by Greg Harmon

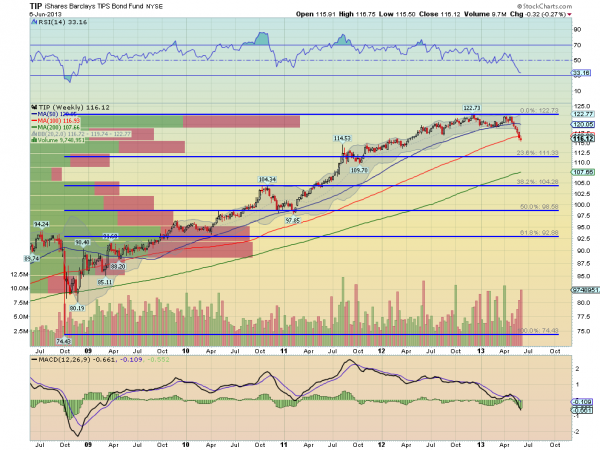

TIP’s or Treasury Inflation Protected Securities, were designed to move higher in price as inflation heats up. In this way they protect against inflation eroding the value of a bond investment. This is the opposite of the impact of inflation on normal bonds, all else equal. These are great in theory, but in times when inflation is falling (i.e. now as noted Wednesday: Remember that Fed Inflation Target…….), TIPS also fall in value. That is no fun. Looking at the chart of the iShares Barclays TIPS Bond Fund, $TIP, shows a massive selloff in these securities over the last month. The chart also shows a series of nested Harmonic Crabs that could be the guide for future movement lower in the potentially deflationary world.

The smaller blue Crab on the right hand side of the chart has a Potential Reversal Zone (PRZ) at 155.50, right where it is currently trading. With the Relative Strength Index (RSI) under 22, this combination would be a good place for a bounce. The rest of the story though suggests a bounce may be short lived. But the story does not look to end there with the red Crab looking for a move lower to 113.46 before reversing and the yellow Crab down to 107.82. The bad news for inflationistas is that each of the red and yellow Crabs can also extend like the blue one did and bring the target lower.

Forgetting the Crabs for a moment, and looking at the weekly the chart, it is resembling a long rounded top. From that perspective it is just getting started and a 38.2% retracement would take it to 104.28 while a 61.8% retracement to 92.88. Is this the TIPS forecasting deflation? Perhaps, although that is not clear. It is clear though that these securities should be avoided at the moment and until inflation appears.

No comments:

Post a Comment