By tothetick

The late 20th century was a jam-packed time for stock-market crashes that would change, shape and alter our lives in so many ways. We had gone through the post-war period and there was heightened wealth in western economies. People were asking for greater recognition and wealth was being distributed and redistributed in the construction of a new world that was supposed to be better and safer. Groups that had until then been largely left unrecognized were now asking to partake in that wealthy society that was being constructed. Women gained even more rights, kids where no longer treated like babies, minority groups were given greater equality.

Consumerism had been born and it changed our outlook on the world. The world had been through great recessions and had suffered enormous losses due to World War II. The United Nations had been set up in 1945 leading to greater cooperation between countries. We would turn into capitalist countries, in true proof of the ‘Golden-Arches Theory’ (i.e. countries that have McDonald’s restaurants), referring to the theory developed by Thomas L. Friedman in 1999, stating that those countries are more likely to avoid war with each other and do business to maintain their wealth. Countries that are rich enough to have developed a middle class (meaning greater wealth distribution, in general) are less likely to put that in danger by going to war with another country that is also a ‘McDonald’s country’. But, it doesn’t stop them waging war on these countries, with whom they won’t necessarily trade, anyhow.

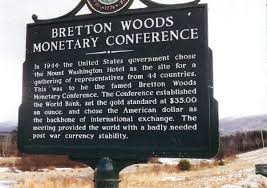

Bretton Woods

The Bretton Woods system had been established fixing rules and regulations among the world’s industrial and economic actors with regard to commercial and financial exchange. It meant the setting up of the International Monetary Fund and also the International Bank for Reconstruction and Development. Money was tied to the US Dollar, by monetary policies that maintained exchange rates between those currencies. It was the period of postwar expansion and economic boom, the Golden Age of Capitalism, lasting around thirty years. The thirty glorious years of the post-war world of capitalism, which came to an end in the 1970s with the oil crises and the Bretton Woods system collapsing.

The 1970s saw the onset of economically-troubled times and the consequences of all of the decisions that had been taken before.

The world became computerized, virtual, distant and yet local at the same time. We were no longer held back and could go anywhere and do anything (or at least we believed that we could). We could even go to the Moon and back. But, our interconnectedness, the fact that we had made the world a smaller place meant that we were to all intents and purposes living in each other’s’ pockets. The age of cascading failure had also been born. We were such a system of interconnectedness that failure in one place triggered failure in successive places, and there was no way of getting out of that. The end of the Golden Age of Capitalism was marked by a succession of stock-market crashes that rocked the world.

Here are a few of them.

1. 1973 Crash

Between January 1973 and December 1974, 699 long days when the Dow Jones Industrial Average plummeted and lost 45.1% of its value. The FT 30 lost 73% of its value on the London Stock Exchange. The 1973 crash is the 7th worst crash in history. It began on 11th January 1973 and ended on December 6th 1974 to be precise.

DJIA 1973 Crash

What caused it? The collapse of the Bretton Woods system, coupled with the devaluation of the Dollar and the oil crisis of 1973. Nobody expected the bubble to burst like it did. The DJIA had made gains of up to 15% in the previous 12-month period. It was also the Nixon shock that played a major part in the collapse of the economies around the world at this time. President Richard Nixon decided to unilaterally stop the direct convertibility of the US Dollar into gold. Thanks to Nixon we have free-floating currencies today.

- Bretton Woods had meant that the Dollar had to be backed by gold (at $35 an ounce) overseas, with all currencies being pegged to the US Dollar. While the US fared well during the post-war period, it suffered from the recovery in particular of Japan and Germany, seeing its economic output fall from 35% to 27% in the world.

- The US-gold stock had also fallen due increased spending at home, the Vietnam War and inflation.

- Thus the money supply had increased (10%) and the USA found itself in the position where it was unable to back the amount of currency in circulation with gold.

- West Germany decided to leave Bretton Woods in May 1971 and countries started asking for gold, redeeming the Dollar.

- The Dollar fell by 7.5% against the Deutsche Mark. Nixon decided to suspend the convertibility of the Dollar into gold and the fixed exchange rate was transformed into a floating one.

Recovery for the countries around the world was slow and arduous after the 1973-1974 crash. The UK never returned to the level prior to the 1973 crash until 1987, just in time for another crash to occur just a few months later. In real terms, the USA only returned to the same level in 1993!

2. 1987 Black Monday

Black Monday 1987 Crash

Monday October 19th 1987 will go down in history. Mondays are bad days. October 28th 1929 bringing about the Great depression and Monday 17th September 2001 stand to testify to that. Why Mondays? Probably because people have the weekend to think over what’s happening, worrying, waiting for the markets to open on Monday morning. They then rush and sell on mass, hoping to cut their losses. Maybe we should work seven days out of seven and cut the thinking time.

- The crash originated in Hong Kong. It moved on to Europe and then lastly the USA.

- Within two weeks Hong Kong’s stock market had dropped by 45.5%.

- The UK had lost 26.45% and the USA suffered a loss of 22.68% (losing 508 points, down to 1738.74).

- It took two years nearly for the DJIA to get back to the same levels prior to the crash.

Program trading has been cited as the major cause of the 1987 crash, although analysts do still dispute this. Program trading is a sample of stocks that are traded according to the evaluation of the market via predetermined conditions. It enables the trading of large quantities of stocks at the same time. In 2012, program trading made up for about 30% of all volume of shares being traded on the New York Stock Exchange. Technological advances were relatively new in 1987 regarding the world of IT. Perhaps today (at least we might hope) the software programs are more sophisticated and reduce the margin of error. There is no need for human intervention and thus large quantities can be bought and sold at the click of a button.

3. 1989 Friday 13th

Friday 13th 1989 Crash

Friday 13th is unlucky for some! This crash was only a mini one in comparison with all of the others that we experienced in the late 20th century. It occurred on Friday October 13th 1989. It seems to have been the result of the failure in the leveraged buyout of UAL Corporation (the parent company of United Airline), worth $6.75 billion. The deal didn’t come off and it resulted in the collapse of the junk bond market.

- The Dow Jones Industrial Average plummeted 190.58 points (6.91%) to 2, 569.26 in just a few hours after the announcement of the deal failing.

- The S&P 500 fell 6.12% to 333.65 (-21.74 points).

- The NASDAQ lost 3.09% (down 14.90 points to 467.3).

4. 1997 Asian Financial Crisis

Asian Financial Crisis

The Asian financial crisis began in July 1997 in Thailand and was triggered by the collapse of the Thai Baht. The government of Thailand did not have enough foreign currency to back its fixed-xchange rate and it was forced to float the Thai Baht, removing its peg to the US Dollar. Thailand was already greatly in debt. It was crippled by foreign debts that had led to the bankruptcy of the country prior to this also. It rapidly spread to Indonesia and South Korea. Then, it hit Hong Kong and Malaysia and the Philippines, dragging them all into a slump.

- The International Monetary Fund intervened in an attempt to halt the economies spiraling out of control and provided $40 billion to stabilize South Korea, Thailand and Indonesia with regard to their currencies.

- Debt-to-GDP ratios for the Association of Southeast Asian Nations (ASEAN) increased by a staggering 180% at the worst moments of the crisis.

- The USA suffered momentary losses, but not to the extent of Asian countries. The DJIA plunged 7.2% in October 1997 as a result. However, the NYSE suspended trading, worried that there was going to be a bigger ripple coming.

- Japan suffered enormously since Asia represented about 40% of their market. GDP real growth for Japan fell from 5% to 1.6% and Japan entered into recession in 1998.

5. 2000 Dot-Com Bubble

dot com bubble burst

The dot-com speculative bubble lasted from 1997 until 2000. March 10th 2000 was the peak with the NASDAQ closing at 5, 048.62 (which was double its value in comparison with the year before). As a comparison, the NASDAQ stands at 2, 891.5 today. The 90s was the decade of the beginning of internet and it saw the launch of internet-based companies (that largely and spectacularly failed). The first web browser was launched in 1993. Whether or not the company was actually internet-based or not, it was sufficient at the time just to let others believe that you were, by adding e- in front of the company name.

- The public was advised by economists and reputable newspapers such as the Wall Street Journal to invest and hit the jackpot, believing that the bubble would not burst.

- But, in 1999, the economy began to slow down. It was announced by analysts that hundreds of internet start-ups would go bankrupt in the coming year. Panic ensued.

- At the time internet-based companies represented 8% of the US stock market, to the value of $1.3 trillion.

- The majority of the 371 publically-traded companies failed that year or they were bought out by some stronger competitors only to be closed down later on.

- They had not managed to turn a profit as they had spent vast sums getting their name known and increasing their customer bases. They collapsed having eaten up their venture capital.

- Boo.com for example spent the sum of $188 million in half a year creating an online fashion company. It closed in May 2000.

Conclusions

People always say that history repeats itself. With our analysis-technology software, with our data and empirical evidence, it is hard to believe that we might have believed for one moment that the stocks that were bought and sold in the latter part of the 20th century would continue to rise without end. With hindsight, it might be easy to look back and see where things went wrong. The hardest thing is to actually avoid the euphoria and the frenzied buying and selling and look at what history has taught us, so that we don’t make the same mistakes again. But we do, time and time again.

No comments:

Post a Comment