by Greg Harmon

Utilities were the first sector to pullback, starting May 1st. And they are nearing levels that present buying opportunities. The Utilities Select Sector SPDR, $XLU, has been in a rising channel since bottoming in 2009 with the market. But the chart below shows that they are now as a group less than 4% from the rising support at the bottom of that channel after

touching the top. Focusing on the last part of the move, since the November lows, they are hitting a 50% retracement of the upward advance Thursday. They could continue lower but if you now move away from the ETF and look at some individual names they yields are getting very attractive. Here are 4 that are worth preparing to enter.

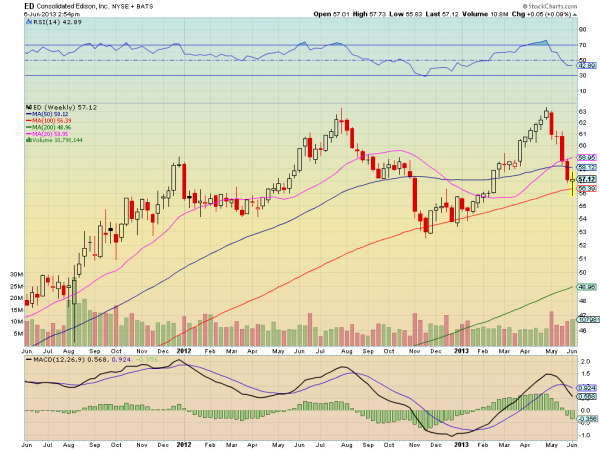

Consolidated Edison, $ED

After pulling back forma double top at 63, Consolidated Edison, $ED, is printing a Hammer, possible reversal candle, on the weekly chart right at the rising 100 week Simple Moving Average (SMA). The Relative Strength Index (RSI), has stopped falling and remains in bullish territory too and the dividend yield is now up to 4.3%.

First Energy, $FE

First Energy, $FE, has pulled back to support at 38.25 where the 200 week SMA is holding. It also shows the RSI turning to flat after the fall. This name has a dividend yield now of 5.6% and I socked a little away in the family accounts today.

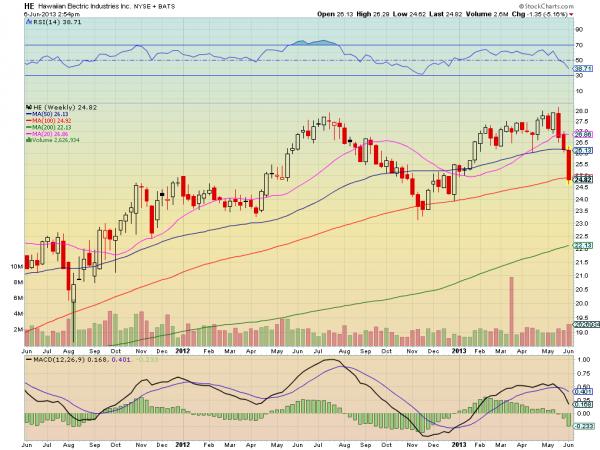

Hawaiian Electric, $HE

Hawaiian Electric, $HE is testing support at the 100 week SMA, a spot where it has reversed in the past. The dividend yield is up to 4.7% in this name, and hey , who does not want to have some connection to Hawaii?

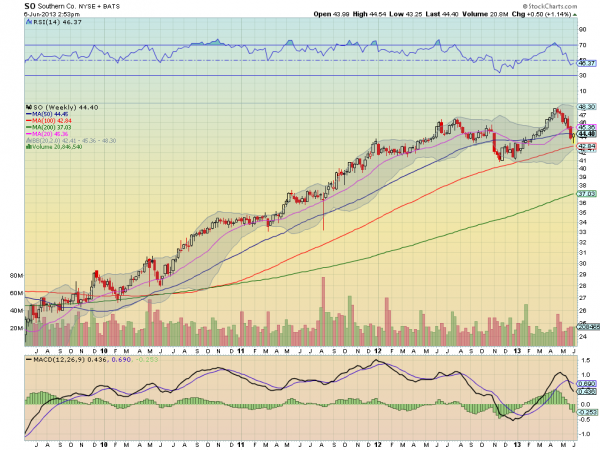

Southern Company, $SO

Southern Company, $SO, is printing a Hammer for the week with a RSI that is rising back up. The stock is finding support at the 50 week SMA and has a dividend yield of 4.6%.

There are many more to consider and I do not advocate buying stocks that are falling. These are weekly charts and if you were to look at the daily charts all have had the RSI below the technically oversold level at 30 with ConEd and Southern Company moving back over it today as potential catalyst for an entry. But it is time to put utilities back on your radar for that turn.

No comments:

Post a Comment