by Charles Hugh Smith

Whatever painlessly masks the dysfunction and corruption of the Status Quo will be the policy of choice.

Here's the challenge the Status Quo monetary and fiscal authorities faced in the 2008 global financial meltdown: how do we maintain the power structure and keep the masses passive while masking the fact that the Status Quo is broken?

The solution: sell bonds to fund benefits to the masses, lower interest rates to zero to keep the explosive rise in fiscal deficits affordable, and rapidly inflate new bubbles in assets that painlessly enrich the top 25% of households who then increase their borrowing and spending, i.e. the "wealth effect."

Lowering interest rates to zero is a two-fer, as it not only enables the central state to borrow vast sums by selling low-yield bonds, it also drives everyone with financial assets into a desperate search for higher yields in risk assets such as stocks and housing. This herding of capital into risk assets helps inflate the bubbles needed to generate "growth."

Here's the beauty of asset bubbles. How do you get trillions of dollars into households without having to borrow the money? You inflate the assets owned by the households: stocks and houses. This magically creates money out of nothing, money that the households can borrow against or sell for cash.

Why not create and distribute cash directly? Two reasons: 1) spreading around trillions of dollars in cash could eventually spark inflation, which would kill the entire project by pushing bond yields higher, and 2) politically, the only cohort the authorities care about are the wealthy who fund the political Elite and the half of the adult populace who votes.

The political calculus is simple: the bottom half of households don't vote, don't contribute to political campaigns and don't have enough income to borrow huge sums of money to enrich the banks. They are thus non-entities in the fiscal-monetary project of maintaining the power structure of the Status Quo.

All the Status Quo needs to do is borrow enough money to fund social programs that keep the masses passive and silent: food stamps, Section 8 housing vouchers, Medicaid, Medicare, Social Security, SSI permanent disability, unemployment, etc.

Unfortunately for the Powers That Be, the cost of placating the rapidly increasing marginalized populace is rising much faster than tax revenues. Here are two charts of interest (source: Kleiner Perkins Caufield Byers 2013 Internet Trends)

The happy story of 2013 is that tax revenues are rising fast while government spending has stopped rising. This is risible, as the same agencies drawing these projections have never forecast a recession or downturn. Taxes rise in bubbles, so no wonder tax revenues are up--and of course, tax rates increased on the margins.

Longer term, Federal expenditures will inexorably rise as the social programs for the elderly absorb 10,000 retiring Baby Boomers a day.

Here's the problem with bubbles: they pop, despite the best efforts of the fiscal and monetary authorities to keep them inflating forever. And when bubbles pop, assets decline in value. Borrowing, spending and tax revenues all decline.

Near-zero interest rates have problems, too: One, they stripmine pension funds and savers seeking save yields on cash, forcing everyone into risk asset bubbles, where those seeking higher yields are crushed when the bubbles pop, and two, nothing stays low or high forever. Piling up debt at near-zero rates is affordable fun, but when rates rise, the costs of servicing the debt pile skyrocket.

At that point, a feedback loop is set in motion that will bring down the entire system: investors will see fiscal authorities struggling to fund their social programs and pay rapidly rising interest on the vast mountain of government debt, and start wondering if the government will be able to meet its rapidly rising commitments with stagnant tax revenues.

The prudent investor, money manager and pension fund manager will demand a higher risk premium to reflect the possibility that the bond will be repaid with depreciated currency.

That will drive up the interest rate on all future borrowing, which will further stress government obligations which will increase the risk of default or depreciation of the currency, and so on.

The only way to stop this feedback from starting is for the central bank to buy essentially all the bonds sold by the government. This is the path that Japan and the U.S. have taken; both the Bank of Japan and the Federal Reserve are buying government bonds, essentially removing them from the tidal forces of the market with instantly created money.

Are there any limits on the balance sheets of the central banks? Why not transfer $100 trillion to the balance sheet of the Fed? Indeed, this path appears absolutely painless to all involved, and that's why Japan and the U.S. have pursued this strategy with such gusto.

Whatever painlessly masks the dysfunction and corruption of the Status Quo will be the policy of choice. And right now, that policy is transferring government bonds to the central banks so the fiscal authorities can continue to borrow and blow trillions of dollars rather than restructure their broken financial systems and economies.

The problem with neutering the market to mask systemic dysfunction is that the return on the policy diminishes at the same time that risk is transferred to the entire system. Risk cannot be disappeared, it can only be transferred or hedged. Burying immense debts in the balance sheets of central banks doesn't make risks disappear, it simply transfers the risk to the entire system.

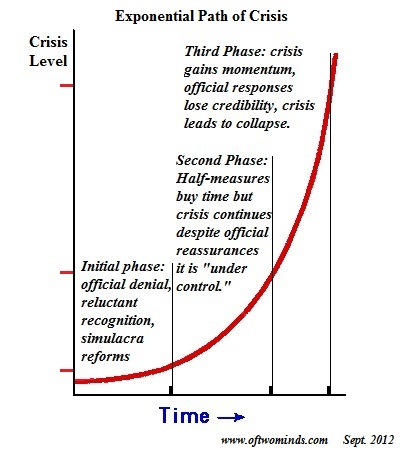

And when you do that, you get a chart like this:

Anyone who is paying attention to the peculiar gyrations and dislocations in the Japanese bond and currency markets has to wonder if Japan has finally succeeded in entering Phase III, when official credibility and the illusion of central control both crumble.

The beauty of bonds and bubbles is fleeting. The fiscal and monetary authorities are claiming the beauty of bonds and bubbles is ageless, thanks to their magic; but no amount of false data and trickery can possibly eliminate the systemic risk piling up behind the rickety facade of illusory control.

No comments:

Post a Comment