by Kimble Charting Solutions

See the original article >>

Friday, June 10, 2011

The Great QE2 Flush Out

By Global Macro Monitor

We’ve updated our Treasury flow charts with new data from today’s release of the Federal Reserve’s Flow of Funds Accounts. The quarterly data are seasonally adjusted and annualized. They reveal quite an interesting picture.

In Q1 2011, the Fed’s QE2 purchases of Treasuries totaled $1.3 TN on a seasonally adjusted annual basis. This number far exceeds the QE2 total program and is one of the reasons why we tend to discount government statistics which have been seasonally adjusted, annualized, and sliced and diced eight ways to Sunday. It’s all we have to work with, however.

Rather than obsessing over absolute numbers, we focus on the relative movements and flows which are quite revealing. The Fed’s QE2 program has been quite successful in flushing households and nonprofits out of their Treasury holdings into asset classes such as mutual funds (see table F.100).

It’s also interesting that foreign flows into Treasuries has declined significantly since the start of QE2 and as a proportional source of financing for the U.S. budget deficit is at one of the lowest levels in years. Though the Fed will continue buying Treasuries with the proceeds from maturing securities — which we estimate to be around $230.4 BN from July1, 2011 to December 2012 — the end of QE2 will be a big test for the markets.

Unless credit markets begin to recover in a significant way, the source of new liquidity to drive major markets is in question, in our opinion. Flows into one market — whether it be equities, bonds, commodities, or foreign assets — will likely be at the expense at another and follow a zero-sum game.

The trick now for traders and investors will be to try and get ahead of the reallocation and determine which market gets sold and which receive the proceeds. Our best guess (and that’s all it is) is the first post QE2 trade will be commodities and Treasuries get sold and high quality/strong balance sheet corporate equities and bonds are bought. It’s about to get very interesting. Stay tuned.

>

click for larger charts

Etichette:

articles,

Economy article,

Finance article,

market articles

Highlights from today’s USDA Reports

By: University News Release

See the original article >>

Following are some of the highlights of today’s USDA reports.

For the current marketing year, no changes were made in the projections of consumption or year ending stocks, but the forecast of the marketing year average farm price was raised by $.10, in a range of $5.20 to $5.50. Some had expected an increase in the projection of domestic consumption. However, a change in the projection of feed use would have been unusual so close to the release of the June stocks estimate and ethanol production is running near the previously projected rate. For the 2011-12 marketing year, the projection of planted acreage was reduced by 1.5 million acres from that reported in the March Prospective Plantings report, reflecting late planting in the eastern Corn Belt and the Northern Plains. The forecast of harvested acreage was reduced by 1.9 million acres, reflecting flooding along the Mississippi and Missouri Rivers. The 2011 crop is projected at 13.2 billion bushels, 305 million below the May forecast, reflecting an unchanged yield forecast of 158.7 bushels. The projection of 2011-12 feed and residual use was reduced by 100 million bushels and the projection of year ending stocks was cut by 205 million, to a total of only 695 million bushels. The projection of the marketing year average price was increased by $.50, in a range of $6.00 to $7.00. Outside the U.S, the projection of the Chinese corn crop was increased by 236 million bushels (3.5 percent).

For the current marketing year, the projection of U.S. soybean exports was reduced by 10 million bushels, reflecting the current slow pace of shipments, and the projection of year ending stocks was increased by 10 million bushels, to a total of 180 million. The projection of soybean oil consumption was reduced by 300 million pounds (1.5 percent) and the projection of year ending stocks was increased by 350 million pounds. For the 2011-12 marketing year, the production forecast was unchanged in spite of very late planting. The projection of soybean exports was reduced by 20 million bushels and the projection of year-ending stocks was increased by 30 million bushels, to a total of 190 million bushels. However, the projection of the marketing year average farm price was increased by $1.00, in a range of $13.00 to $15.00.

For the marketing year ended on May 31, the estimate of U.S. imports was reduced by 10 million bushels, the export projection was increased by 20 million bushels, and the projection of year-ending stocks was reduced by 30 million bushels. The NASS forecast of the size of the 2011 U.S. winter wheat crop was increased by 26 million bushels, reflecting an increase of 0.8 bushel in the forecast of the average yield. The WAOB forecast of the spring wheat crop was reduced by 11 million bushels, reflecting delayed planting.

Production of all classes of wheat is forecast at 2.058 billion bushels, 150 million smaller than the 2010 crops. Consumption forecasts for the 2011-12 marketing year were unchanged, resulting in a 687 million bushel projection of year ending stocks, 15 million below last month’s projection. The 2011-12 marketing year average farm price is projected in a range of $7.00 to $8.40, $.20 higher than the May projection. Outside the U.S., the projected size of the EU crop was reduced by 262 million bushels (5 percent).

The picture painted by today’s reports is one of extremely tight U.S. and world feed grain supplies and more adequate inventories of wheat and soybeans. However, U.S. wheat stocks are expected to decline as are soybean stocks outside the U.S. Considerable uncertainty still surrounds the prospective size of the U.S. corn and soybean crops with favorable summer weather required to offset the lower yield implications of late planted crops. Prices should continue to be well supported, with the USDA’s June 30 Acreage and Grain Stocks reports looming as very important.

Etichette:

articles,

commodity,

commodity article,

grains,

market articles

USDA Lowers Corn Production Estimates

By: Marc Schober

The USDA updated the U.S. and World balance sheet estimates for major agricultural commodities in the World Agricultural Supply and Demand Estimates (WASDE) report today. WASDE reports in the summer are a barometer of overall world demand, forecasted production, and inventory adjustments. In June, U.S. ending stocks for 2011/12 were revised lower for corn and wheat, but increased for soybeans.

Corn

Bullish news for the U.S. corn continues midway through 2011, as the 2011/12 U.S. projection for corn production and ending stocks were decreased by 305 and 205 million bushels to 13,200 and 695 million bushels respectively. Current USDA projections rank this corn crop as the largest corn crop in U.S. history, but ending stocks are the lowest since 1995.

The USDA maintained its forecast for corn yields and beginning stocks, at 158.7 bushels per acre and 730 million bushels respectively, but lowered its planted acreage forecast (to 90.7 million acres, from 92.2 million acres), and its harvested acreage forecast (to 83.2 million acres, from 85.1 million acres).

Production revisions were the result of planting delays through early June in the eastern Corn Belt and northern Plains. The USDA believes this reduction in planted area, will more than offset likely gains in the western Corn Belt and central Plains where planting was ahead of schedule by mid-May. Harvested area is lowered 1.9 million acres, to 83.2 million with the additional 400,000 acre reduction reflecting early information about May flooding in the lower Ohio and Mississippi River valleys and June flooding along the Missouri River valley.

Corn ending stocks are projected 35 million bushels lower than beginning stocks indicating a stocks-to-use ratio of 5.2 percent compared with the 2010/11 forecast ratio of 5.4 percent. The 2011/12 season-average farm price for corn is projected at a record $6.00 to $7.00 per bushel, up 50 cents on both ends of the range.

World corn production was slightly lowered to 866 million metric tons from May’s forecast of 868 million metric tons; decreases in U.S. production were offset by increases in Chinese production. Global corn ending stocks however were reduced by 13% to 112 million metric tons; lower usage was forecasted in the U.S., but was off by increases in expected Chinese demand.

Soybeans

The USDA raised its estimate of ending stocks for the 2011/12 crop to 190 million bushels from its May estimate of 160 million bushels. This was the result of, reductions to the estimates of ending stocks for the 2010/11 crop and soybean exports for the 2011/12 crop by 10 and 20 million bushels respectively. Demand erosion for the 2011/12 U.S. crop is anticipated from an increase in the recently harvested Brazilian soybean crop.

The U.S. season-average soybean price for 2011/12 is projected at $13.00 to $15.00 per bushel, up $1.00 on both ends of the range.

Global soybean production and ending stocks were each lowered marginally from the May report. While production and usage levels have remained consistent with estimates, we remain focused on the development of the U.S. soybean crop, which represents 34% of world production and import demand from China.

Wheat

U.S. 2010/11 wheat ending stocks were lowered to 809 million bushels from 839 million bushels. This estimate is based on lower U.S. imports and higher than expected exports.

The USDA raised its forecast of 2011/12 wheat yields to 43.1 bushels per acre, from 42.5 bushels per acre, but lowered its planted and harvest acres by 300 and 220 thousand acres respectively. They also left U.S. wheat usage and exports for 2011/12 unchanged from previous estimates. These estimates project ending stocks 15 million bushels lower at 687 million bushels, but remain above the 10-year average.

Total world wheat production was estimated at 645.82 million bushels, down from December’s estimate of 646.51 million bushels. The decrease was due to heavy floods in Australia and difficult production in Kazakhstan, partially offset by increased production in Argentina and Brazil.

The 2011/12 season-average farm price for all wheat is projected at a record $7.00 to $8.40 per bushel, up 20 cents on both ends of the range, reflecting both tighter domestic supplies and higher expected corn prices. The forecast 2010/11 wheat farm price is also raised this month, up 5 cents per bushel to $5.70 per bushel.

Overview

As grain stocks continue to decline into the fall; we are closely monitoring demand and basis levels of old crop corn. Post July corn is at $7.90 per bushel and is poised to close at an all time contract high. If demand levels remain consistent, prices of commodities will continue their climb higher towards harvest.

With a poor start to the growing season, the next two months are critical across much of the Midwest, as corn plants are beginning to determine their yield potential. The USDA has set large production goals and producers are going to have to rely on near perfect growing conditions and proper management techniques to assist in them in achieving these levels.

Pay attention to crop conditions, demand, and weather patterns this summer, as grain prices could continue their historical climb higher.

See the original article >>

Etichette:

articles,

commodity,

commodity article,

market articles

Corn price hits record as US slashes stocks hopes

by Agrimoney.com

Typically, revisions are not made until at least a late-June acreage report.

The USDA, while lifting its estimate of last year's Chinese corn harvest by 5.0m tonnes, and adding 6.0m tonnes to its forecast for the forthcoming crop, estimated that its figures on consumption were even further out – by 8m tonnes in the current season and 13m tonnes in 2011-12.

Corn prices hit a record high, reinforcing its premium over wheat, after the US heightened fears for supplies by hacking its estimate for world stocks, reflecting weaker US harvest prospects and a belief that estimates for Chinese consumption have been massively underestimated.

Chicago corn for July delivery soared to $7.93 a bushel in early deals, the highest ever for a spot contract, after the US Department of Agriculture, in its latest influential Wasde report, slashed its estimate for world inventories of the grain by 17.3m tonnes.

The downgrade, equivalent to a wiping out the harvests of Canada and Russia, stunned investors.

"The USDA did not fail in surprising the trade once again," Benson Quinn Commodities said.

Matthew Pierce at PitGuru said: "This is a shock. I feel this is an absolute game changer."

"There is no hope of stopping the rally in corn now," he added, referring in particular to the new crop December contract which fell just 1 cent short of rising the maximum allowed in opening trade.

The December lot stood 2.4% higher at $7.11 a bushel as of 16:30 GMT, with the July contract easing back to $7.83 a bushel, a rise of 2.5% on the day.

Chicago wheat, which typically enjoys a premium to corn, stood at $7.43 a bushel for July.

'Near the pipeline minimum'

The inventory downgrade reflected in part a bigger-than-expected cut to hopes for domestic supplies after the USDA - contrary to historical precedent – cut its forecast for domestic corn area to reflect the slow pace of seedings.

| USDA US corn data 2011-12, change on last, (market forecast) Area planted: 90.7m acres, -1.5m acres Area harvested: 83.2m acres, -1.9m acres Output: 13.20bn bushels, -305m bushels Feed use: 5.0bn bushels, -100m bushels Carry-in stocks: 730m bushels, unchanged, (+24m bushels) Year-end stocks: 695m bushels, -205m bushels, (-76m bushels) |

The estimate for plantings was cut by 1.9m acres to 90.7m acres - albeit still 2.5m acres more than last year's sowings - with a further 400,000 acres of sown crops estimated lost to the floods around the Mississippi, Missouri and Ohio rivers.

The US harvest was pegged at 13.2bn bushels (335.5m tonnes), 305m bushels (7.7m tonnes) less than previously forecast.

The decline fed through into a cut of 205m bushels (5.2m tonnes), to 695m bushels (17.7m tonnes), in the estimate for US stocks at the close of 2011-12, a figure a little below market forecasts.

"This is near the pipeline minimum of 600m-650m bushels," US Commodities said.

"The market now has no margin of error for the balance of the summer. [Price] breaks should be well supported on corn."

Wayward Chinese data

However, the downgrade also reflected a massive change to forecasts for corn in China, where official data have gained a reputation for inaccuracy, in part because of a tendency among provincial authorities to manipulate statistics to improve their case for handouts from Beijing.

| Selected USDA world corn data 2011-12, and change on last World output: 866.14m tonnes, -1.55m tonnes World carry-in inventories: 117.44m tonnes, -4.75m tonnes World year-end inventories: 111.89m tonnes, -17.25m tonnes Chinese output: 178.0m tonnes, +6.0m tonnes Chinese consumption: 181.0m tonnes, +13.0m tonnes Chinese year-end inventories: 51.01m tonnes, -12.0m tonnes |

Kathleen Merrigan, the USDA's acting secretary of agriculture, gave no explanation for the revisions to China's consumption data beyond saying they were down to "both feeding and industrial use".

The production upgrades were attributed to a bigger estimate for sowings, with yield estimates held steady.

"Data from the Chinese government indicates that corn area increased by more than 4%in 2010-11 as farmers reportedly expanded corn acreage in response to higher relative profits for corn and government policies that encouraged grain production," USDA analyst Paulette Sandene said.

Seven weeks' supplies

World stocks were estimated closing 2011-12 at 111.9m tonnes, down from a May estimate of 129.1m tonnes.

Factoring in use, the revision means that the world is expected to end the season with stocks equivalent to last less than seven weeks, compared with last month's assessment of nearly eight weeks.

That would represent the tightest supplies for 16 years, and compared with stocks equivalent to well over three months' consumption which the world held at the turn of the century.

Etichette:

articles,

commodity,

commodity article,

corn,

grains,

market articles

Cotton goes limit up as US crop downgraded - again

by Agrimoney.com

New York cotton futures reversed a correction which has seen them, twice this week, drop the daily maximum - and turned limit up instead, helped by a downgrade by the US to its harvest hopes.

The US Department of Agriculture cut by a further 1.0m bales, to 17.0m bales, its forecast for domestic cotton production this year, as a drought continues to savage Texas, the country's top cotton-producing state.

The downgrade was "due mainly to expected higher abandonment resulting from the increased severity of the drought in the South West," Kathleen Merrigan, the USDA's acting secretary of agriculture, said.

The estimate for abandoned acres was raised by 600,000 acres to nearly 2.4m acres, equivalent to nearly 19% of plantings – and compared with less than 300,000 acres last season.

The highest abandonment, at least since the 1960s, was recorded in 1998, at 2.6m acres, equivalent to 20% of sowings.

Exports reduced

The USDA forecast that the weaker harvest would have limited impact on US stocks at the end of next season, with the production decrease offset by weaker expectations for exports, including those in the current, 2010-11 crop year.

| Selected USDA US cotton estimates, change on last and (year on year) Area sown 2011-11: 12.57m acres, unchanged, (+14.6%) Area harvested 2011-12: 10.20m acres, minus 600,000 acres, (-4.7%) Year-end 2011-12: 2.50m bales, unchanged, (+11.1%) Year-end 2010-11: 2.25m bales, +500,000 bales, (-24%) |

America is the world's top cotton exporter.

The report also edged higher, by 320,000 bales to 45.8m bales, the estimate for cotton stocks held by other countries, as high prices keep a lid on consumption.

'No safety net'

Nonetheless, the revisions were deemed bullish by analysts, given the risks posed by such tight supplies.

"I think we've seen the high production numbers for the year, and that as time goes by they will drift downward," Jurgens Bauer at PitGuru said.

Rabobank said the report suggests that "major users will have more domestic supply, but the world's number one exporter, the US, will have less to sell".

Given record low inventories expected at the end of 2010-11, "and expectations of diminished supply from the US in 2011-12, the globe has little recourse if supply disruptions occur".

Lower supply vs lower demand

Cotton for July stood the exchange maximum of 6.0 cents, or 4.1%, higher, at 151.05 cents a pound, in late deals in New York. The contract had lost 12% in the previous four trading sessions.

The new crop December lot was 2.1% higher at 132.90 cents a pound.

"The market's reaction to the report suggest concerns about the supply of the fibre in the new season is starting to attract attention," supplanting concerns about high prices curbing use in 2010-11.

Etichette:

articles,

commodity,

commodity article,

cotton,

market articles,

Softs

What's Leading and Lagging Today?

by Bespoke Investment Group

Below we highlight the performance of the S&P 500 and its ten sectors today as well as from 4/29 through yesterday when the index fell 6.16%. As shown, Financials, Energy, and Materials were the three sectors that fell the most from 4/29 through yesterday, and they're outperforming on the upside today as well. Industrials and Technology also underperformed during the pullback, but they're not seeing the kind of bounce today that investors in the sectors would hope for. Health Care, on the other hand, outperformed significantly from 4/29 through 6/8 with a decline of just 0.74%, and today the sector continues to outperform the overall market with a gain of 1.33%. Health Care is up 12.4% so far in 2011, which is by far the top performing sector in the market (Energy ranks 2nd with a YTD gain of 9.3%).

See the original article >>

Etichette:

articles,

eMini SP,

Finance article,

Index,

market articles

Stock Market Potential Long Term Topping Process Underway

By: Steven_Vincent

In the introduction to this report, I detailed many of the non-technical elements that should have happened and could have happened and almost happened--but that ultimately failed to happen--leading to a non-confirmation of an ongoing bull market. Let's reiterate: I gave the bull the benefit of the doubt and argued its cause to the extent that it gave a cause to argue. But when reality departs from argument I will have to go with reality. Let's look at some technical factors which failed to confirm an ongoing bull market and give substantial cause to anticipate a renewed bearish environment.

First let's examine a long term chart of SPX:

Since the August/September 2010 bottom, we have been operating under the thesis that SPX was probably in a bullish Wave 3 advance. If this is the case, there are some technical characteristics which should be present and some which should not be present. Separately, the persistently declining volume over the course of entire run and the successive RSI divergences are not necessarily troublesome, but together they add up to a technical non-confirmation and make the move much more likely to be a C wave. If the 50 MA of volume starts to turn up and volume levels persist above the 50 MA during an ongoing decline, that will probably be a long term bear signal. If RSI declines below 30 and breaks its March 2009 low, that would also be another confirmation of a bearish shift.

The 50 EMA of Advances-Declines is testing its key support zone from which intermediate term rallies have been initiated many times since March 2009:

Of course, it's possible that it may rally sharply off this support zone again and the market may reverse. But there are some signs that that is not what is going to happen this time. First, note that the indicator has made lower highs as the market made higher highs--a bearish divergence. Second, note that the indicator recently bounced off of support but failed to attain a new high before heading back down again. Also note that the indicator is now nearly at its support level after a minor sell off in the market. This means that if the market breaks support this week the indicator is likely to also break through support and head back down to its May or July 2010 lows or below. This would likely represent a bearish range shift for this indicator and the markets.

Percent of Stocks Above 200 EMA has broken down badly:

This is just one example of the many indicators that are leading the markets lower. The indicator has declined to readings well below the March and November lows while market price has not yet even taken out the March lows. Generally when technicals lead a market lower it is a good signal that market price will follow soon.

While the situation described thusfar could certainly reverse and propel markets higher, the important point to be grasped here is that on every count there have been significant attempts to move in a direction that would be bullish for stocks and general asset prices that have FAILED badly and REVERSED strongly in the opposite direction. What makes this even more inauspicious is the total failure of the trading and investing community to come to recognize and come to terms with the situation. Trapped in attachment to to established views they may be forced to reckon with reality all of a sudden, producing a steep, sudden decline in prices as everyone heads for the exit at the same time.

In the short term a minor rally is possible as there may be a bit of short term selling exhaustion and a bit too much bearishness creeping in to the markets. if there is a rally, the next minor high should be a good shorting opportunity for the next wave down, which will likely be the strongest move down seen yet this year.

Etichette:

Analysis Technic,

analysis technic article,

articles,

eMini SP,

Index,

market articles

US Dollar Death Spiral, Economy Hurtles Toward System Failure

By: Jim_Willie_CB

The combination of $trillion bond fraud, dependence on inflating home equity for economic development, oversized cars, oil dependence, constant market intervention, insolvent banks, insolvent homes, outsourced industry, endless war, budget deadlock amidst runaway deficits, raided US gold treasury, mammoth future benefit obligations, and handing over the keys at USDept Treasury to Goldman Sachs has left the United States to fend off systemic failure. The creeping price inflation that stems from USFed hyper monetary inflation and total ignorance on basics of capitalism like business formation have left the US vulnerable to disorder and chaos. The chaos in fact grows with the passage of time and the ruin of money, against a background of a cruel middle class squeeze. With one citizen in seven on food stamps and over 22% of the population jobless, the sunset of the American Empire is well along. The banker oligarchs are gradually killing the nation, its democracy, and its wealth engines during a sustained strangulation process.

UNDERWATER NATION THAT CANNOT SWIM

Comments by economists continue to center on consumer spending and desired job growth, without any mention of business investment and reduced regulatory impediments. The nation has no clue among leaders to engineer a recovery. Tragically, it is not possible unless the housing market rebounds convincingly, and unless the big US banks are liquidated. The negative momentum is so grotesque. It is like a man sliding backwards on a steep icy street with no objects nearby to grab. The remarkable fact in my view is that so many trained economists and market mavens are shocked that the USEconomy is entering another recession. They must have considered Clunker Car program, New Homebuyer Tax Credit initiative, and the General Motors bailout all to be genius concepts. They seem poorly trained in capitalism, and well trained in asset inflation management laced with public indoctrination. To the sound money crowd, the degradation was obvious. The landscape is taking on the same look at mid-2008 when all hell broke loose on the financial and economic fronts. It should not be so surprising, since nothing has been fixed.

Innovation remains prevalent among technology and telecommunication firms. Too bad so much of the product output is done by US subsidiaries in Asia. The USGovt leadership thought a green revolution would make for a solid initiative until it realized that most of the purchases would come from Asia. The high speed rail projects almost all involve Chinese equipment. The US is so badly on a slippery slope, that a simple debt default might be the best of outcomes to hope for, given the nasty added ramifications that could come from chaos. The main location for innovation within the USEconomy seems to be in financial fraud and military weapons. Former USFed Chairman Volcker once accused the financial industry of having only one productive innovation in three decades, the automatic teller machine (ATM), a scurrilous accusation indeed.

The American people, having been exposed to a powerful cost surge, futile compromises to address the USGovt budget deficits, profound mortgage fraud, a series of fixes without solution that are disguised elite banker redemptions, tremendous waste of over $2.5 trillion in various policy initiatives, exemption from Wall Street prosecution, chronic housing market decline, and phony economic statistics, are awakening to the reality of a systemic failure USEconomy, punctuated by a USTreasury Bond default. The preliminary signal is full isolation by the USFed as sole buyer of USTreasurys at USGovt debt auctions. They are currently buying about 80% of USGovt debt at official auctions. Many dopey analysts have put forth the notion, even within the gold community, that a debt default is impossible given the control of the global reserve currency to cover the debt. This is shallow thinking in my view. Once the USFed and its monetary engines are exposed on the world stage to rely upon hyper monetary inflation to sustain the broken USGovt financial contraption where fraud and war and insolvency are the three passengers without a driver, the USDollar will be punished, avoided, and become the object of even more profound revolt. The leaders can swim only if they push others in the pool underwater. Most debt default starts with a nasty run on the currency.

The underwater nation suffers from massive insolvency in the banking sector. Three bad jokes are played upon the US public. 1) They are told that the banks hold large Excess Reserve accounts at the USFed, earning interest income. Lie! The funds are Loan Loss Reserves moved from the banks to the USFed, where the central bank is hiding its own insolvency. The banks will need those funds to cover losses. The USFed by loose calculations is between $1.4 trillion and $1.8 trillion in the red, mainly from purchasing overpriced mortgage assets, some of whose leveraged items are totally worthless. The housing market is not coming back. The USFed itself is starging at the abyss, and might resign its commission. 2) The big US banks claim also that they have tightened their lending standards. Lie! They are insolvent and therefore must reduce their lending on a grand scale. The big US banks are in possession of far less capital than they claim, thanks to the FASB accounting rule change put into effect in April 2009. Their plight worsens. They cannot dump REO bank owned homes on a depressed market. The big US banks are trapped in an extreme and worsening condition, insolvent to the tune of $3 trillion. The FDIC pretends to have funds to support over $7 trillion in banking deposits, but their insurance fund has long been depleted. The MyBudget360 outfit does great work in analysis of the housing market and mortgage finance. See their chart below on bank balance sheet over-statement. 3) Lastly, US corporations we are told own huge cash balances. Lie! Their foreign subsidiaries command the cash, and it will not be put to work on US soil, even with handsome benefits to repatriate the funds. Business prospects look horrible in the United States, the land of fraud, insolvency, and war.

The underwater nation at the domicile level is tragic. Fully 28.4% of homeowners suffer from negative equity. They owe more on their home loans than the value of their homes. Some call it being underwater, others upside down. A second mortgage misery has taken root. Almost 40% of homeowners who took out second mortgages are underwater on their loans, more than twice the rate of owners who did not draw funds in such loans. Also 38% of borrowers who took home equity loans are underwater. By contrast, 18% of borrowers who do not have these loans are underwater. This data is according to CoreLogic. According to Federal Reserve Board data, homeowners took out a total of $2.69 trillion from their homes at the height of the housing boom between 2004 and 2006. A grand dependence was fostered, turned into a nightmare. That tally includes cash-out refinancings. Such sources of funds have vanished altogether. In fact, the trend has reversed, as homeowners are putting more money into their home equity in attempts to relieve their insolvent condition. The risks extend beyond the borrowers to banks, in a parade of insolvency and ruin for homeowners and big banks.

USGOVT DESPERATE GRABS

THE USGOVT IS DESPERATE FOR FUNDS. The unspoken message regarding the increase to 3% in US bank reserves requirements is that the USFed and USDept Treasury are seeking additional buyers of USTBonds when they attempt to draw QE2 to a close. This week, a controversial bank rule from Basel 3 was put into effect. US banks must put up more in reserves. They central bank has decided to eat their own banks. A banker civil war is at risk of being triggered. Stick with more basic desperation. The USGovt is making progress in raiding federal pension funds, so far snatching $79 billion. Some calling it accounting sleight of hand, but others call it confiscation much like the replacement of gold at the USTreasury with paper IOU certificates. It is worth the effort to quantify the USTreasury plunder of official retirement accounts, after the Social Security Trust Fund has been gutted. The USGovt debt limit must be raised, but compromise cannot be achieved. So the government raids public pensions with the same impunity that Wall Street commits bond fraud and deals with counterfeit. We are still looking for over $1 trillion in undelivered USTBonds, the infamous failure to deliver. The Wall Street firms found a clever method to feed their own liquidity by selling USTBonds they did not own. Of course, the regulators have a GSax pedigree. The Civil Service Retirement & Disability Fund (CSRDF), according to Stone Mountain, has been raided for $22 billion in recent weeks, with funds replaced by government IOUs. The funds have suffered a sizeable disinvestment, to be sure, to keep America strong.

The balance of securities held by the Thrift Savings Fund, aka the G-Fund, also according to Stone Mountain, has been raided for $57 billion in recent weeks, with funds replaced by government IOUs. The funds have suffered a sizeable disinvestment, to be sure, to keep America strong.

The retirement funds have seen a raid of nearly $80 billion in the past 3 weeks just to make space for further funding of bloated government, defense spending, and healthcare benefits. Under Treasury Secy Geithner, the USGovt has begun a Debt Issuance Suspension Period (DISP) for about 2-1/2 months, ending on August 2nd. The USCongress argues over small potatoes like $38 billion in spending. They argue over keeping certain spending intact, and keeping the war off limits to discussion entirely. They argue over imposing tax increases. They do not bother to pursue cuts to mindless programs of no value, like those suggested by Senator Coburn of Oklahoma. The nation of citizens is also prone to raids of pension funds, basic 401k pension fund loan grabs. Investors tap their inner bankers, even if with heavy tax penalties. In 2010, one in seven workers borrowed from a 401k plan, according to the consulting group AON Hewitt. Today, almost 30% of 401k savers have a loan outstanding against such funds, the highest in recent history.

So as Rome burns, the legislators fiddle and the generals wage war for private gain. The situation is best put into perspective by David Stockman, former Budget Director in the Reagan Admin. He said, "The real problem is the de-facto policy of both parties is default. When the Republicans say no tax increases, they are saying we want the US government to default. Because there is not enough political will in this country to solve the problem even halfway on spending cuts. When the Democrats say you cannot touch Social Security, when you have Obama sponsoring a war budget for defense that is even bigger than Bush, then I say the policy of the White House is default as well."

But the true insanity and unfixable nature are brought into proper perspective by John Williams, who heralds from the noble Shadow Government Statistics clan. He said, "[The USGovt deficit] cannot be covered by taxes. The government could take 100% of everyone's income, corporate profits, and it would still be in deficit. [Conversely] they could also cut every penny in government spending except for Medicare and Social Security, and they would be in deficit." The message by Williams is that the national government finances are not even remotely fixable, even with total income confiscation, even with almost full government shutdown!! GOLD & SILVER PRICES SHOULD ZOOM ON A BILLBOARD MESSAGE BY STOCKMAN AND WILLIAMS ALONE. My forecast made in September 2008 stands, that the USGovt debt default will occur in two to three years time. Time is up, and the threat of debt default looms large.

NOTHING FIXED, STILL INSOLVENT & FRAUD RIDDEN

The following paragraph should be read twice:

One should constantly remember that no solution to the financial crisis has been installed, nothing fixed, no big banks liquidated, no end to monetary inflation, no end to outsized USGovt deficits, no change of Goldman Sachs running the USGovt finance ministry, no discharge of big bank home inventory, no end to secretive subterranean support of stocks and bonds, no revival of the housing market, no return of US industry from Asia, no prosecution of Wall Street for multi-$trillion bond fraud, no end to money laundering of narco funds to Wall Street banks, no interruption to the endless costly wars, no end to the propaganda obediently pumped out by the US press & media networks. Nothing has changed except that some commodities are lower in price, including the queen Silver.

The steady stream of debt downgrades around the world curiously overlooks perhaps the worst offender of all, the United States. Refer to its horrendous PIIGS-like key ratios with much higher volume of debt. It seems good sport to nail Greece or Spain with a debt downgrade, when the US wrestles with a debt limit and chronic $1.5 trillion annual deficits, even costly endless wars. So Moodys is telling the USCongress that they better raise the debt ceiling or else. Or else what? Nothing!! The German debt rating agency Feri had the stones to downgrade the USGovt debt from AAA to AA. It is a significant slap in the face. They pointed to the fact that for the third consecutive year, the USGovt deficit is over 10% relative to gross domestic product (GDP). Its CEO Tobias Schmidt said, "The US government has fought the effects of the financial market crisis primarily by an increase in government debt. We do not see that here is sufficient alternative measures. Our rating system shows a deterioration, so the downgrading of the credit ratings of US is warranted. Deficits of such magnitude are not a sustainable fiscal policy. We would reconsider the rating when the US government creates a long-term sustainable budget."

The debt rating agencies are bound by extreme political pressure, and probably secretive pressures also, maybe even outright bribery or violent threats. The agencies can shoot at the scouts like Bank of America, Citigroup, and Wells Fargo, but few if any alarm bells are actually going off. The champion of all insider trading, of investing in opposition to clients, of front running USGovt policy, of deceptive collusion with foreign governments on currency swaps to hide debt, the venerable Goldman Sachs might be in some trouble. The Goldman Sachs credit default swap could serve as a predictor for USGovt debt default. It has begun to rise and cause concern.

It is almost funny, if not tragic, that despite deferred criminal prosecution on mortgage bond fraud, despite being banned in Europe for misrepresentation and collusion to conceal sovereign debt, Goldman Sachs still has total control of the USDept Treasury. If only the people were more aware that GSax under Robert Rubin leased, sold, and leveraged a few $trillion in profit from the gold bullion that used to reside in Fort Knox. A reliable source has a friend who manages a security group in Fort Knox, which is used today to store nerve gas, nothing more, certainly no gold. The Jackass fully expects a USGovt debt default will come in the form of a forced debt forgiveness, during a grand global conference, with a hidden military threat looming. Events in Libya are extremely telling on the threat of war and wealth confiscation. A total of $95 billion in frozen (later stolen) Qaddafi wealth is a strong banker motive to conduct a good war in Libya. In all, $32 billion in Libyan funds were frozen in major US banks, and 45 billion Euros were frozen in major European banks.

Two events occurred within 24 hours of big significance. 1) The USFed Chairman Bernanke spoke after the financial markets closed. He cited numerous singular events to blame for the rising price inflation that has plagued the USEconomy in recent months. He accepts no responsibility from the historically unprecedented release of the hyper monetary inflation spigot to cover the USGovt debts and purchase USTreasury Bonds that the world no longer wants. The USFed is currently purchasing between 75% and 80% of all USTreasury auction bonds, notes, and bills. They use a nifty quick turnaround with the obligated Primary Bond Dealers. What used to distributed to bond funds like PIMCO and pension funds across the US land are no more. The dedicated Primary Bond Dealers have resorted to shoving all the USTreasury product back to the USFed inside one month in anything but routine FOMC operations, usually in two weeks time. The US financial press reports hardly a peep. In the last few months, every time Bernanke spoke, to discuss the weak prospects of the USEconomy, the high commodity price phenomenon, the putrid banking situation, the droopy housing market, the falling USDollar, and the ongoing activity of Quantitative Easing, the USDollar fell and the Gold price rose. Nothing has changed in that respect. Waiting until 5pm to speak only caused the response to occur in the next morning.

2) The OPEC nations met at their usual pow-wow in Vienna Austria, but they accomplished nothing. They split 6 in favor and 6 against on a crude oil production increase. The dirty little secret is that the Saudis no longer have ANY spare capacity. The world always counts on the Saudis to compensate for lost output like what has been felt from Libyan disruption. The crude oil price jumped $2 quickly on Wednesday morning. My view is that the OPEC nations no longer harbor any sympathy for Western nations, have no interest in relieving their cost problems from rising energy prices. They see their own food prices rising fast, when they are more vulnerable to food prices as a people. They observe the unrest in Egypt, the war in Libya, and can see the flight of gold from those countries, while assets are confiscated in Western banks. The OPEC nations see more opportunity to gather in greater petro income at a time of great strain for their own economies and banking systems.

A geopolitical impact is on the horizon. The Saudis cannot increase output. The Petro-Dollar defacto standard is built on Saudi oil, whose volume is far less than believed. They have a dead elephant oilfield in Ghawar, details in the private reports. The Bernanke speech that cited numerous exogenous factors, plus the OPEC stalemate, seems to provide the Gold & Silver price the lit fuse for rising. The Petro-Dollar requires USMilitary protection of the Saudi royal billionaires. They are busy cutting deals for Persian Gulf security from China and Russia. It requires control of oil supply by the Saudis. It requires a US$-based purchase & sale of crude. All three requirements are slowly vanishing. The Petro-Dollar is dying a slow death. With its disappearance will come the Third World to the United States.

Paul Craig Roberts served in Reagan Treasury Dept, and also worked as editor at the Wall Street Journal. He knows about what he speaks. He described the horrendous economic situation for the USEconomy. He puts blame on Wall Street and US Corporate executives who use Asian labor in outsourcing, rendering the US nation of workers poor. Even astute analysts like Roberts all avoid the 1970 Vietnam War effect and 1973 OPEC Embargo effect that produced big deficits and serious price inflation in the US, forced the break of the Bretton Woods gold standard, and lifted the entire wage scale to where it became uncompetitive and vulnerable to globalization. Roberts discussed the secondary inflation effect, a common Jackass theme. The bankers and political leaders do not wish to see wages rise, since it would complete the systemic price inflation effect. Instead, they watch the rising cost structure, led by food & gasoline most visibly, and attempt to obstruct wage gains. My analysis has pointed out that the leaders in preventing wage gains are advocating and promoting lost income, personal ruin, and deep poverty of the middle class. Roberts instead calls it the Graveyard Effect from a desire to install lower US labor rates in order to compete with the BRIC nations, the emerging market nations. He went so far as to accuse our leaders of trying to promote debt slavery managed within a growing police state.

QE3 A CERTAINTY

Ultimately, the wretched condition of the USEconomy, the US banks, the US households, and the USGovt guarantees continuation of Quantitative Easing. The USFed and USDept Treasury are actively pursuing a Scorched Earth program to send the financial markets downward, even as the laundry list of horrendous USEconomic statistics reads endlessly. Details on the degradation of the USEconomy can be found in the June Hat Trick Letter report. The next round might be renamed Global QE. Watch the Japanese Yen, whose exchange rate is back over 125 in a sudden upward thrust, fully forecasted by the Jackass in April. They are selling USTBond assets to raise cash for reconstruction and to cover trade deficits. If another G-7 Meeting is hastily convened, they will coordinate USTBond purchases again. Call it Global QE, a far more powerful Quantitative Easing initiative with greater commodity price impact on a global scale. Expect it.

- Basically, QE2 was a failure, so it will be repeated.

- The QE2 provided demand for USTreasury auctions, when most foreign creditors went on a buyer's strike. So QE will be repeated.

- The housing market has resumed its downward path, with frightening declines to the bank balance sheets. So QE will be repeated.

- The big US banks remain insolvent, loaded down by a mountain of one million REO homes in inventory. Buyers of mortgage bonds have disappeared. So QE will be repeated.

- The USGovt deficit picture is a full blown nightmare. Rather than see market mechanisms kick into gear, with higher interest rates imposed, the leaders will continue on the hyper monetary inflation path. So QE will be repeated.

- Talk of the risk trade counter to the USDollar ending is nonsense. Weimar has met Wall Street, the syndicate handlers of the USGovt and US security agencies. The Printing Pre$$ with US nameplate cannot be stopped. So QE will be repeated.

- The Gold & Silver prices will move up hard, as soon as the light bulb goes on that QE3 is imminent without interruption. One must be a total moron not to anticipate its immediate installation. To decide not to continue QE would force failures upon major US banks.

- The USFed is all bluff with no good cards in their poker hand. They will wait for stocks to be a little cheaper and both sides of the USCongress to beg for QE3.

Inflation is all the US banking leadership knows. Left with poor or limited policy options, they will inflate more. Struggling with national insolvency, they will inflate more. Unable to load on vast stimulus packages, they will simply rely upon basic run-of-the-mill inflation. The USFed Chairman should be called the Secretary of Inflation, in a perfect world. Inflation is all they know. They will inflate until the USEconomy is a burned crisp and the US banking system is a charred ruin. The USDollar is halfway complete with a death spiral. GOLD & SILVER PRICES WILL RESPOND WITH A MOONSHOT. The FOREX market is not the domain of fools.

THE USDOLLAR DEATH SPIRAL

The big FX currency traders realize the USDollar is in a terminal decline. The big FX currency traders realize the USGovt and USFed are locked in a corner with no good policy alternatives. The rebound from May has ended. It relieved the oversold condition, and not much else. Crude oil is back over $100 per barrel. Gold is back pecking away at the $1550 level. Silver is set to challenge the $40 level again. Nothing has changed except the illusion of a tighter USFed policy, which is slowly fading away in a reality backdrop. Recall their nonsense propaganda in early 2010, about an Exit Strategy from the 0% corner. Instead, as the Jackass correctly forecasted, they went deeper with a QE card. Then amidst denials, another correct Jackass forecast, they went deeper with a QE2 card. They will go to a QE3 card next, since they are far more desperate with even more ruinous fundamentals than a year ago. It could go into a pre-emptive Global QE, thus relieving the USFed as the lone perpetrator, my forecast. The USDollar knows it. The investor community is awakening to it. The USEconomic statistics echo the QE sirens calling the corporate ships at sea to their deaths on the rocky shores. Gold & Silver will rise in the second half of the year. This time the Second Half Recovery will feature precious metals on an absolute tear!!

Etichette:

articles,

Currencies,

dollar index,

Economy article,

Finance article,

market articles

S&P Stock Market Cycle Points Lower

By: Mike_Paulenoff

Today is day # 59 within my 70-75 day S&P 500 cycle. This means that the cycle is 79%-84% complete (from its prior low on March 16), and also means that it is in its final 15%-20% (down hard) period ahead of its anticipated low/bottoming timefame in and around the end of June-early July (June 27-July 6).

Also due to bottom at that time is the 20-25 day cycle, forming a "dual cycle low."

Rallies usually fail and surprises tend to trigger negative price reactions within this "down hard" portion of the dual cycle period. My next optimal target zone points towards a test of critical support around 1255-1249, which represents both the rising 200 DMA and the prior significant (dual cycle) low at 1249.05 from March 16.

See the original article >>

Etichette:

Analysis Technic,

analysis technic article,

articles,

eMini SP,

Index,

market articles

THE BALANCE SHEET RECESSION CONTINUES

by Cullen Roche

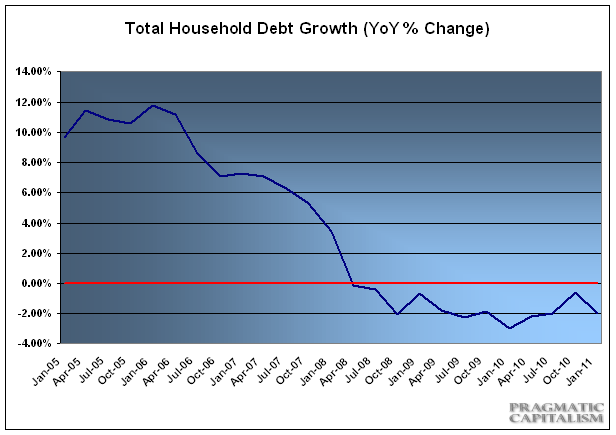

This may very well be the most important data point that we are currently receiving every quarter. Yesterday’s Z1 released by the Federal Reserve showed a continuing decline in household credit. The latest reading showed a -2% decline in total household debt growth versus last year. The Fed summarized the data:

“Household debt declined at an annual rate of 2 percent in the first quarter; it has contracted in each quarter since the first quarter of 2008. Home mortgage debt fell at an annual rate of 3½ percent in the first quarter, ¾ percentage point more than the decline posted last year. Consumer credit rose 2½ percent at an annual rate in the first quarter, the second consecutive quarterly increase.”

Total household debt continues to decline

Frustratingly, I’ve been discussing this dynamic for well over 2 years now. In early 2009 I wrote about why this wasn’t the banking crisis that Ben Bernanke thought it was, why the aid package would likely fail to help Main Street (it focused too much on Wall St) and why we were remarkably similar to Japan:

“Unfortunately, our leaders have misdiagnosed our problem as a banking crisis and not a Main Street crisis. We have ignored the real root cause of the problem which lies not with the bank balance sheets, but with the household balance sheets. As I have long maintained, we are looking more and more like Japan and the balance sheet recession they suffered. While we ignore Main Street in favor of Wall Street it’s likely that the recession on Main Street will endure….”

Being a consumer driven economy this decline in debt remains the most important component of our economic plight. As I’ve previously explained, the collapse in consumer debt has been the primary cause of weak economic growth. Consumers took on excessive debt levels during the housing boom and when housing prices collapsed their balance sheets were turned upside down. Consumers were left with excessive debt, collapsing aggregate incomes and a subsequent balance sheet recession. The overall result is that consumers are still working to pay down this debt and remain in saving mode as opposed to debt accumulation and spending mode.

This is a highly unusual event that has only been seen on rare occasion in developed economies over the last 100 years. As this process occurs there is only one entity that can help to stabilize the economy – the US Federal government. As we know from the sectoral balances, when the private sector is in saving mode and not spending mode (due to debt reduction) and the current account remains in deficit, there is only one sector that can offset this weakness in an attempt to create economic growth. That is the public sector. Thus far, we’ve managed to fend off the austerity chatter, however, the risks appear to be on the rise as government officials become convinced that the United States is bankrupt (something that is fundamentally impossible).

This is the exact situation we have seen in Japan for the last 20 years and it is currently occurring in much of Europe. If the United States implements a policy of austerity there is little doubt that the economy would continue to contract again, unemployment would increase and the economic malaise would worsen. By my estimates, this situation is likely to persist well into 2012 and perhaps longer depending on how the economic environment progresses.

* Addendum 1 - It’s important to note that the consumer debt reduction process is a good development. It is necessary to help build the foundation for a sustainable recovery. Consumer debt accumulation in moderate levels should been seen as a good thing. Unfortunately, it was the excessive debt binge that caused our current predicament. As this process heals over the years we should embrace it and accept it as a necessary part of the natural economic progression following a debt bubble. That requires a unique policy response and a particularly important need to focus on Main Street’s woes and not Wall Street’s woes.

** Addendum 2 – Because monetary policy works largely to increase the debt levels and by helping the banking sector, it can actually be detrimental to this natural healing process during a balance sheet recession. This is why we should reject further Fed intervention in the markets and encourage Congress to look into potential aid packages such as a reduction in taxes.

Etichette:

articles,

Economy article,

Finance article,

market articles

THE SECTOR FINANCIAL BALANCES MODEL OF AGGREGATE DEMAND AND AUSTERITY

By Scott Fullwiler

As Stephanie Kelton has recently published two excellent pieces explaining the sector balances in the context of government “belt tightening” (see here and here), a logical next step is to present this in the sector financial balances model of aggregate demand. This post will only briefly review that model before applying it to austerity policies; those desiring more complete background can find it here, and a printable version here.

Posts by several others describing various aspects of the model are also linked to therein.

Stephanie concludes her first piece with the following:

“This is not rocket science, but it appears to befuddle scores of educated people, including President Obama, who said, ‘small businesses and families are tightening their belts. Their government should, too.”’ This kind of rhetoric may temporarily boost his approval ratings, but the policy itself will undermine the efforts of the very families and small businesses that are trying to improve their financial positions.”

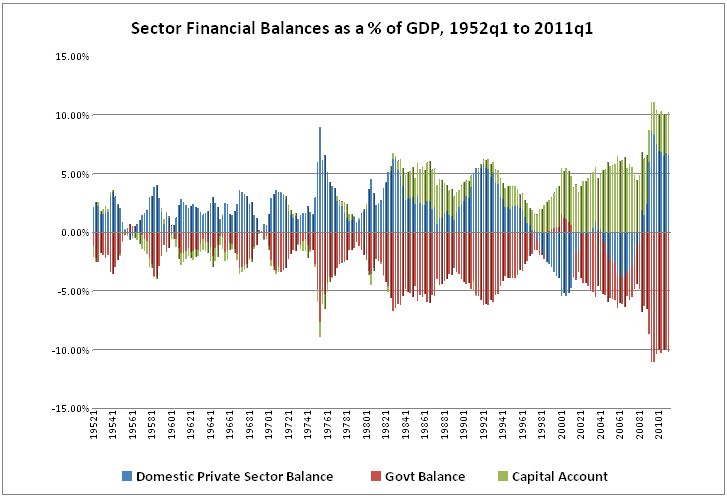

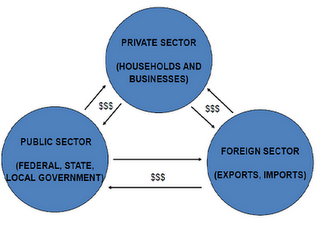

The sector financial balances model of aggregate demand (hereafter referred to as the SFB model) is based on the same basic macroeconomic accounting identity explained in Stephanie’s posts:

(1) Domestic Private Sector Net Saving = Government Sector Deficit + Current Account Balance

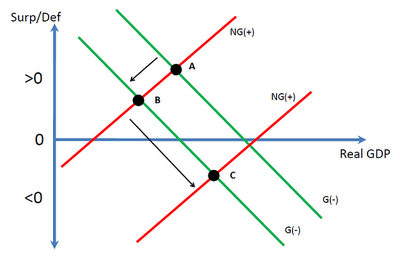

We prefer this particular arrangement of the accounting identity because it recognizes that the financial flows in the economy are a closed system—one sector’s surplus/deficit is by accounting identity offset by the opposite for another sector or a combination of the other two. This is represented visually by Figure 1 below.

Note that “net saving” for the domestic private sector refers to the outlays relative to income for the entire sector; where income is higher than outlays, the net balance for the sector is increasing and we say the sector has “net saved” or “deleveraged,” and vice versa where the opposite is the case (i.e., “net dissaved” or “leveraged”). Monitoring the relative movements in the three balances over time has been shown in numerous MMT and Levy Institute publications during the past 15 years or so to be useful for tracking the economy’s current and projected behavior. For more background, see my earlier post linked to above.

The SFB model isolates the government and non-government sectors, so the equation is rearranged:

(2) Domestic Private Sector Net Saving – Current Account Balance = Government Sector Deficit

Since the current account balance and the capital account balance are by accounting identity the same but opposite sign, this can be rewritten as:

(3) Domestic Private Sector Net Saving + Capital Account Balance = Government Sector Deficit

What this says is that for the domestic private sector to net save, the government sector’s deficit must be larger than any current account deficit (i.e., a negative current account balance) or, equivalently, a positive capital account balance. Again, this is by accounting identity. The significance of this historically is that the domestic private sector (in the US and elsewhere), as currency users (as opposed to currency issuers), in most years and certainly on average attempt to have positive net saving. Negative net saving positions have been shown to be associated with Minskyan financial fragility and also asset price bubbles.

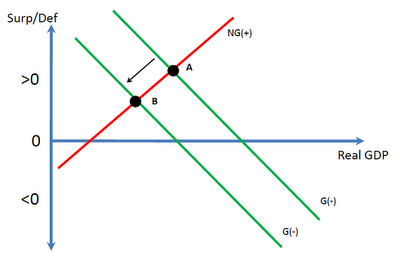

As I’ve linked above to the previous post describing how the model is built, I will simply move on at this point to the model itself, as shown in Figure 2.

For simplicity, I’ve relabeled the lines as NG(+) and G(-) from the more complex labels in the earlier post. The NG(+) line shows the combined desired net saving by the domestic private sector and the capital account balance at every level of real GDP. That is, from traditional, standard textbook macroeconomic relationships, as incomes (real GDP) rise, domestic private net saving rises and so does the capital account balance (again, explained in more detail in my earlier post and others linked to therein). The G(-) line is the negative of the government’s budget position at every level of GDP; again, it’s standard to recognize that, say, government tax revenues fall as the economy worsens (moving northwest on the G(-) line, while it improves as the economy improves (southwest on the line).

The horizontal axis shows where the balances would all equal zero if the two lines intersected. The “>0” and “<0” on the vertical axis refers to whether NG(+) or G(-) is positive or negative; that is, if the two lines intersect above the horizontal axis, the intersection is in the “>0” space, and the NG(+) and G(-) balances are positive (that is, since the government is running a deficit). Where the intersection is in the “<0” space, the two are negative (that is, the government is running a surplus, as in the negative of G(-)).

Point A in Figure 2 represents the current state of the economy, where the government’s large deficits are mirrored by an even larger domestic private sector balance and a modest current account deficit (see Stephanie’s posts for the most recent data).

Figure 3 shows the path the economy took to arrive at point A. Pre-Crisis, representing the peak of the previous expansion, with a modest government deficit (about 3% of GDP) accompanying small domestic private sector deficits (about 2%) and still larger current account deficits (about 5%). (So, for equation 2, this would be -2% +5% = 3%; the “Pre-Crisis” intersection should probably be a bit higher above the horizontal axis than is shown for the graph to be scaled properly.)

The crisis and deep recession saw a very large shift to the left of the NG(+) line, representing a significant increase in desired domestic private net saving (i.e., reduced desire for the sector to increase leverage as it was during the preceding several years) and an accompanying increase in the government’s deficit (shown in the graph as the move to the “Crisis” intersection). Following the crisis, stimulus measures have shifted the G(+) line to the right to the current intersection at point A, though the economy remains well below full utilization of capacity. The graph is consistent with reports suggesting a significant part of current government deficits are due to the recession, perhaps even more so than being due to fiscal stimulus (though that’s not necessarily important for my purposes here).

Austerity measures such as are currently being planned by US policy makers would have the following effect, ceteris paribus (all else constant), in the SFB model:

As shown in Figure 4, austerity measures will shift the G(-) line left and thereby improve the government’s budget position at every level of real GDP—again, ceteris paribus—though the actual deficit reduction will only be as large as planned by policy makers if the NG(+) line is perfectly vertical. In reality, it can be expected that the move to austerity—yet again, ceteris paribus—would result in some combination of deficit reduction and reduction in real GDP as the economy moves to point B. How this gets divided up between the two would depend upon the slope of the NG(+) line, which is well beyond the scope of this post.

So, if austerity makes the economy worse off, and the economy is already in bad shape, why do it?

Of course, there are the misplaced concerns about bond vigilantes whose actions could supposedly raise US interest rates in the absence of austerity, thereby shifting the NG(+) further left (as higher rates reduced desired leveraging of the sector) and further worsen the economy now or at some inherently unknowable time in the future. (It should be noted that deficit doves believe this story, too, except they place the inherently unknowable date far enough in the future that austerity is not considered necessary, at least for now.)

But most, including apparently many of our current policy makers, anticipate that austerity will actually improve the private sector’s “confidence” in the economy and thereby stimulate both business investment and household spending. In the SFB model, this is shown as a willingness to re-leverage in the domestic private sector, and thus a shift rightward of the NG(+) line to point C that raises real GDP.

In this hypothesized scenario, austerity could theoretically improve the economy and significantly improve the government’s balance. Of course, to improve the economy to the degree necessary would require that either the domestic private sector balance decreased significantly, even returning to negative rates seen during 1998-2008, or that the current account balance improved that much more than the domestic private sector balance (Stephanie explained this, as well, in her second post). Such an improvement in the current account balance is highly unlikely in the current environment of a global recession and given the austerians’ assumption that the domestic private sector takes off (since some of that increased spending will be on imports).

More importantly, though, is that this scenario—absent a large and highly unlikely improvement in the trade balance—significantly worsens the domestic private sector’s balance while the economy is in the midst of a balance-sheet recession. This was Stephanie’s point in the paragraph I quoted above. Should that scenario come to pass, it would simply put off a (much) worse crisis in the future as the deleveraging required to fix both existing balance sheets of the private sector plus the added debt that would be necessary to expand the economy in the midst of austerity (i.e., by definition the sector’s financial balance would be deteriorating) would be daunting.

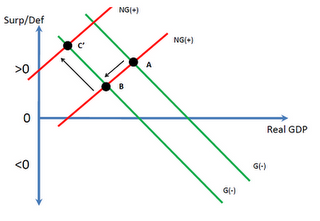

Instead, what we might expect to see happen in response to austerity, particularly while in the midst of a balance-sheet recession in which the domestic private sector (mostly the household sector) is attempting to fix balance sheets, is that austerity could be met with still more reductions in desired leverage by the domestic private sector. Households already struggling to avoid bankruptcy and meet payments might now reduce spending even more in the face of reduced spending and layoffs at all levels of government. Businesses, rather than having more confidence, may instead have less confidence that sales will materialize in the near term, and put off more than they have already adding to productive capacity. It would also not be surprising if they shed still more jobs than they already have as a result. This scenario is shown in Figure 6, where instead of a shift right in the NG(+) line, there is a shift left and the economy instead moves to point C’ and goes into a still much deeper recession than in points A or B.

As Stephanie said, a policy of austerity “will undermine the efforts of the very families and small businesses that are trying to improve their financial positions.” In doing so, as shown here, the economy could get worse, much worse.

The response to austerity by the domestic private sector suggested by Figure 6 has led MMT’ers to frequently argue that austerity could actually raise deficits—note that point C’ shows a larger government deficit than exists at point A before austerity is implemented. Figure 6 thus demonstrates the historical analogy frequently raised by Richard Koo, who argues that the attempt by the Japanese government in 1997 to reduce budget deficits in the midst of a balance-sheet recession resulted in larger deficits, not smaller ones. We may be already seeing the same thing in the UK, as deficits there are now growing in the aftermath of austerity measures undertaken late last year.

Overall, particularly given the current balance-sheet recession, the SFB model helps explain why MMT’ers view the government’s budget position as endogenous to the private sector’s reaction to any attempt at austerity, and why we always argue that governments can never directly control their budget positions.

Etichette:

articles,

Economy article,

Finance article,

market articles

Subscribe to:

Posts (Atom)