By Lorraine Woellert and Jeanna Smialek

Consumers and companies are starting to act as if the economic expansion is here to stay.

Purchases of new homes jumped in May to a five-year high, while business investment plans improved for a third straight month, figures from the Commerce Department showed today in Washington. The last time households were this confident was in January 2008, according to another report.

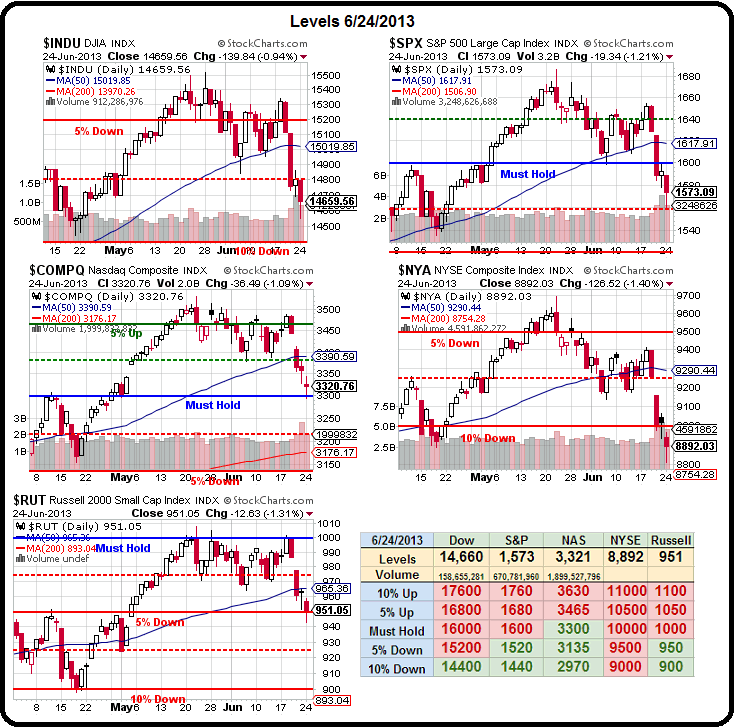

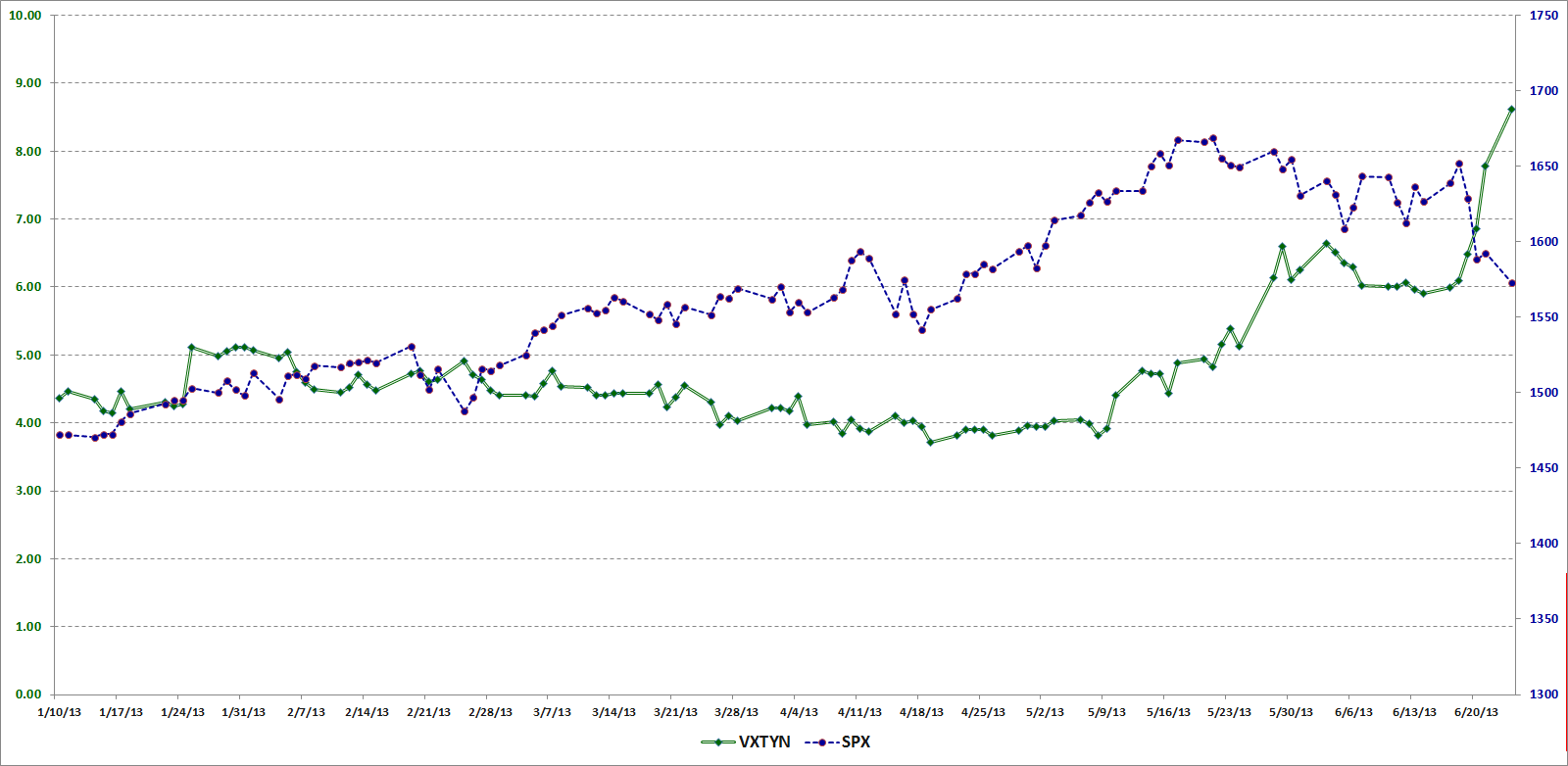

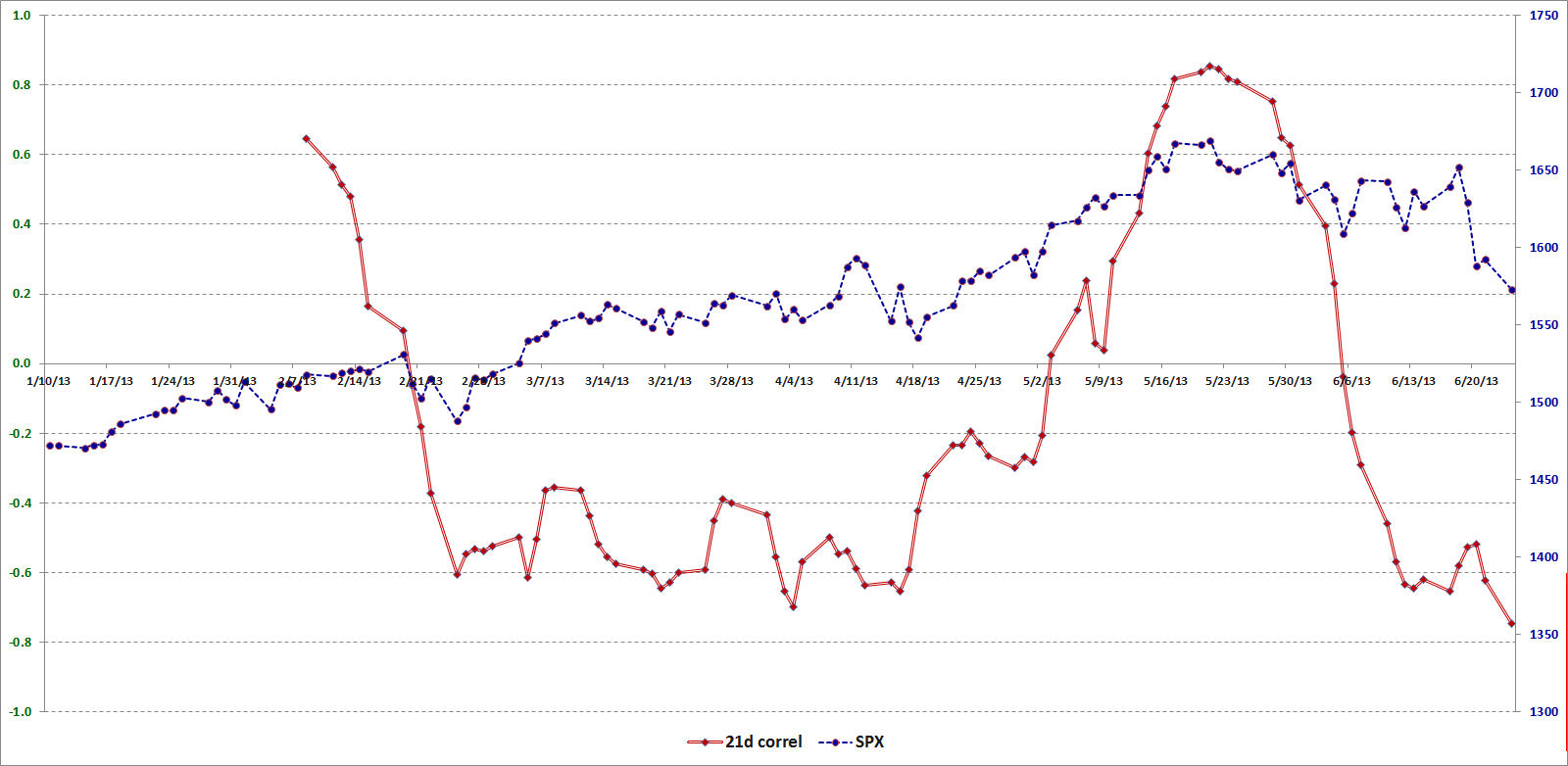

The data point to the self-sustaining expansion the Federal Reserve is seeking to nurture as rising property values boost household wealth and spending, while businesses invest in new equipment to meet growing demand. Stocks climbed, with the Standard & Poor’s 500 index rebounding from a nine-week low, as the figures supported forecasts the economy will overcome a mid- year slump and accelerate in the second half of 2013.

“It’s all good news,” said Mark Zandi, chief economist at Moody’s Analytics in West Chester, Pennsylvania. “The economy is going to gain traction.”

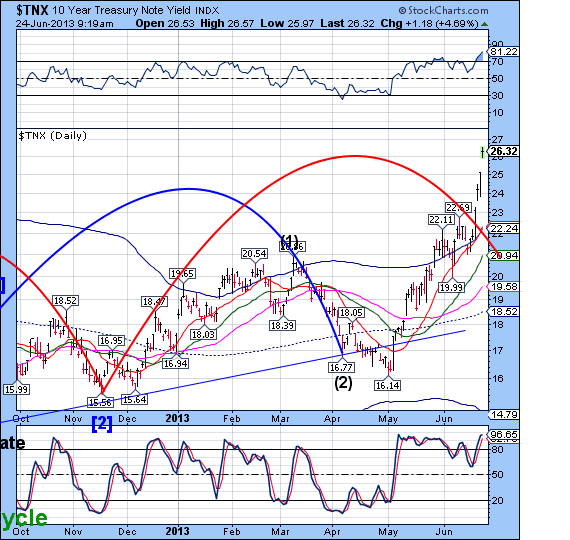

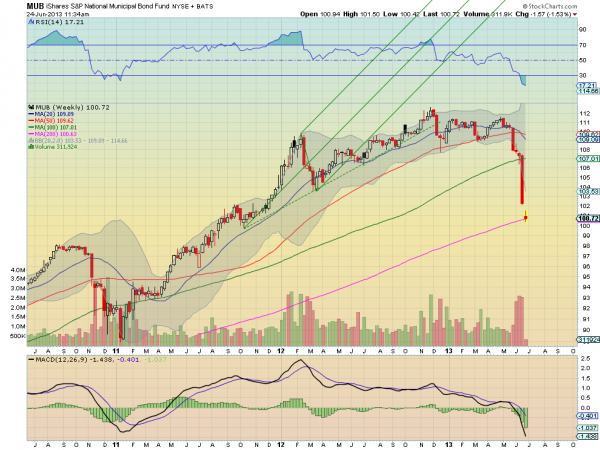

The S&P 500 climbed 0.9% at 1,587.61 at 1:07 p.m. in New York. Treasuries fell, pushing the yield on the benchmark 10-year note up to 2.60% from 2.54% late yesterday, as the data boosted the case for the Fed to slow bond purchases later this year.

Builders sold 476,000 new properties at an annualized rate last month, a 2.1% gain from April, exceeding all estimates in a Bloomberg survey and the most since July 2008, the Commerce Department figures showed. The median selling price climbed to $263,900, up 10.3% from May 2012.

Builder Earnings

Lennar Corp. is among builders seeing increased sales, orders and higher average purchase prices. The third-largest U.S. homebuilder by revenue today reported second-quarter earnings that beat analysts’ estimates.

Miami-based Lennar delivered 4,464 houses, compared with 3,222 homes a year earlier, while the average sales price increased to $283,000 from $250,000. Orders rose 27%.

“Against the backdrop of recent investor concerns over mortgage rate increases, we believe that our second-quarter results together with real-time feedback from our field associates continue to point towards a solid housing recovery,” Chief Executive Officer Stuart Miller said in the statement.

Values of existing properties are also picking up. Home prices in 20 U.S. cities rose 12.1% in April from the same month in 2012, the biggest year-over-year gain since March 2006, a report from S&P/Case-Shiller showed. The 1.7% increase in April from the prior month followed a 1.9% March advance, marking the biggest back-to-back gains since records began in 2000.

Housing Outlook

The demand for housing is driving residential construction and aiding the economic expansion. Consumers who long held off on purchases are entering the market even as borrowing costs rise, encouraged by the increases in property values and gains in employment.

“The housing recovery is alive and well and has a long way to go, and higher rates aren’t going to choke it off,” said Joe LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, who projected a gain to 475,000, matching the highest in the Bloomberg survey. “It’s given the economy, or will give the economy, a lot of oomph.”

Americans are gaining confidence as their biggest asset, a house, becomes more valuable. The New York-based Conference Board’s consumer sentiment index increased to 81.4 in June from 74.3 a month earlier, data from the private research group showed.

Other Measures

Today’s figures are in line with the Bloomberg Consumer Comfort Index, which has been hovering around a five-year high reached in late April. American households last week were the least pessimistic about the current state of the economy in more than five years, the Bloomberg index showed.

Spirits are lifting as employment picks up. The Conference Board’s survey showed more consumers thought opportunities will open up in the next six months and an increasing share said jobs were plentiful right now.

Houses aren’t the only thing consumers are more willing to buy as prospects improve. Cars and light trucks sold at a 15.2 million annualized rate in May, putting 2013 on course to be the best year for automakers since 2007, according to industry figures.

The gains in spending, which account for 70% of the economy, are helping to bolster the expansion after government budget cuts took effect in March.

“Unambiguously, the economy is showing signs of improvement despite sizable fiscal drag,” said Jim O’Sullivan, chief U.S. economist at High Frequency Economics in Valhalla, New York. Among the positives “has been the improving labor market, but in addition, wealth in general has been rising, at least up until the last week.”

Early Cutoff

The Conference Board said the cutoff day for responses to be included in the report was June 13. Since then equities have declined, with the S&P 500 dropping 2.5% on June 20, the biggest one-day selloff since November 2011.

Growing demand for cars and trucks and gains in homebuilding are helping counter weakness in export markets, benefiting manufacturers such as BorgWarner Inc. and United Technologies Corp. Businesses may also decide to replace aging equipment, which will help bolster expansion in the second half of 2013.

Orders for durable goods, those meant to last at least three years, climbed a larger-than-projected 3.6% for a second month reflecting broad-based gains, according to figures from the Commerce Department.

Business Investment

Orders for non-defense capital goods excluding aircraft, a proxy for future business investment in computers, electronics and other equipment, climbed 1.1% in May after rising 1.2% and 1.1% in each of the prior two months.

Shipments of those products, a measure used in calculating gross domestic product, rose 1.7%, the biggest gain since November.

“This is the missing piece for an upswing in economic activity,” said Millan Mulraine, director of U.S. rates research at TD Securities USA LLC in New York. “Business capital investment activity is off to a strong showing. If businesses start investing, they’ll add to their workforce.”

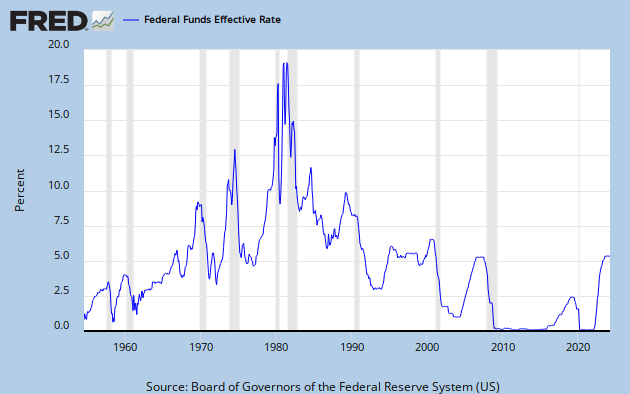

Fed Chairman Ben S. Bernanke said last week that the central bank may begin to pare its $85 billion in monthly asset purchases this year if the economy performs as policy makers forecast. The process could be completed by mid-2014, by which time the jobless rate will probably have dropped to around 7%, he said.