by Greg Harmon

Wednesday US Treasuries ($TLT)

delivered a smack down, putting the US Equity Markets ($SPY) and

Gold ($GLD) in their place. This was detailed in the

link below. Thursday this continued with the US Dollar Index, Copper and Crude

Oil taking sides. Let’s take a look.

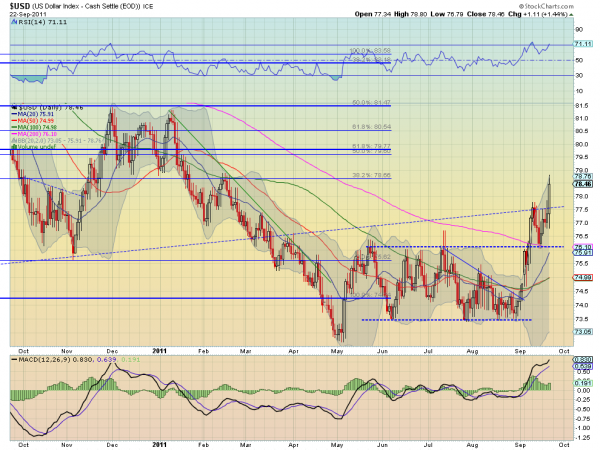

The US Dollar Index ($DX_F, $UUP) was

the big winner launching through the 3 year rising trend resistance out of a

bull flag. The measured move out of the flag is to 80.10 but it has some

resistance along the way at 79, and then 79.28, and 79.60. The rising Relative

Strength Index (RSI) and increasing Moving Average Convergence Divergence (MACD)

indicator support more upside. Like Rocky Balboa, almost down for the count, it

is rising up off the mat to take on the world, joining Treasuries.

Copper ($HG_F, $JJC),

thought by many to be the tell for future market direction, responded with only

bad news. Falling through support at 3.69 and now attempting to hold support at

the 61.8% retracement of the move higher from June 2010, at 3.46 it’s best hope

is that the RSI is becoming oversold. That said the trend is down and the

indicators suggest more to come. If it is a market tell then this is not a

pretty story to come.

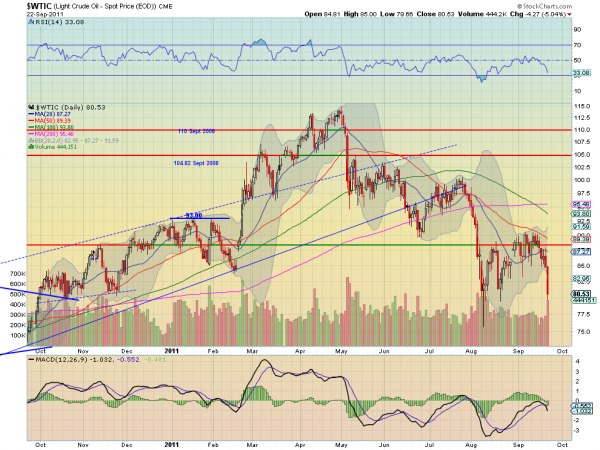

Crude Oil ($CL_F, $USO) was

also a casualty of the recent global moves. It finally broke the bear flag

lower, and now sees its next support at 77 and has a target on a Measured Move

to 70. The RSI and MACD also point to more downside.

Looks like the new world order, at least for the short run, has been set over

the last two days. US Treasuries and the US Dollar are in charge and driving all

risk assets and economically sensitive assets lower. Treasuries and the US

Dollar up, at the expense of the US Equity Indexes, Gold, Crude Oil, and Copper.

Paper promises outperforming hard assets and profitable companies. May God help

up.

No comments:

Post a Comment