By Poly

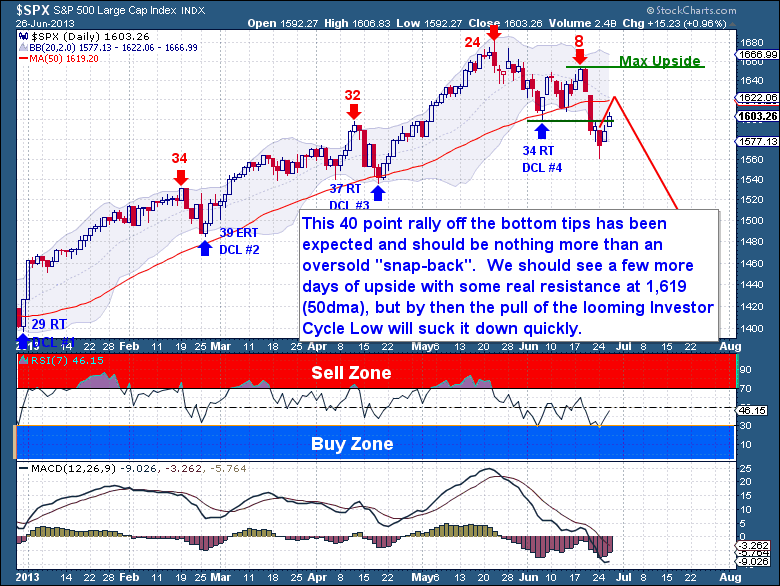

I’m still very comfortable with where the equity Cycle is headed. Nothing about this action has me thinking any different; this 40 point rally off the bottom tips has been expected. As I outlined over the weekend, this should be nothing more than an oversold “snap-back”. Even so, I believe we should still have a few more days of upside with at least a test of the 50dma currently at 1,619. From there we could see a “poke” above the 50dma to excite the bulls, so a rally that gets stopped within the 1,620-33 range would certainly be within my expectations.

It’s at that point that the pull of the looming Investor Cycle Low will suck it down quickly. The first two drops this month were about widening the Bollinger Bands and placing the bulls on notice that the Cycle (sentiment) has turned. It’s the next drop that should come quickly and fall without coming up for air.

As a precaution and so you’re aware that not all frameworks are always perfect, I’ve coded the chart below with the max upside line. From a final Daily Cycle standpoint there is absolutely no reason for the S&P to be closing above that Day 8 high. If it were to close there, then we must be careful as this Monday’s low could end up marking a Cycle Low. Obviously I don’t hold much weight in this occurring, so it remains one of those items we need to just keep an eye on. Trading without understanding both side of the equation is falling victim to bias.

This as is an excerpt from Wednesday’s premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly.

No comments:

Post a Comment