Click for larger chart

>

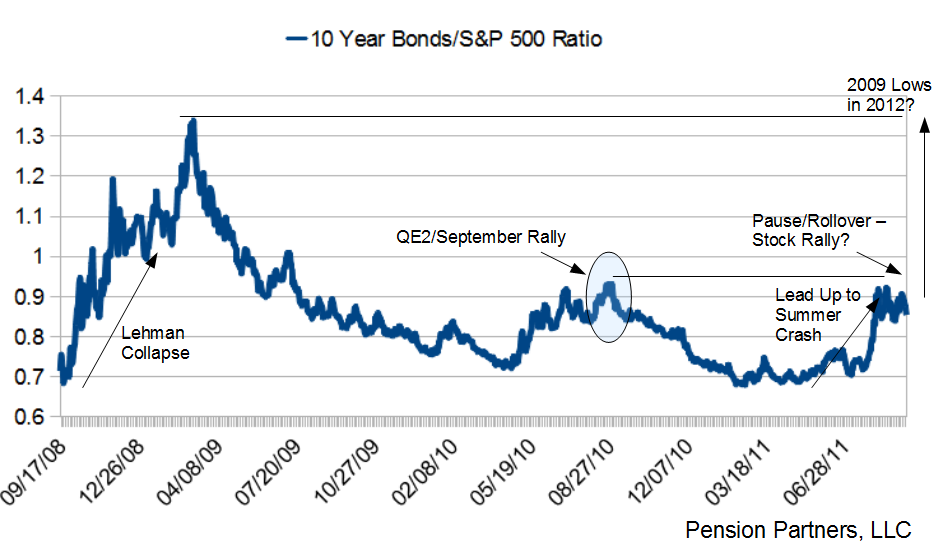

Michael Gayed of Pension Partners wonders if that the current Stock/Bond

ratio is suggesting a rally:

“The chart above shows the price ratio of the 7-10 Year Treasury ETF relative to the S&P 500. Prior to the Summer Crash of August, Treasuries began to slowly outperform equities before spiking as macro problems came into focus. Interestingly, notice that the relationship of bonds to stocks whereby bonds outperform stocks has been stuck in a holding pattern for the past few weeks. All this despite global news seemingly getting worse (no jobs in U.S., possible Recession, Greece, Italy, etc). This is indicative of a high probability rally in risk assets as investors begin to realize the bonds are no longer out-pacing stocks in the face of very negative macro news.

Investing is all about probabilities and the odds do suggest that for now, we could be in a very real risk-on moment (right when no one reading the news thinks we should be). Of course, should a Lehman-like event occur, all bets are off since the possibility does remain that bonds could spike once again and reach for the 2009 relative peak (March 2009 equities lows)…”

See the original article >>

No comments:

Post a Comment