by Greg Harmon

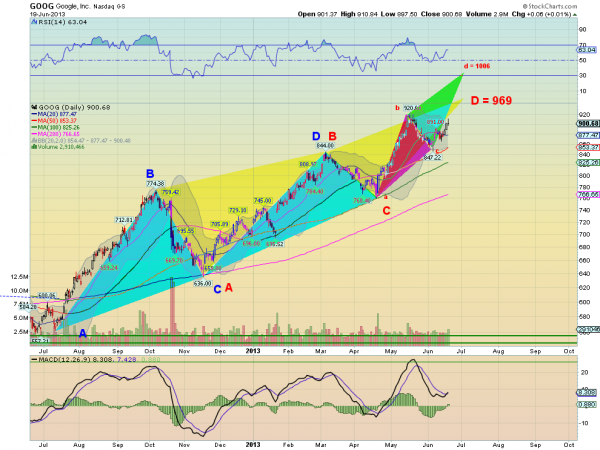

Seems strange doesn’t it? I have been talking about Google, $GOOG, for months. Done a few earnings trades for clients, but not owned it. Until today. I could have started a position on a pullback to the Simple Moving Averages (SMA) after the peaks at 729 or 745 in the chart below, I suppose. It was tough to start a position from the breakout over 760 with the Relative Strength Index (RSI) over 70. That kind of locks you out all the way up to the 844 top. I don’t know what I was doing during the May climb. My son’s First Communion or something. Then there was the peak at 920 and pullback. So what made me pull the trigger today? It starts from that 920 pullback. Stalling this time at 50 day SMA, the RSI held at the mid line before reversing, instead of pulling back all the way to the 30′s. When price started to rise it started from a bullish position. It was the little indicator at the bottom of the chart that flipped the switch for me today. The Moving Average

Convergence Divergence indicator (MACD) stopped falling and crossed to positive today on the histogram as the signal line turned up. Today Price, RSI and MACD became aligned. I bought July/August 930 Call Calendars, looking for a continued move higher but perhaps a stall at 920 to keep it from reaching 930 before the July Expiry in 4 weeks. It is early, but the Open Interest in the July 930 Calls is building and there is also good size beneath it at 900 and 910. Any of those could help create a barrier. But I also have some flexibility. I can buy the July 930′s back if they become cheap or swap them for a higher strike in August to create a Call Spread if they the price rises too fast and I risk being short the stock. I did not post a trade entry so I will not include it in the performance calculation. But I will do follow up posts here. If I forget let me know, I am getting near 50 now and forget some things.

No comments:

Post a Comment