weight.

“Livestock feeders have most of their corn needs covered into the start of the harvest,” Tarter said. “We’ve been a net seller of corn during the last three months because of the increased substitution of other grains in livestock rations.”

The USDA’s March report had a margin of error for on-farm corn storage of 4.8%, 5% for soybeans and 5.4% for wheat. Three years earlier, it was 3% for corn, 4.6% for soybeans and 4.2% for wheat.

The government also releases its second survey-based forecast for corn planting tomorrow, after the wettest March-to- May period on record threatened to reduce acreage and yields from North Dakota to Missouri.

Fewer Acres

Corn probably was sown on 95.431 million acres, or 1.9% less than the record 97.282 million farmers intended in March, a Bloomberg survey showed. Some are leaving fields fallow, electing instead to make claims on federally subsidized crop insurance policies, said Bill Gary, the president of Commodity Information Systems in Oklahoma City, Oklahoma, a company providing analysis and information to traders.

About 65% of the crop was in good or excellent condition on June 23, from 64% the previous week and 56% a year ago, the USDA said. Yields may average 156 bushels an acre this year, the third-highest on record and boosting production to a record 13.62 billion bushels from 10.78 billion last year, Gary said.

“The transition from extremely tight supplies during the summer to a more adequate supply into September and October should keep futures in a nervous, erratic state,” he said. “Barring extreme weather in late July, December corn futures are expected to work lower toward the $4 area into harvest.”

See the original article >>

Wolf Richter

Wolf Richter