by Greg Harmon

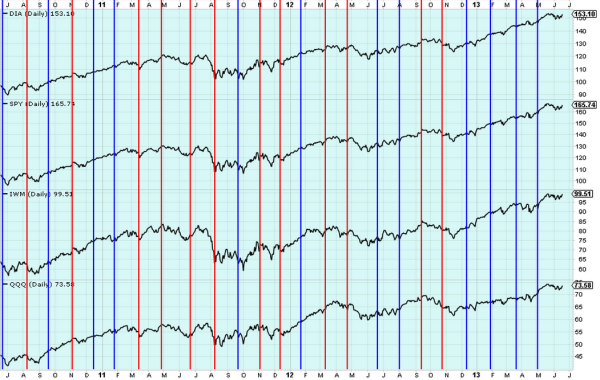

I have no idea what Bernanke might say. Maybe as a lame duck he takes of off the niceties and tells America he is out of ideas and we are screwed if Congress continues to do nothing. Probably not. Maybe he convinces the FOMC that they should continue QE at the current pace until he retires so he can go out on a long high note. There are many people that watch what the Fed does and says as a full time job. They have volumes to say about what the message might be and how to interpret it. I care only how the market interprets the message and have done a little digging. The chart below may seem a little crowded but you can embiggen it. The ETF’s of the 4 major averages, The Dow ($DIA), S&P 500 ($SPY), Russell 2000 ($IWM) and Nasdaq 100 ($QQQ) are stacked on top off each other. The vertical lines are placed at the

dates of the FOMC meetings over the last 3 years. As a technician I am interested how the statement may or may not impact these indexes. The red lines are when the FOMC meeting changes the course of the market. Not the major trend but the intermediate trend. You can see that it happens often. In fact it has not gone more that 3 meetings without an intermediate change, until this current streak of 4 meetings. with the markets running flat into the meeting it gets more exciting as the change, if it comes could be either way. How are you prepping for the the announcement?

No comments:

Post a Comment