Don’t look now, bond investors, but there may be a bit of a sea change happening in how bonds react to falling stock prices (or perhaps, more correctly – how stocks react to falling bond prices). Most investors have been taught that bonds are conservative, and that you want bonds in your portfolio as a diversifier which should provide a hedge to your stock holdings in a down market.

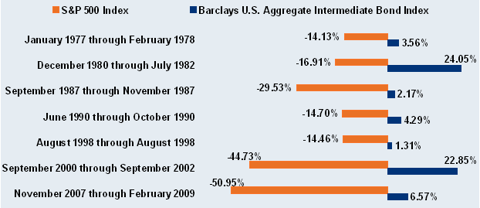

This has generally held true over the years, as can be seen in the following chart via Charles Schwab via SeekingAlpha:

(Disclaimer: past performance is not necessarily indicative of future results.)

But the last 5 weeks has seen a dramatic difference in this long held market axiom that bonds should go up when stocks go down, with the S&P 500 and US 10 Yr Note futures down an almost identical -4.2% and -4.3% month to date in June. What’s more, the big down days (last Wed, Thurs., Fri) all saw bonds down big as well.

Chart Courtesy: Finviz.com

(Disclaimer: past performance is not necessarily indicative of future results.)

How rare is this in the current environment? Well, the current 5 day rolling correlation of .974 is the highest when looking at moves over 1% up or down since July of 2011, and significantly higher than the average 5 day rolling correlation of -0.63 over the past 2 years (and -0.62 during the past 12 months). We plotted the rolling 5 day rolling correlation between the cash prices of the S&P 500 and 30 Year US Govt. Bonds over the past 2.5 years to get a better look:

(Disclaimer: past performance is not necessarily indicative of future results.)

You can see the spike up in correlation, but the question is what happens to the world (and to a lesser extent managed futures performance) if this chart flips and the average correlation between stocks and bonds is more like positive 0.5 over the next 2.5 years. That would surely cause some havoc in the portfolios of investors who rely on bonds for diversification and expect them to be a flight to safety in times of a market crisis. The thing is – if the rise in interest rates causes the market crisis – then what?

That’s exactly what the Boston Globe warned their readers of a couple months ago.

“That may mean troubling times ahead for investors who have come to rely on bonds as a reliable place to hide from the risks of the stock market. If bond portfolios get hit hard, that could mark a third major setback for investors since 2001, following two dramatic stock market plunges. A serious bond market decline would not take place all at once, like a bad session in the stock market. But bond investors could face a slow, steady bleed for years, with annual losses of about 1 to 2 percent.”

How managed futures perform in a rising interest rate environment is yet to be seen, but we like our chances being able to go short interest rate futures (rates up), even though there are likely to be headwinds in terms of negative roll yield (we’ll have more on that in an upcoming newsletter…stay tuned)

No comments:

Post a Comment