By Sarah Marsh and Paul Taylor

The European Central Bank will intervene decisively on markets to protect Italy and Spain from an accelerating debt crisis, a monetary source said on Sunday, indicating it would buy government bonds of the euro zone's third and fourth biggest economies.

The agreement of the bank's policy-making Governing Council marked a watershed in the ECB's fire-fighting after modest bond buying efforts last week failed to stem contagion to the currency bloc's larger economies.

Officials on an ECB conference call carefully considered the situation in Italy and Spain, and took note of a statement by France and Germany on Sunday stressing their commitment to European financial reforms, the source said.

"The Euro system will intervene very significantly on markets and respond in a significant and cohesive way," the source said, adding the ECB would shortly issue a statement.

The move aims to help keep markets at bay after last Friday's U.S. debt downgrade added to the euro zone's sovereign debt crisis, until the bloc's own rescue fund can take over.

Germany and France earlier said in a statement that the EFSF bailout fund would soon be able to buy government bonds of debt strugglers Italy, Spain, Greece, Portugal and Ireland.

ECB President Jean-Claude Trichet had wanted the policy-setting Governing Council to take a final decision on buying Italian paper after Prime Minister Silvio Berlusconi announced new measures on Friday to speed up deficit reduction and hasten economic reforms, other euro zone sources said.

One said the council would also discuss possible emergency liquidity measures to prevent money markets freezing.

The Eurosystem comprises the ECB and national central banks of the 17 countries that share the euro single currency.

German Chancellor Angela Merkel and French President Nicolas Sarkozy said they were committed to getting approval from their parliaments for new powers for the European Financial Stability Facility rescue fund by the end of September.

That will allow the EFSF to buy government bonds in the secondary market if the ECB thinks it is warranted and if euro zone member states agree, potentially absolving the ECB of the need to do so, a policy that a powerful minority of its council members strongly oppose.

"France and Germany are confident that the ECB analysis will provide the appropriate basis for secondary market interventions as it will help determine the case when financial stability of the euro zone as a whole is at risk," the leaders said.

Their statement reiterated the agreement at last month's emergency euro zone summit which granted a second bailout to Greece, but the focus on the EFSF's ability to buy government bonds once the bloc's parliaments have ratified its new powers was meant to encourage the ECB to do the same in the interim.

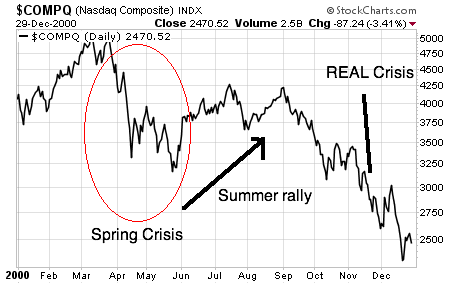

Twin debt crises in Europe and the United States are causing global market turmoil and stoking fears of the rich world sliding back into recession.

Another source said the ECB meeting was put back into the evening to see what measures U.S. authorities were prepared to take to calm markets after credit ratings agency Standard & Poor's downgraded Washington's AAA rating to AA+ on Friday.

"The important part of the picture now is the U.S.," that source said.

G7 TO CONFER

Finance ministers of the Group of Seven major industrialized nations are to hold a teleconference late on Sunday (European time) to discuss a response to the crisis after senior officials conferred by telephone late on Saturday.

The ECB reactivated its controversial sovereign bond-buying programme last Thursday but only bought small quantities of Irish and Portuguese bonds, seeking more front-loaded austerity measures from Italy.

Italian and Spanish 10-year bond yields spiked to 14-year highs when investors saw the central bank was not buying their paper.

Under pressure from EU peers and the central bank, Berlusconi announced late on Friday plans to bring forward balancing the budget by one year to 2013, enshrine a balanced budget rule in the constitution and push through welfare and labor market reforms after talks with trade unions and employers.

Merkel and Sarkozy welcomed the new Italian plan.

"Especially the Italian authorities' goal to achieve a balanced budget a year earlier than previously envisaged is of fundamental importance," they said.

However, details of Italy's austerity drive are thin, leaving many analysts -- and maybe some in the ECB -- skeptical.

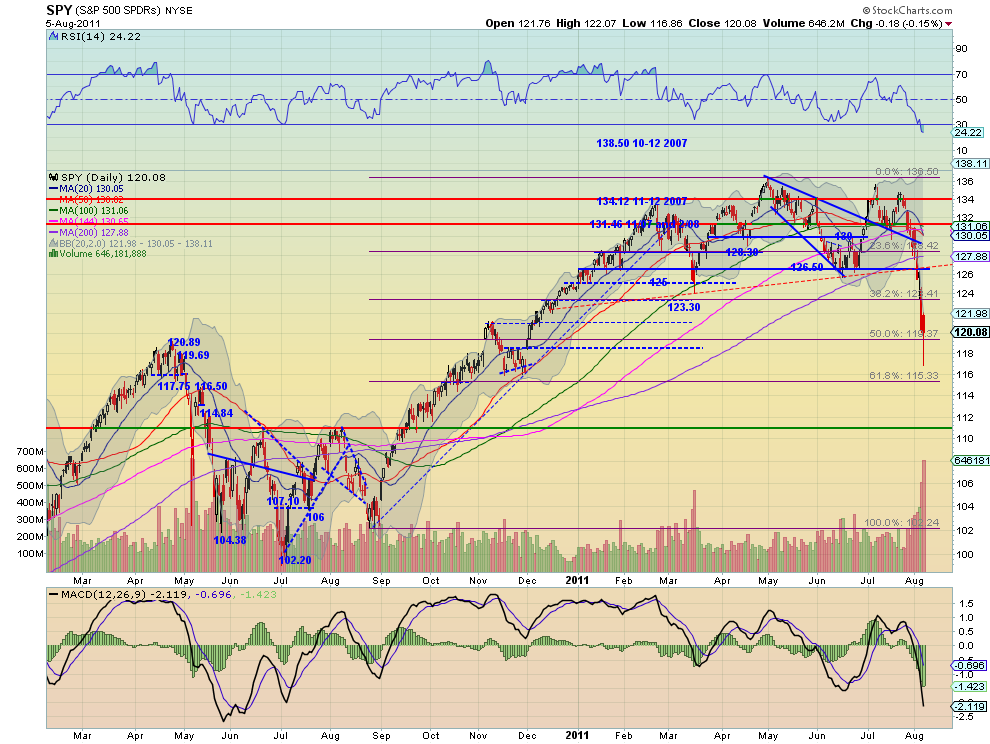

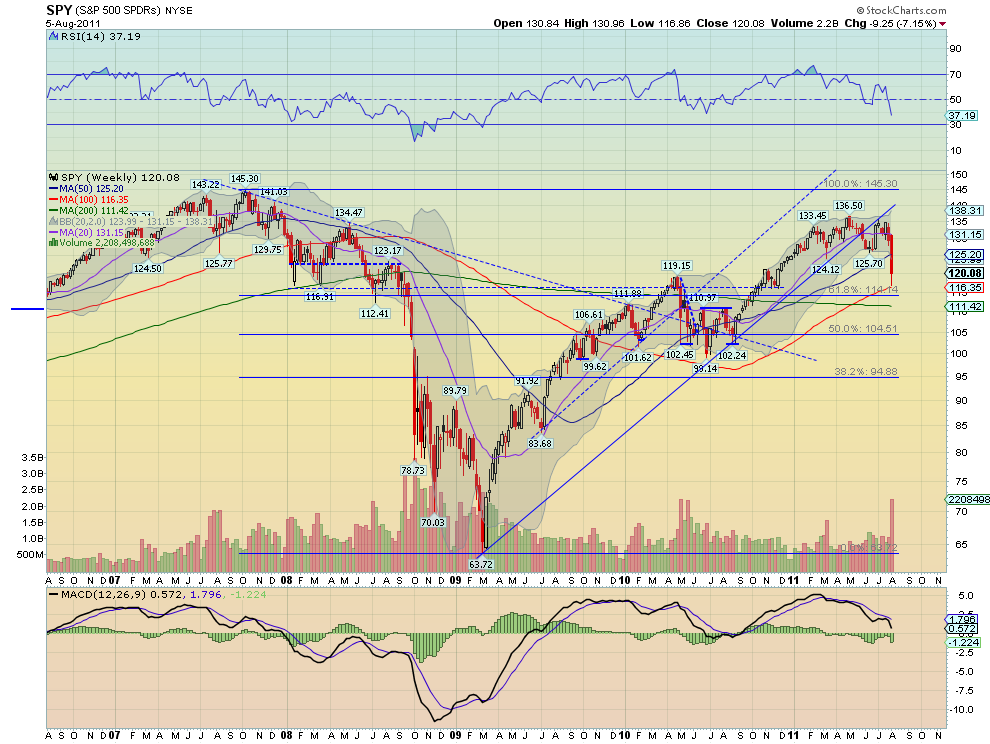

After a week that saw $2.5 trillion wiped off global stock markets, political leaders are under pressure to reassure investors that Western governments have both the will and ability to reduce their huge and growing public debt loads.

That had raised pressure on the ECB to act to calm bond markets until the euro zone's 440-billion-euro rescue fund is empowered to intervene on secondary bond markets and give countries in difficulty precautionary credit lines.

It has also prompted widespread calls from economists and market analysts for the euro zone to at least double the size of the European Financial Stability Facility -- a move that EU paymaster Germany and its close ally France has rejected as unnecessary.